The document provides 10 tips for ensuring suppliers are real, including obtaining W-9 and W-8 forms, performing initial TIN matching and validation of supplier information, initial and ongoing compliance screening, comparing employee and supplier data, and conducting an annual supplier fraud risk analysis. It emphasizes the importance of protecting the supplier master file due to the risk of purchasing and finance fraud.

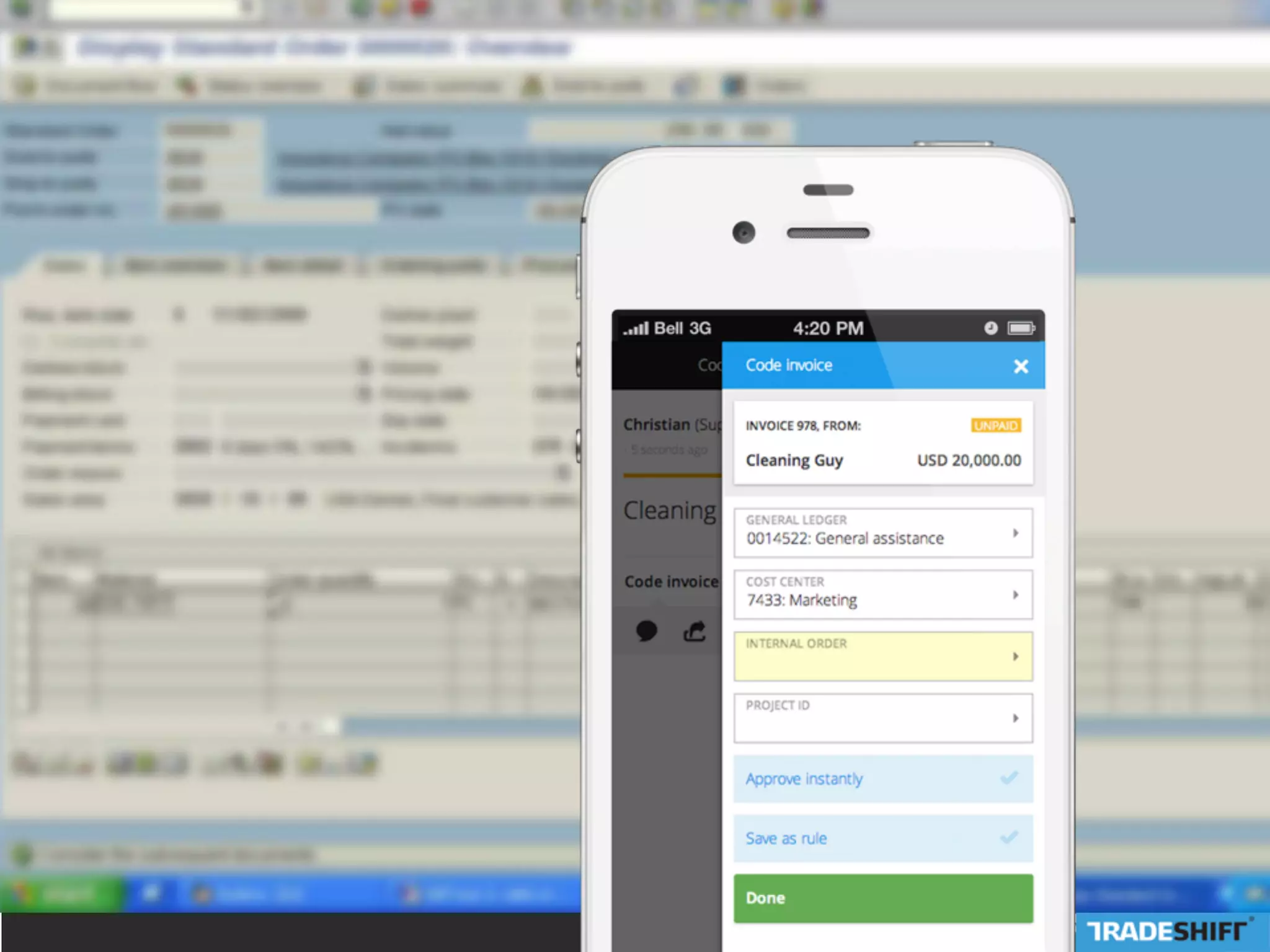

![▪ Flexible cloud platform enabling businesses to

connect, collaborate and transact with their

supply chain

▪ State-of-the art automation, data intelligence

and collaboration technology that is cloud

based, mobile ready, and simple to use

▪ Our mission is to help businesses and their

employees connect to and create value for their

entire supply chain

• Over

500,000

suppliers

in

over

100

countries

• 5

million

suppliers

connected

through

pla]orm

partners

such

as

Intuit

• Fastest

growing

B2B

pla]orm

in

the

world

today

with

more

than

2000

suppliers

joining

every

week

About Tradeshift](https://image.slidesharecdn.com/tradeshiftsuppliervalidation-doxey7-30-14-140821101225-phpapp01/75/Ten-Tips-to-Ensue-that-Your-Suppliers-are-Real-31-2048.jpg)