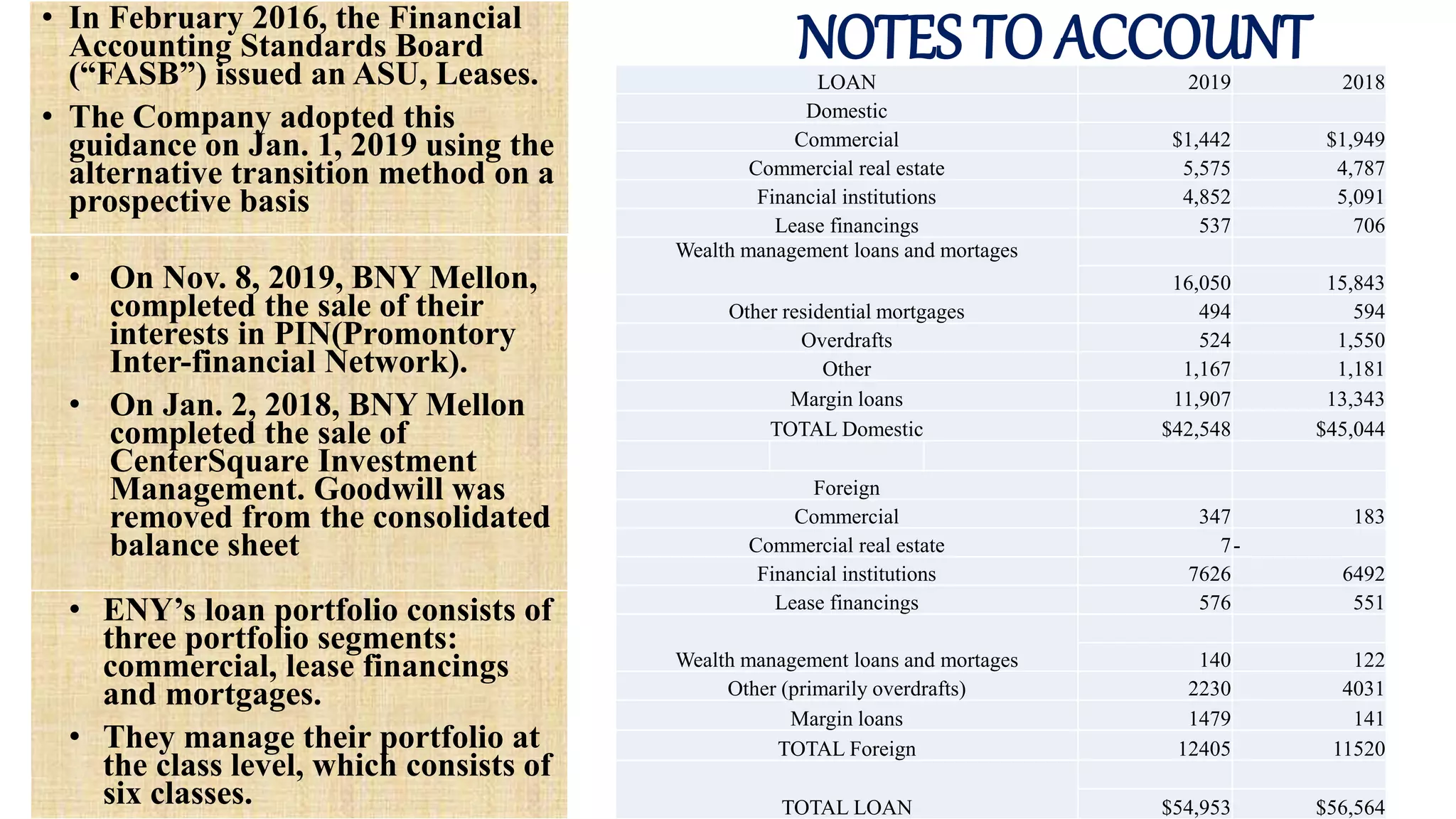

BNY Mellon is a global investment company established in 1784. It provides investment management, investment services, and wealth management. In 2019, BNY Mellon reported revenues of $16.5 billion, net income of $4.4 billion, and assets under management of $1.9 trillion. It operates in over 35 countries and has over 51,000 employees. BNY Mellon faces competition from other large financial institutions but maintains a leading position in custody banking and asset servicing.