This document discusses investment banking and outlines the regulations around investment banking in the UAE and India. Some key points:

1. Investment banking provides strategic advisory, financing, and risk management to entities. Core activities include managing capital issues, market making, and advisory services for acquisitions and restructurings.

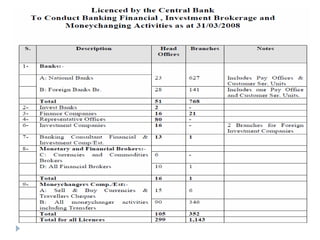

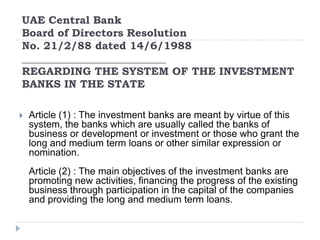

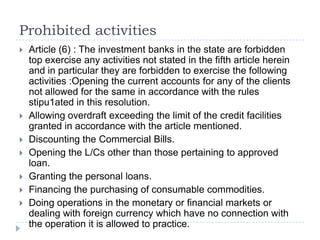

2. In the UAE, investment banks are licensed under Regulation No. 21/2/88 and can engage in activities like participating in company capital, project financing, and portfolio management within certain restrictions.

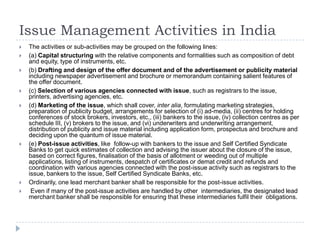

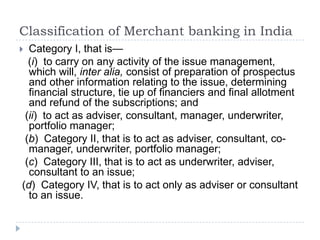

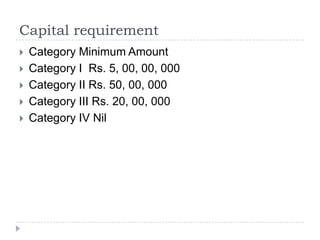

3. In India, merchant banking is classified into four categories with different capital requirements and permitted activities. Category I can perform the full range of investment banking services.

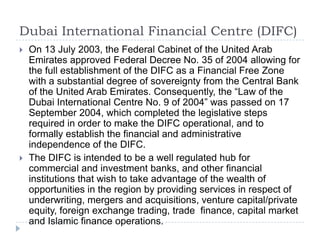

![DIFC…

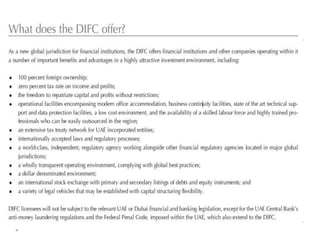

The DIFC is a wholesale financial centre catering primarily to institutional investors and accordingly does not cater

for retail financial businesses.

The DIFC focuses on the following financial services sectors

1. Banking Services : DIFC offers a wholesale platform for investment banks and financial intermediaries looking to

establish underwriting, M&A advisory, venture capital, private equity, private banking, trade finance and brokerage

service operations and to take advantage of the numerous associated opportunities in the region.

2.Capital Markets : The Dubai International Financial Exchange (“DIFX”) provides a liquid and transparent market for

the hundreds of successful privately owned companies in the region and soon to be privatised businesses which

require listings on a liquid, transparent and efficient stock exchange. It also offers facilities to companies from

outside the region to be dual listed.

3. Asset Management & Fund Registration : More than a trillion dollars of wealth is held by institutional and private

investors in the region. Many regional companies and retail banks outsource the management and administration of

these funds to specialist providers outside the region. The DIFC offers a highly attractive opportunity for asset

management firms and private banks to gather and manage this growing pool of assets closer to their client base.

4. Insurance and Reinsurance : With economic growth, industrialisation and improved regulation, the region is

experiencing a changing attitude towards risk and an increasing awareness of the need for insurance. Due to slow

growth in more mature traditional markets, the world’s insurance and reinsurance companies are now assessing

markets such as the Middle East. The DIFC has set out to create a global [re-]insurance hub to foster the

development of a thriving insurance market by attracting global insurance and reinsurance companies, brokers,

captives and other service providers.

5. Islamic Finance : The global market for Islamic financial products is worth over $260 billion and is expected to grow

at 12 to 15 per cent a year over the next ten years. It is likely to account for some 50 to 60 per cent of the total

savings of the world's 1.2 billion Muslims within the next decade. There is a growing number of infrastructure

projects within the region requiring Sharia compliant finance, but the market is still under-developed and

fragmented. Dubai aims to become a major centre for product innovation for Islamic investors and borrowers.](https://image.slidesharecdn.com/investmentbankinguae-120212055401-phpapp01/85/Investment-banking-uae-15-320.jpg)