Embed presentation

Download to read offline

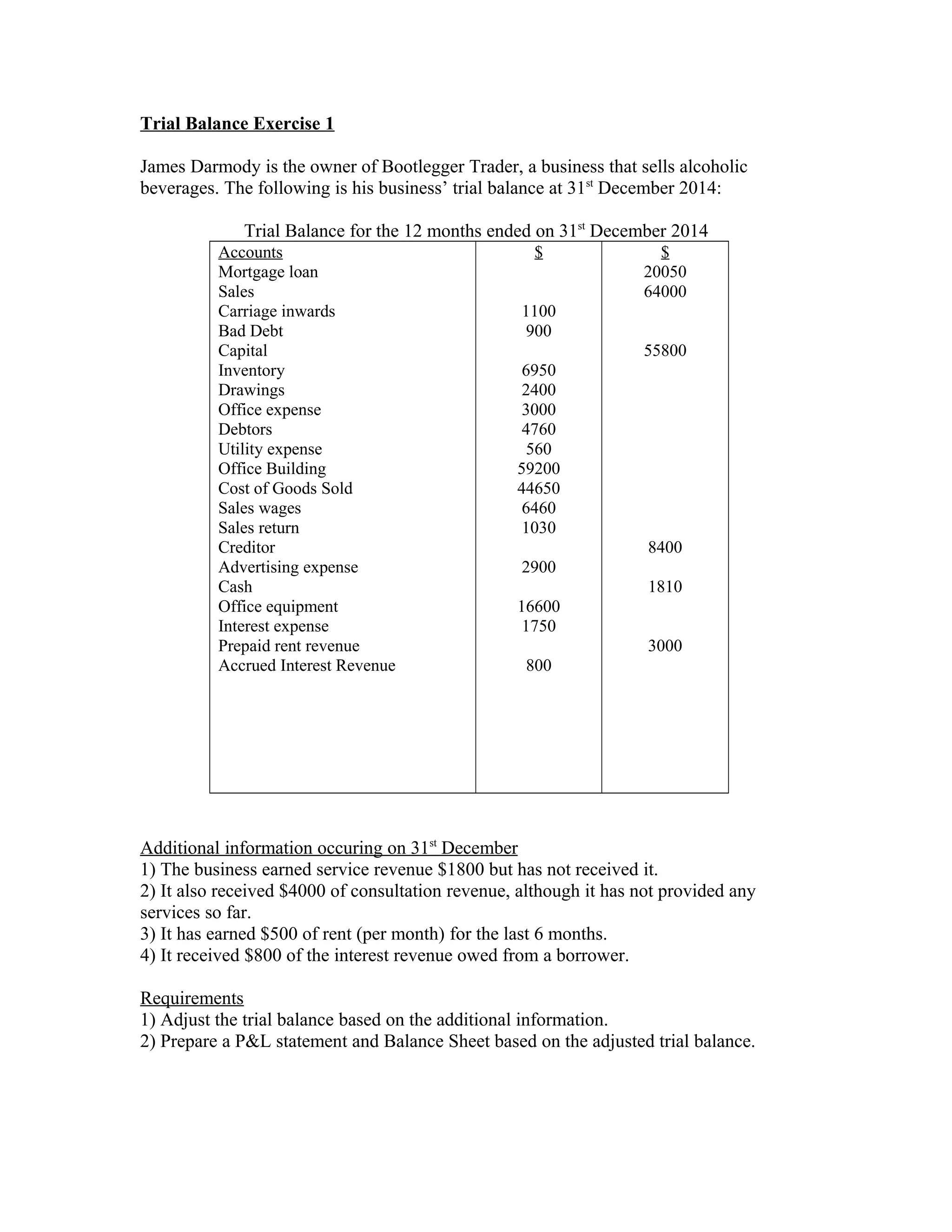

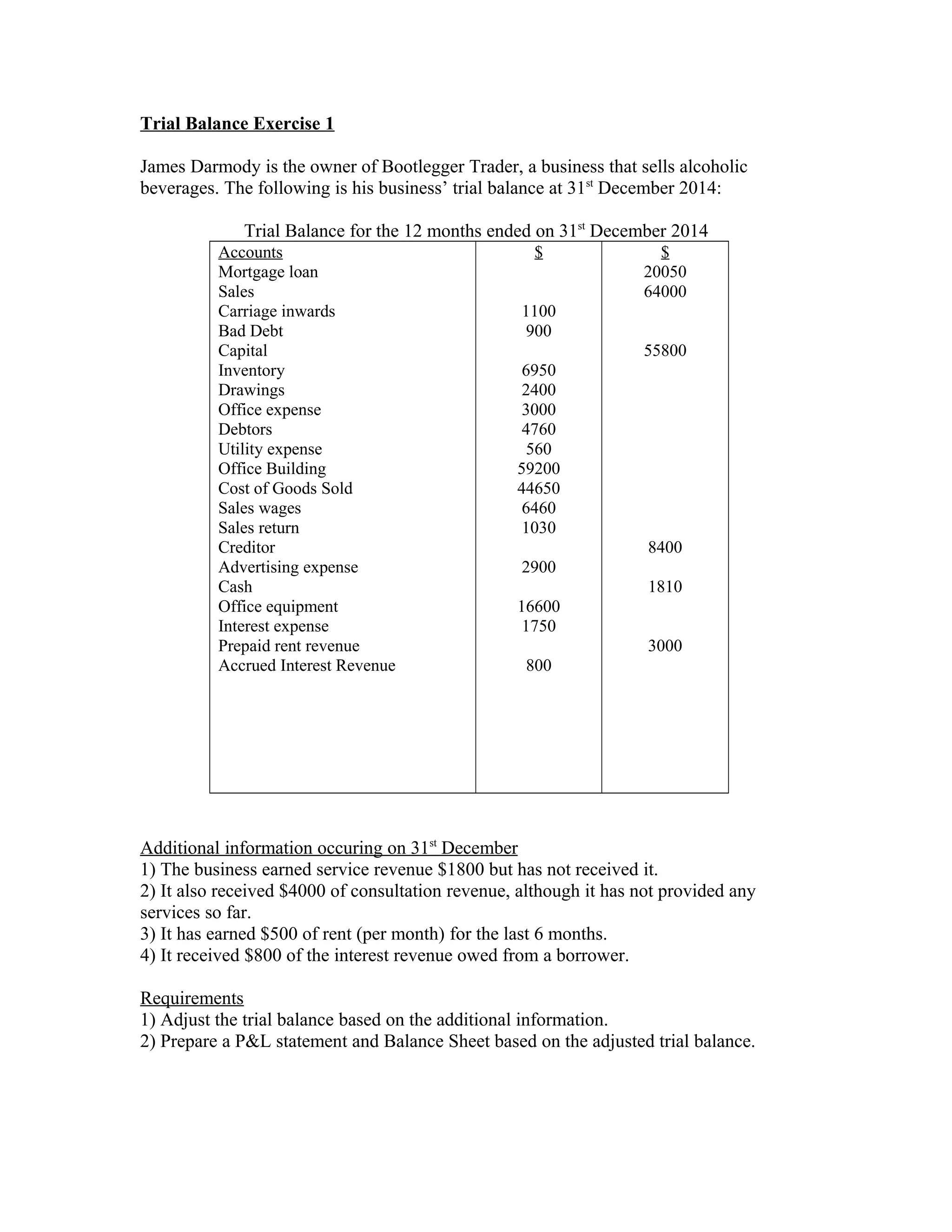

The trial balance for Bootlegger Trader shows account balances as of December 31, 2014. Additional information provided adjustments to accounts for accrued revenue not yet received, unearned revenue received in advance, and prepaid rent expense. The adjusted trial balance is to be used to prepare an income statement and balance sheet showing the company's financial position at year end.