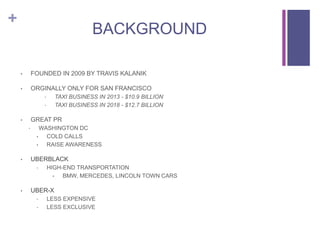

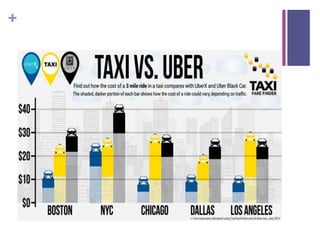

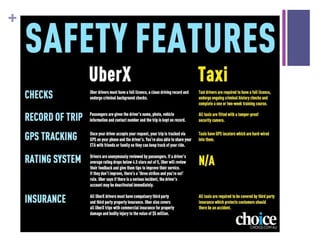

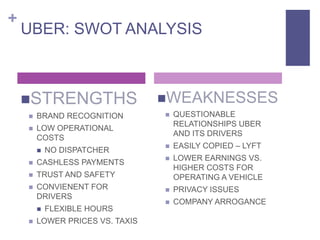

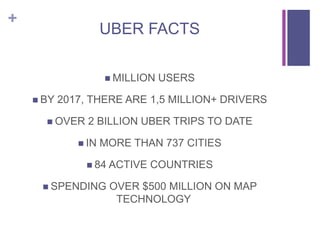

This document provides a case study presentation on Uber and the sharing economy. It discusses Uber's business model as a mobile platform that connects drivers and passengers, highlights its innovative and customer-focused approach, and analyzes Uber's strengths and opportunities in disrupting the taxi industry through a SWOT analysis. The presentation evaluates Uber's value chain and recommends expanding additional services and electrical vehicles to further its growth.