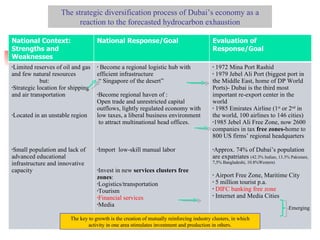

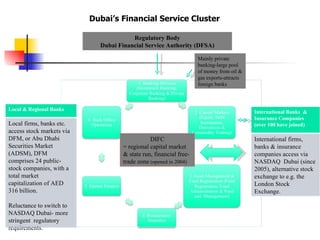

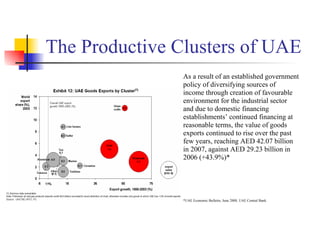

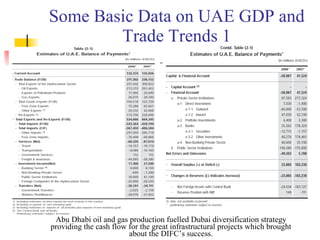

1) Abu Dhabi's oil and gas wealth fueled Dubai's diversification strategy and major infrastructure projects, leading to the success of the Dubai International Financial Center (DIFC).

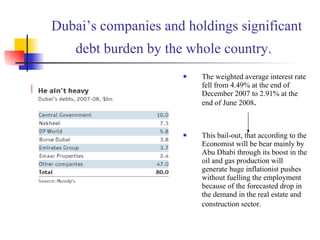

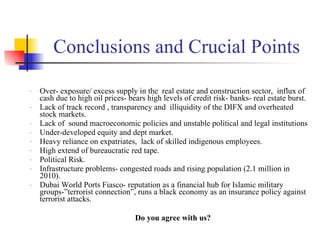

2) However, the DIFC showed lack of transparency, high credit risk, and overexposure to the real estate sector, leaving Dubai significantly in debt following the global financial crisis.

3) The debt crisis threatens Dubai's clusters and could negatively impact employment, economic growth, and investor confidence across the UAE if not properly addressed.