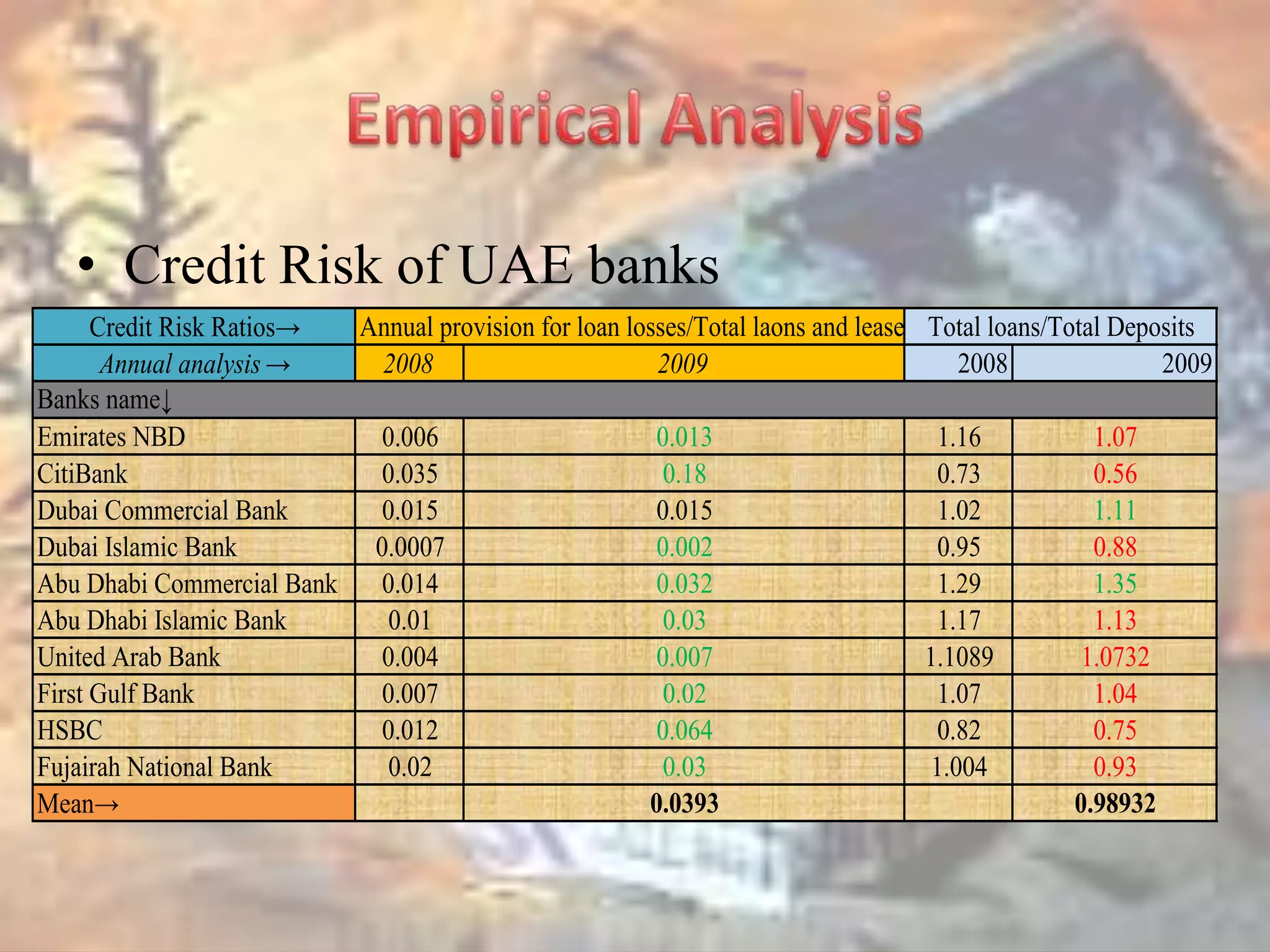

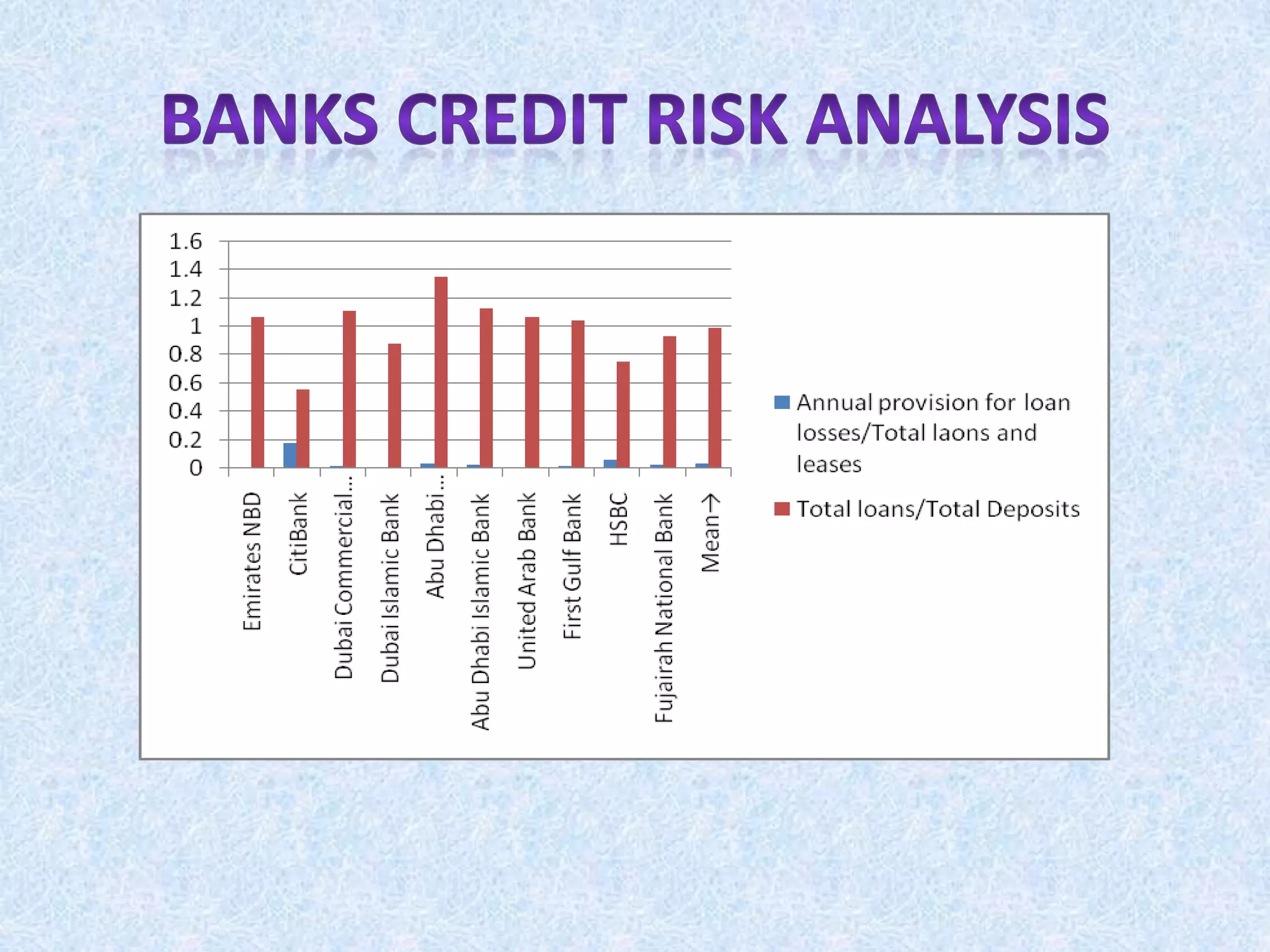

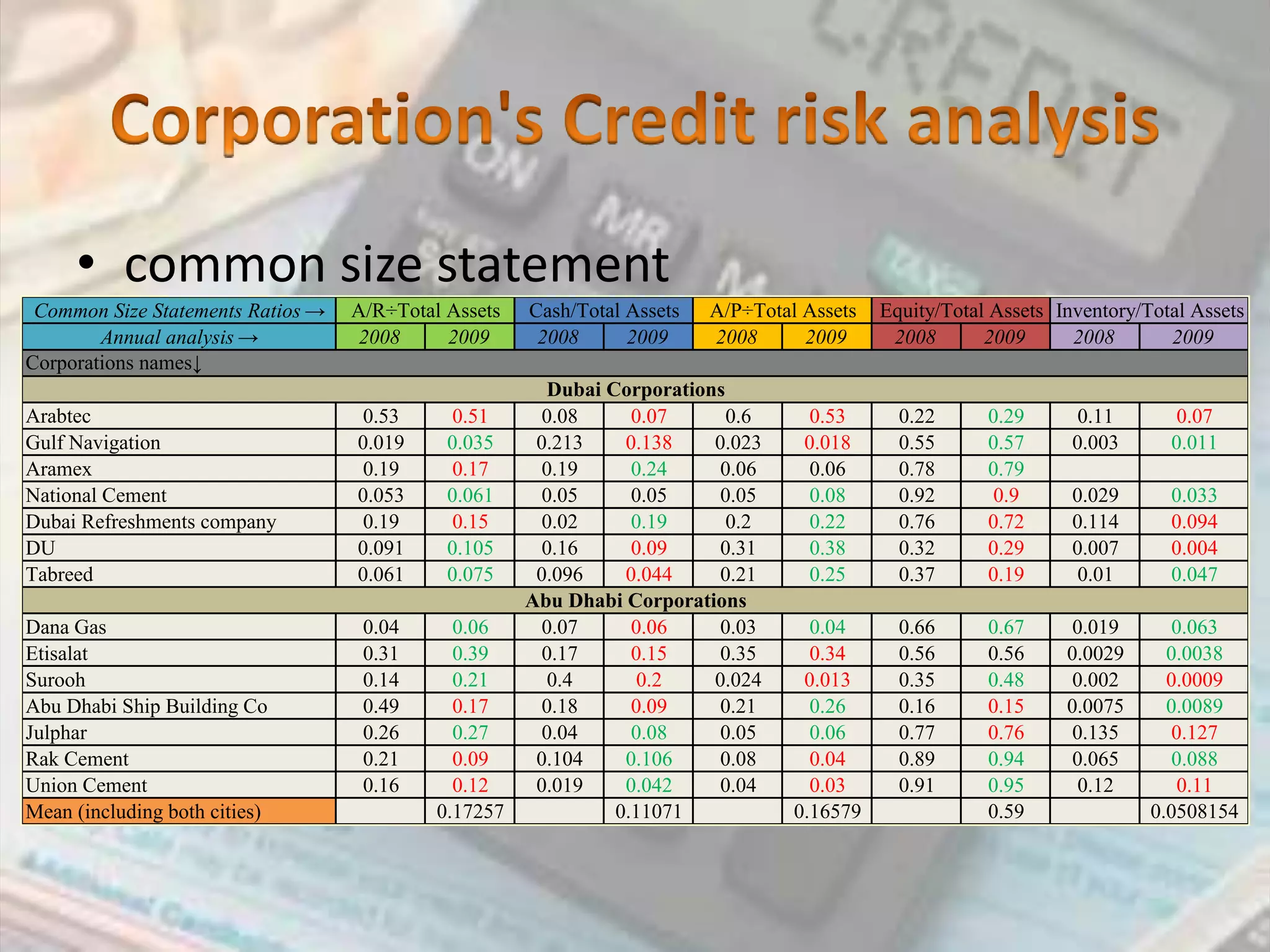

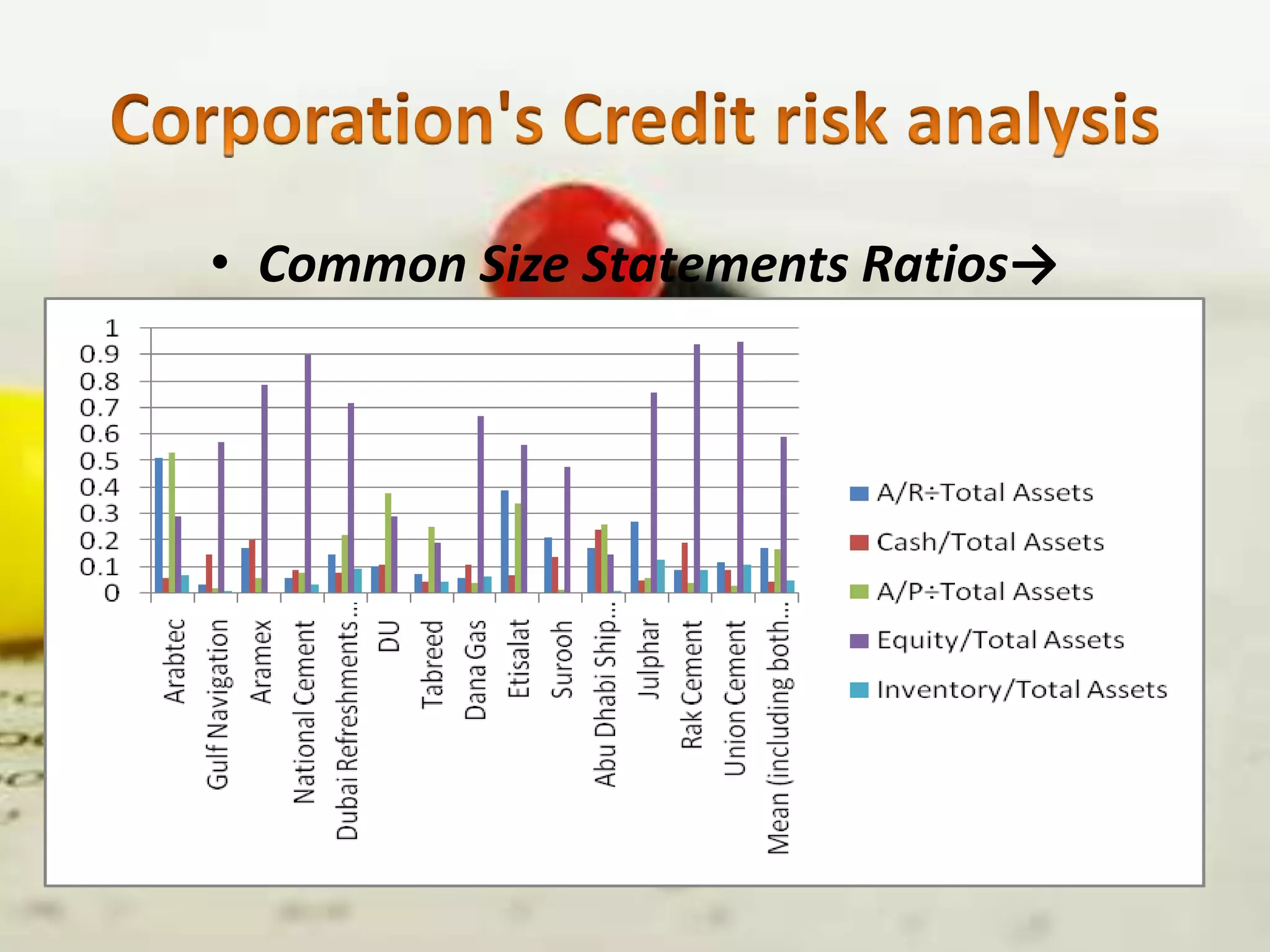

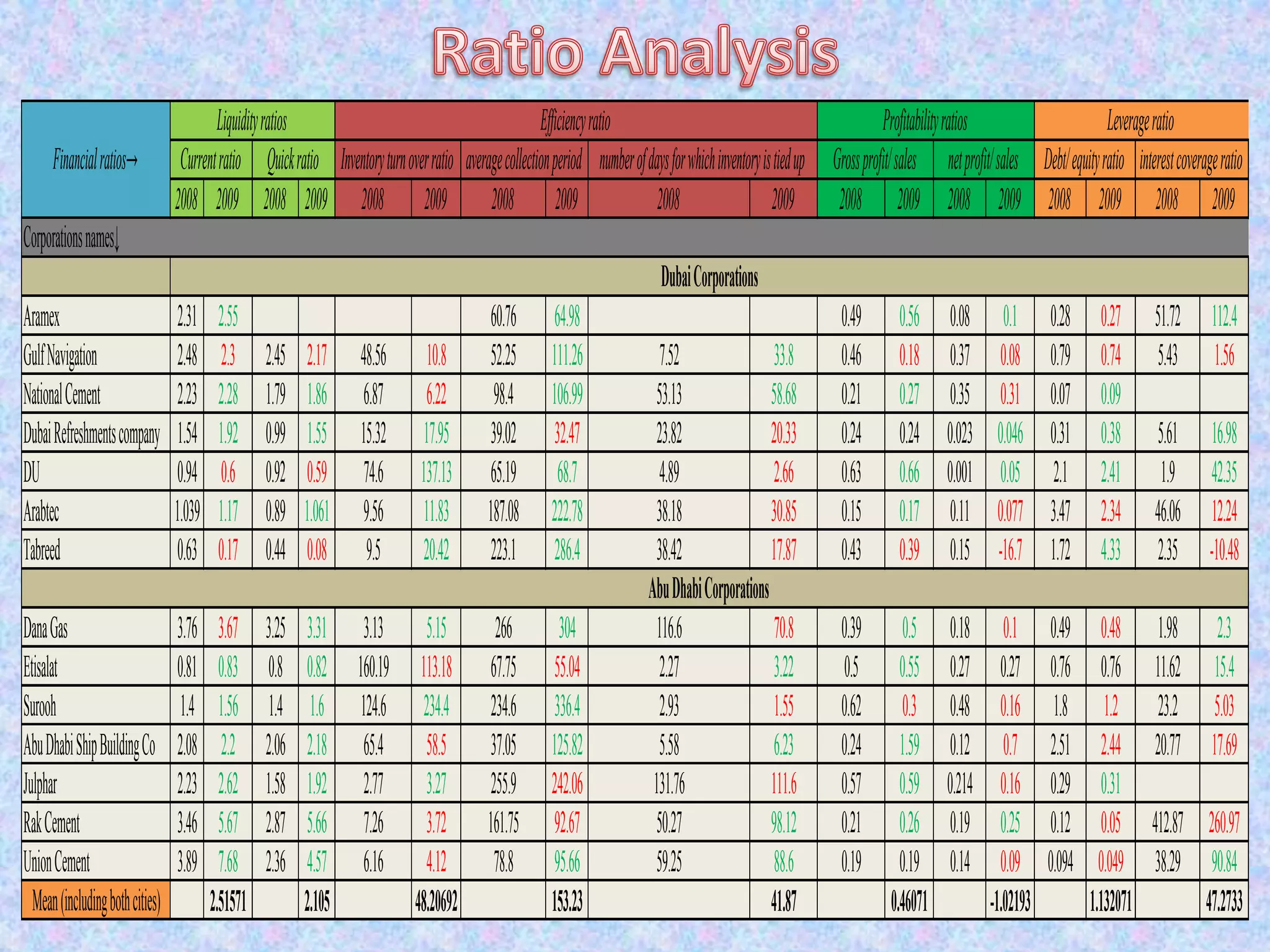

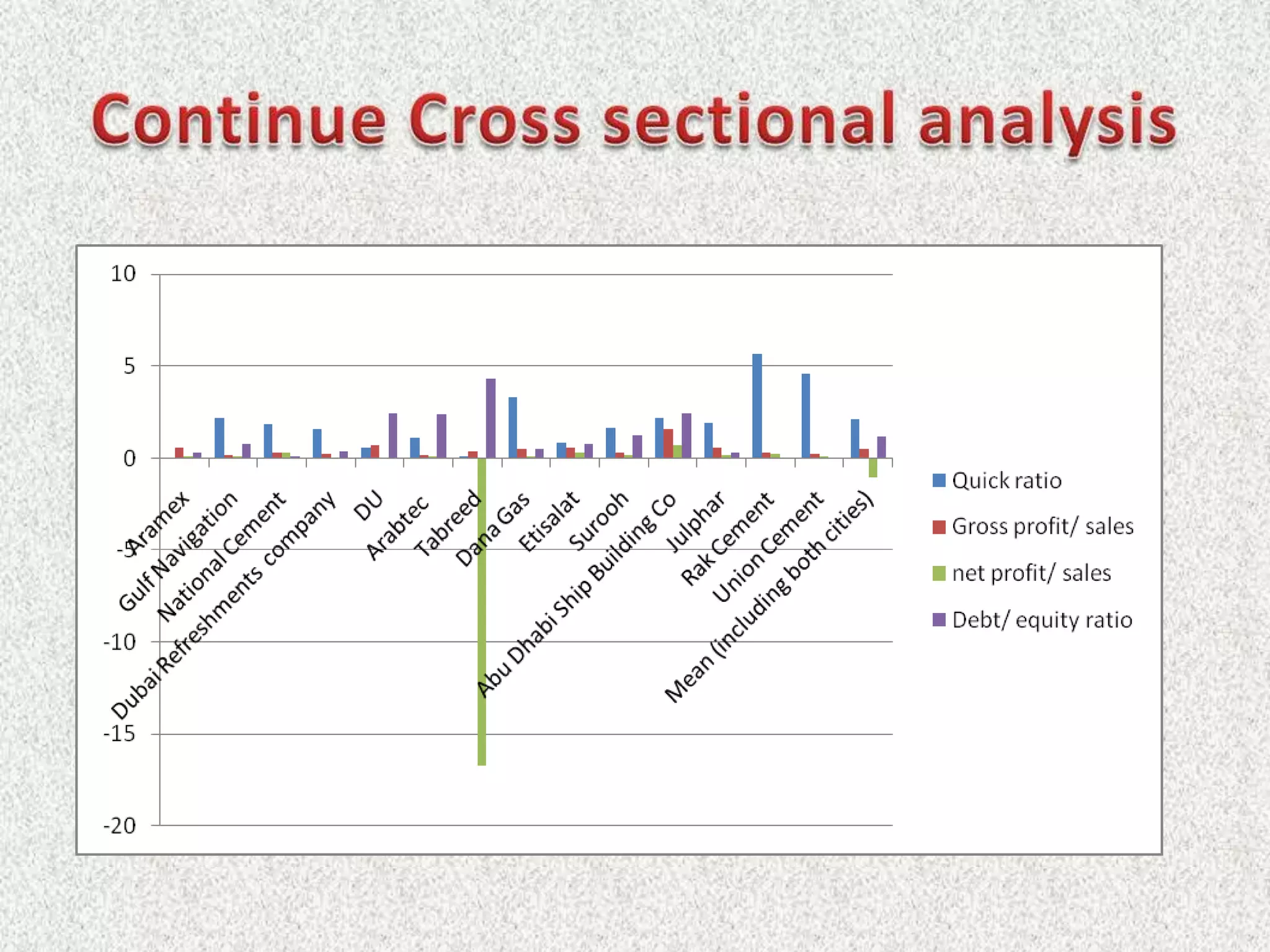

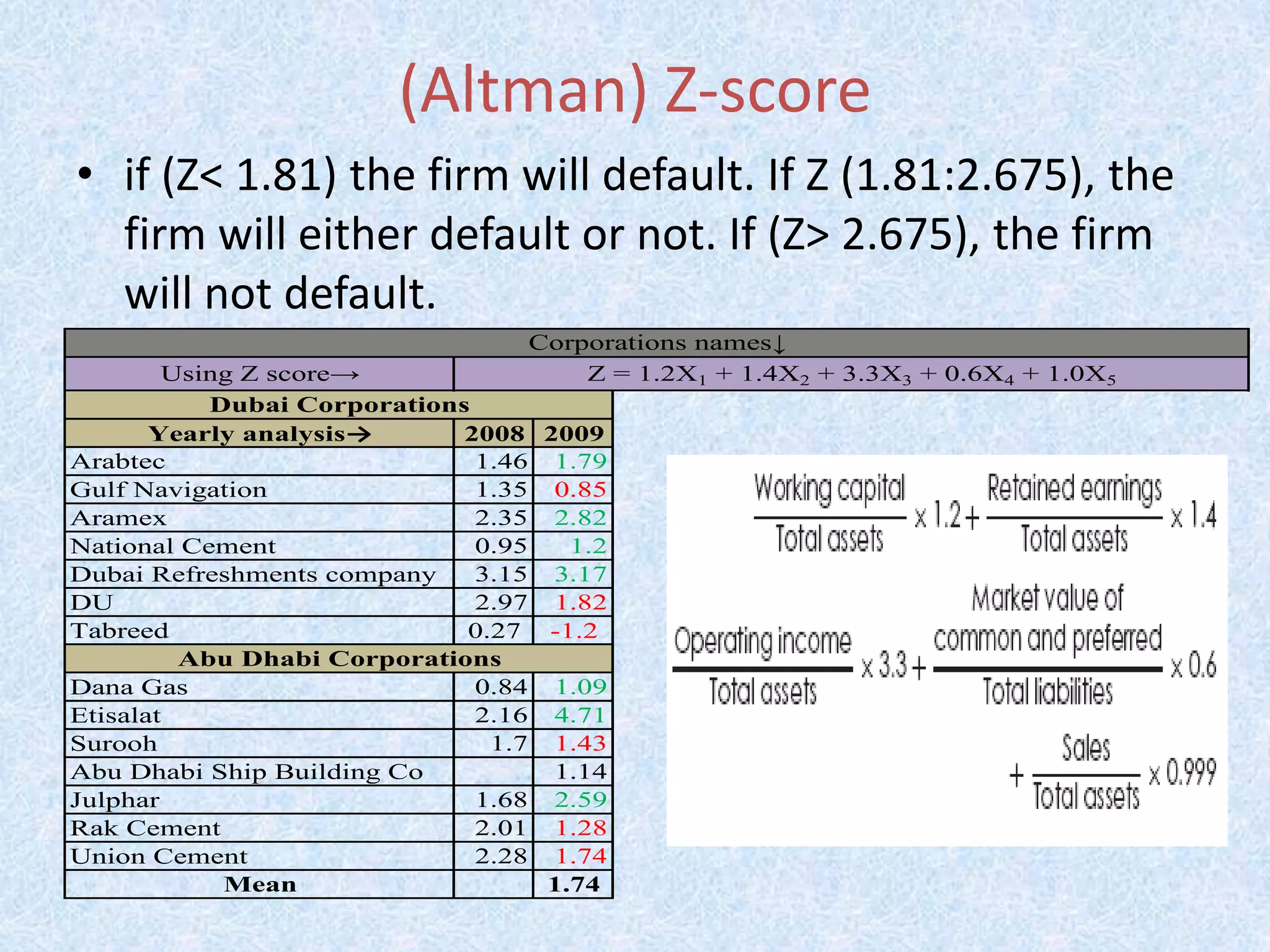

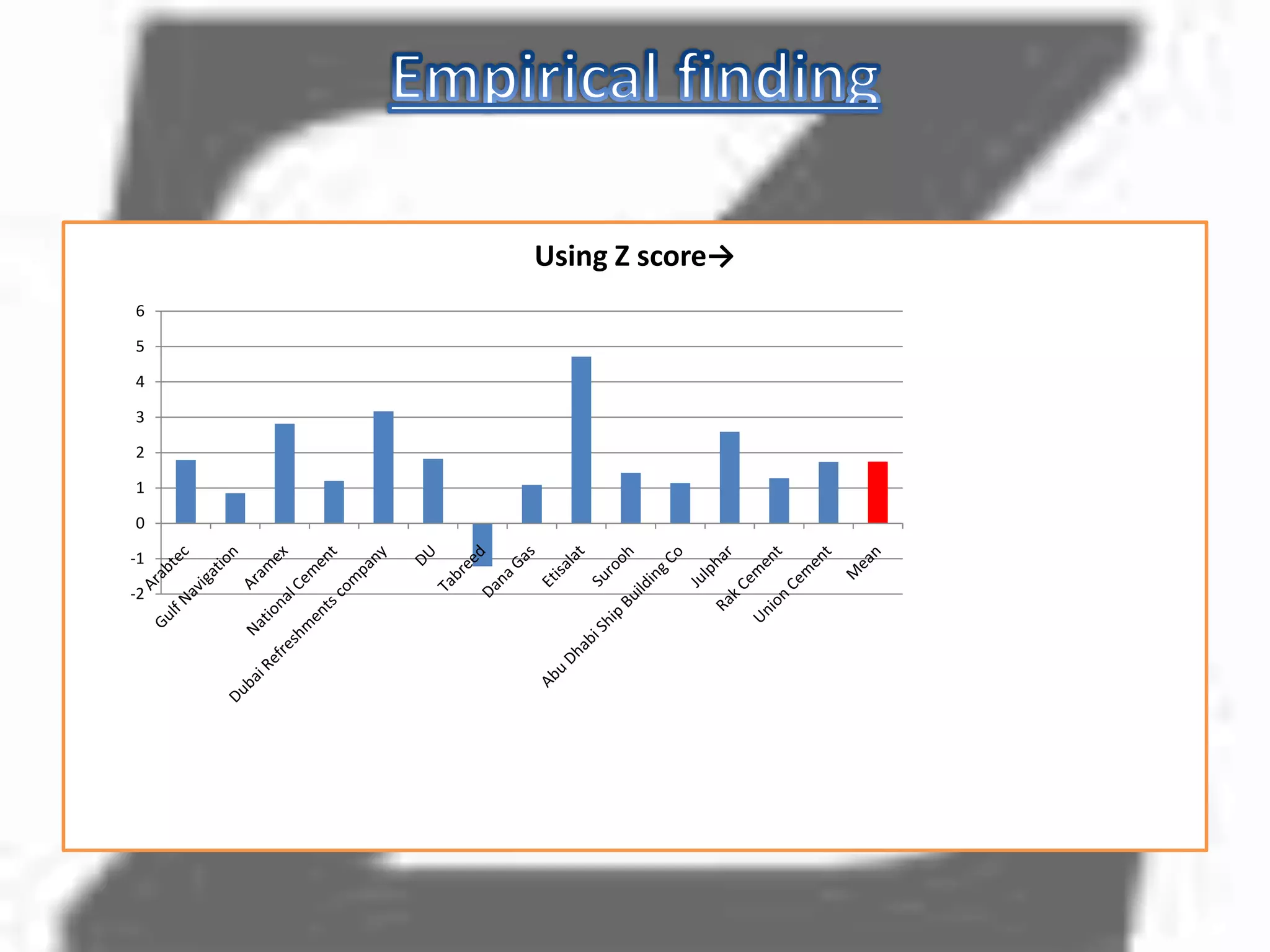

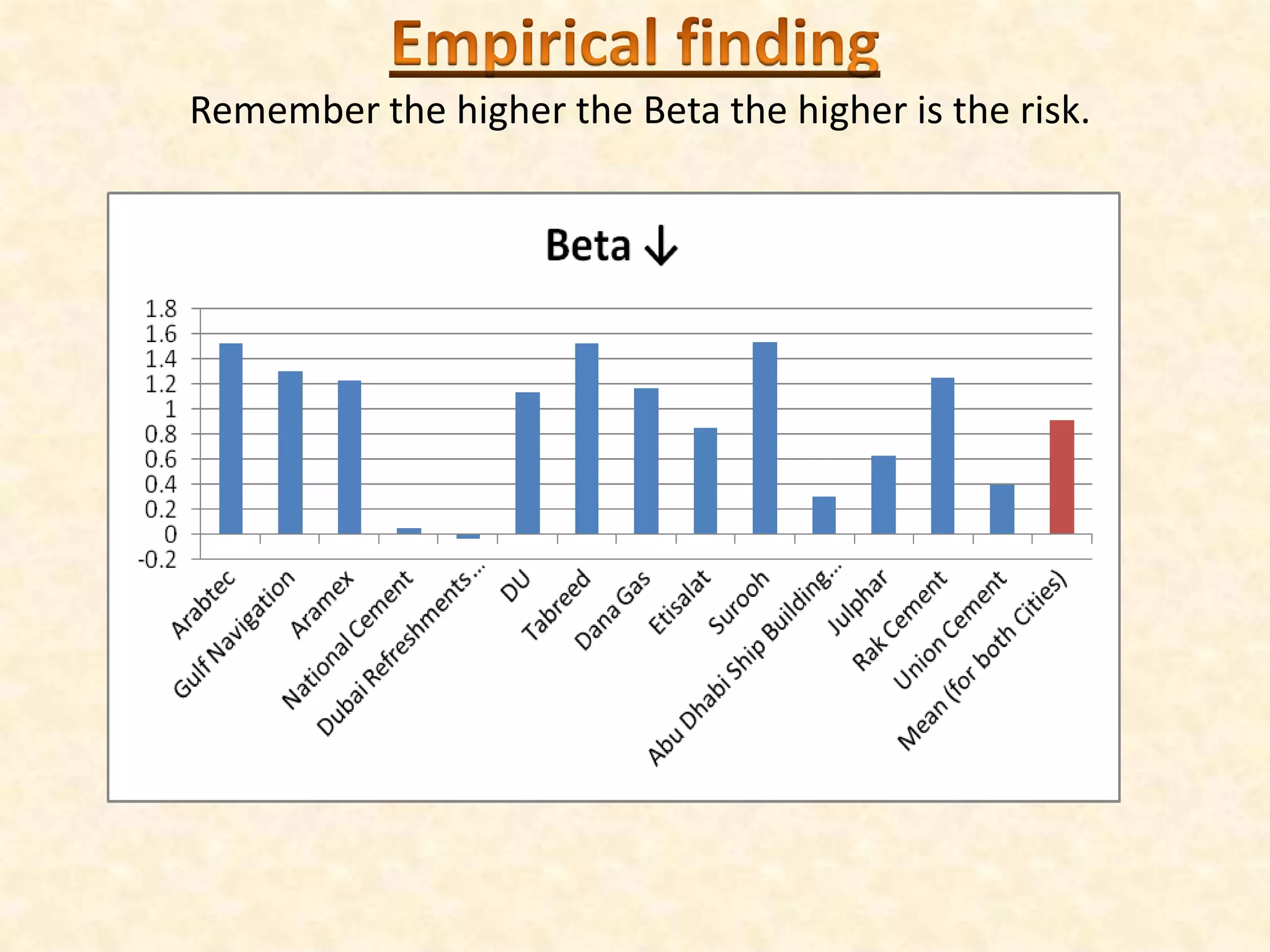

This document analyzes the credit risk of UAE banks and corporations. It discusses research methodology, hypotheses, types of credit risk, and principles of managing credit risk. Cross-sectional analysis of corporate financial ratios is used to assess creditworthiness. The empirical analysis finds Etisalat and Surooh to have the lowest credit risk among corporations, while Citibank and HSBC are found to have the lowest risk among banks. Conclusions state that analysis of financial ratios can help identify firms and banks with the highest and lowest credit risk.