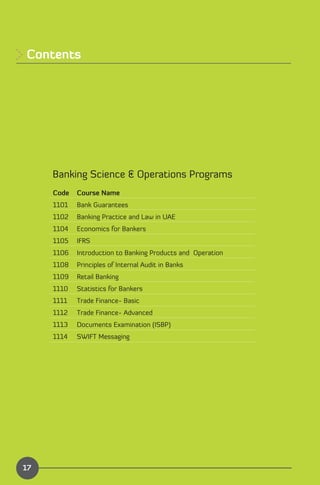

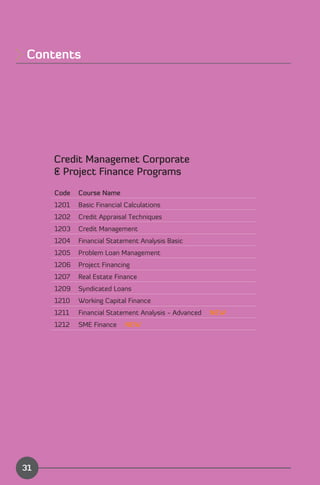

The document is the 2013 annual training plan for the Emirates Institute for Banking and Financial Studies (EIBFS). It provides an overview of the new programs and features being offered in 2013, including expanded course offerings in Dubai, new e-learning programs, leadership development programs, and a specialized certificate in retail banking. The chairman's and general manager's messages emphasize supporting the banking and finance sector through continuous skills upgrading and innovative programs to meet industry needs. The plan aims to qualify professionals and support the growth of the UAE economy.