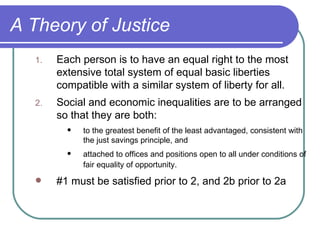

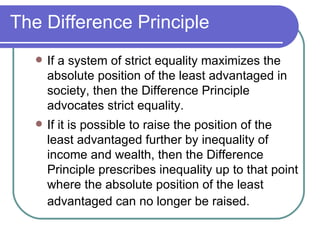

Distributive justice involves how benefits and burdens in society should be distributed. It addresses questions like how income, wealth, and opportunities should be distributed among individuals and groups. There are various theories for the basis of distribution, such as equality, merit, free market transactions, or maximizing individual needs. John Rawls' theory of justice as fairness holds that social and economic inequalities are justified only if they benefit the least advantaged and positions are open to all under conditions of fair equality of opportunity.