This document provides an overview of Deutsche Bank, including:

- It is a global financial company founded in 1870 and headquartered in Germany.

- It has over 100,000 employees with a presence in 75+ countries.

- The company offers corporate and retail banking services through divisions like corporate and investment banking, private banking, and asset management.

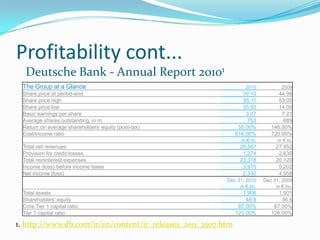

- In 2010, Deutsche Bank reported revenues of €28.6 billion and net income of €2.3 billion.

- The company aims to improve its retail operations, focus on client-driven businesses, and expand in developing markets going forward.