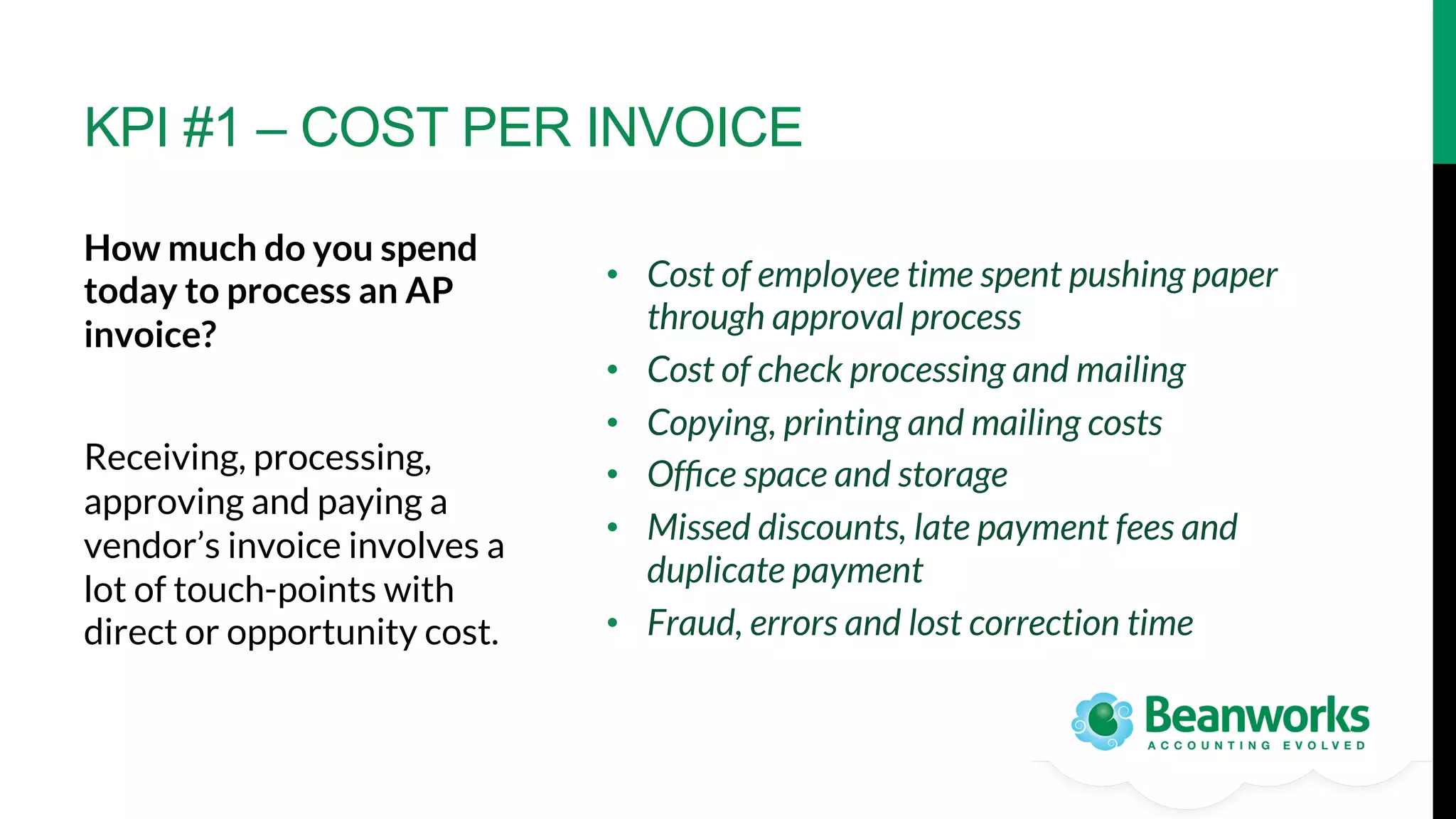

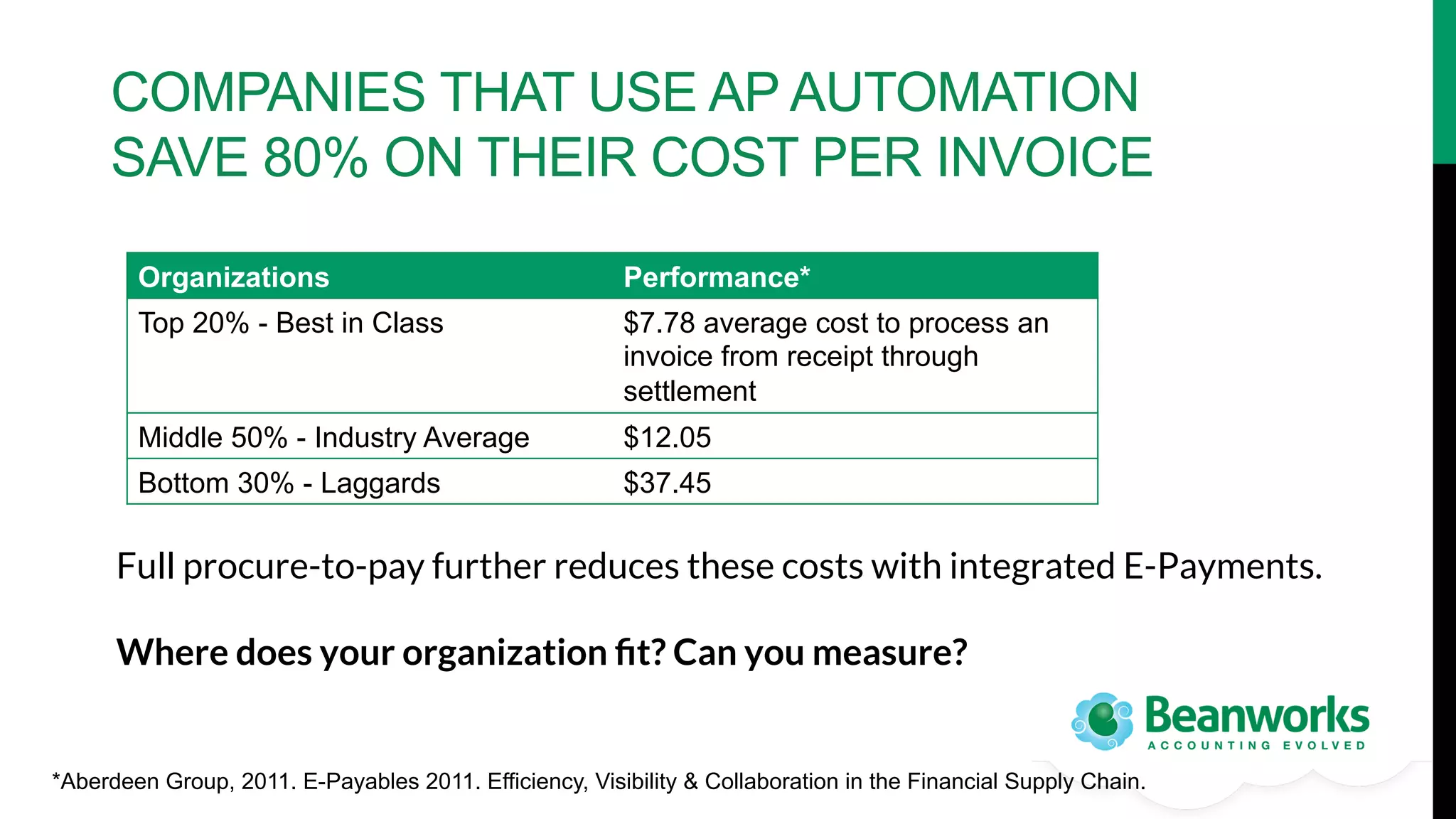

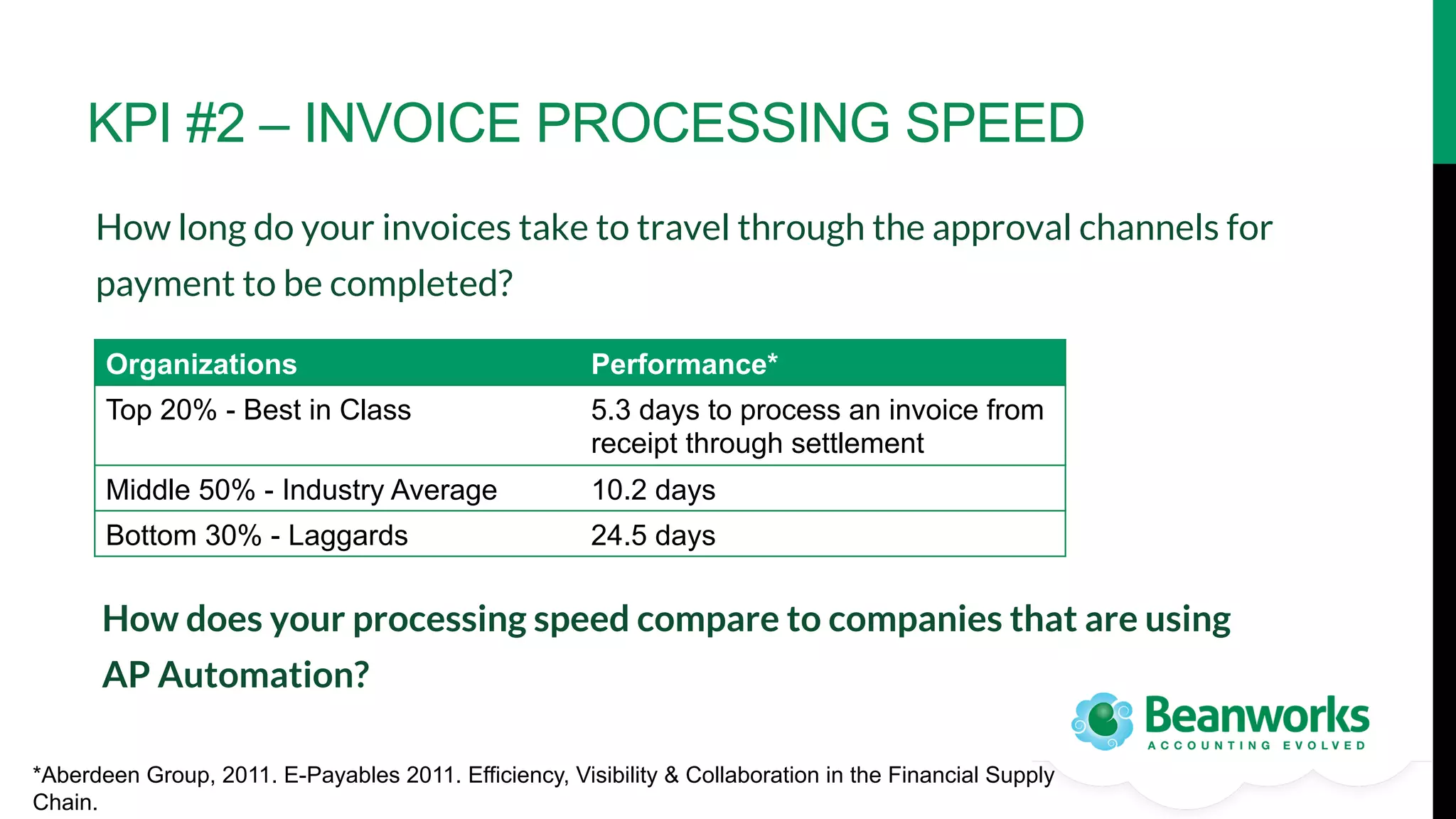

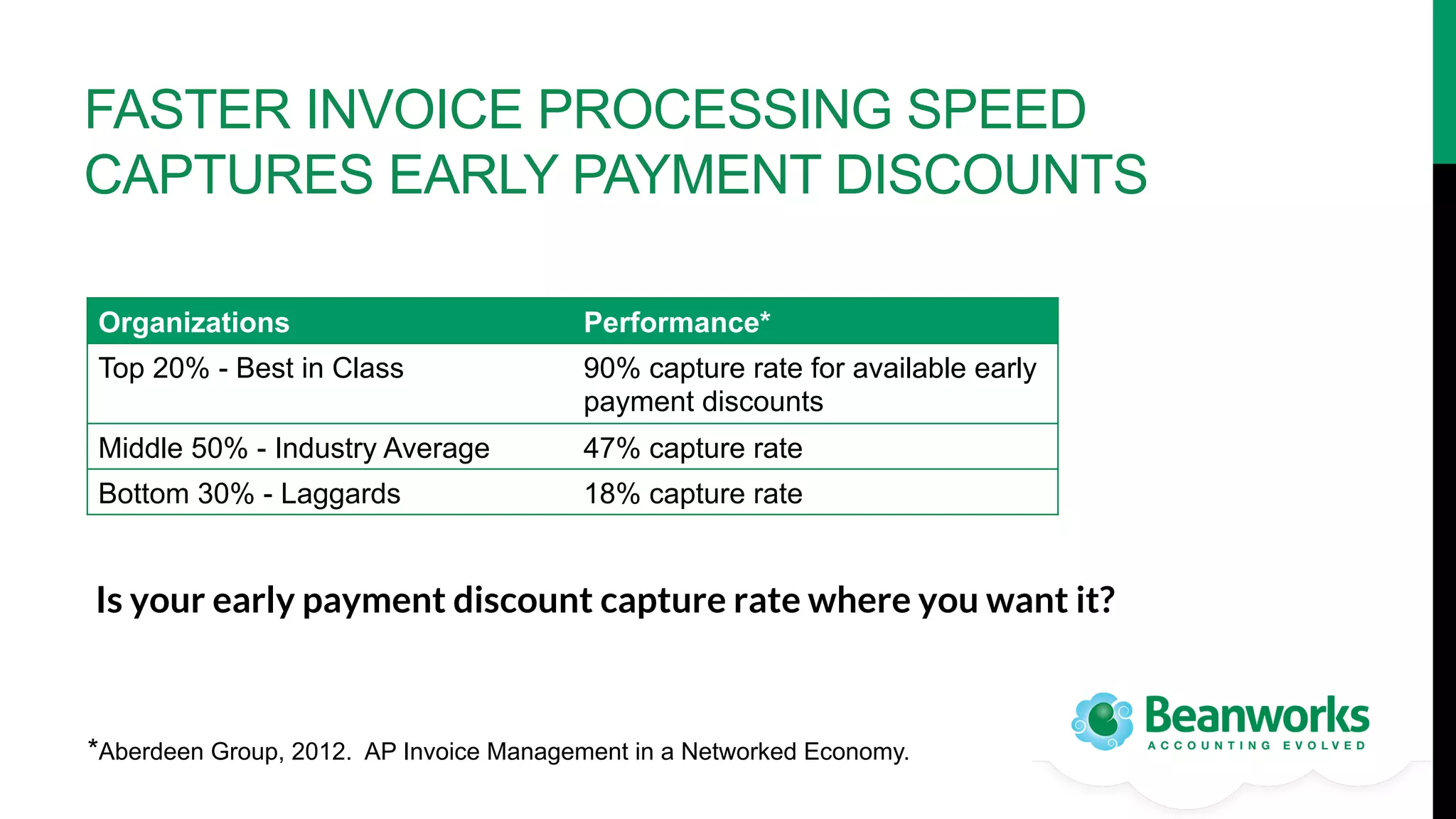

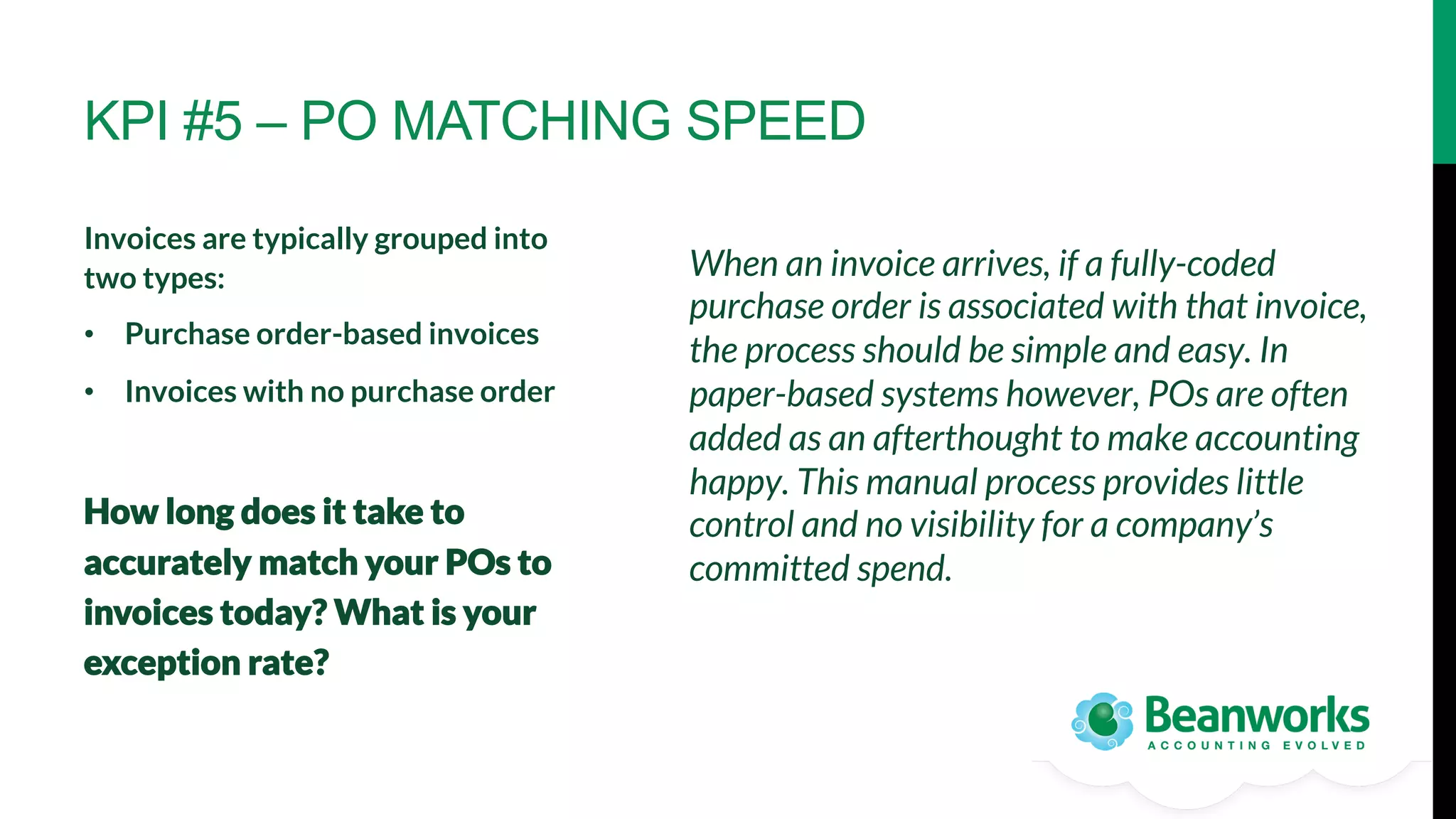

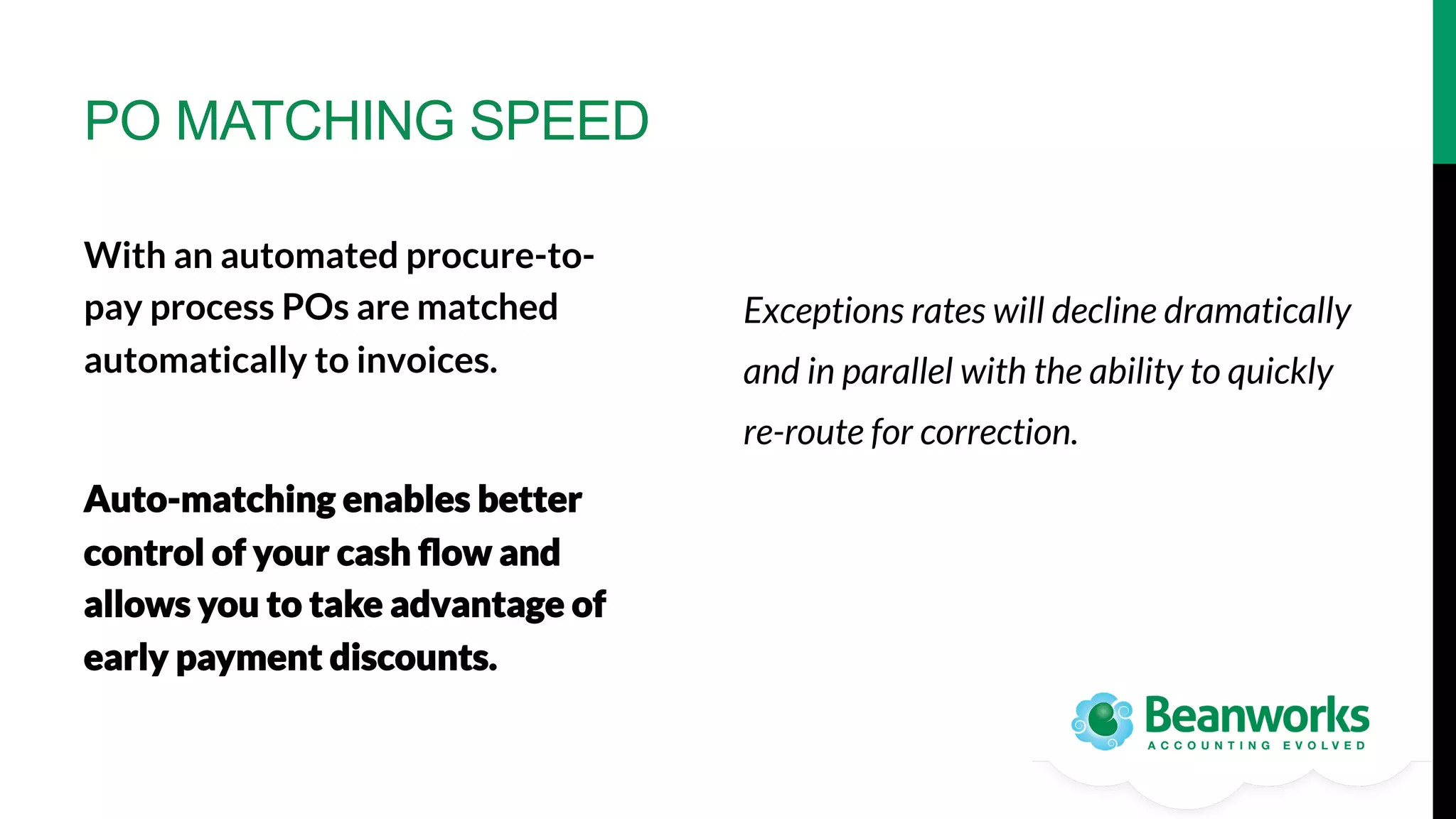

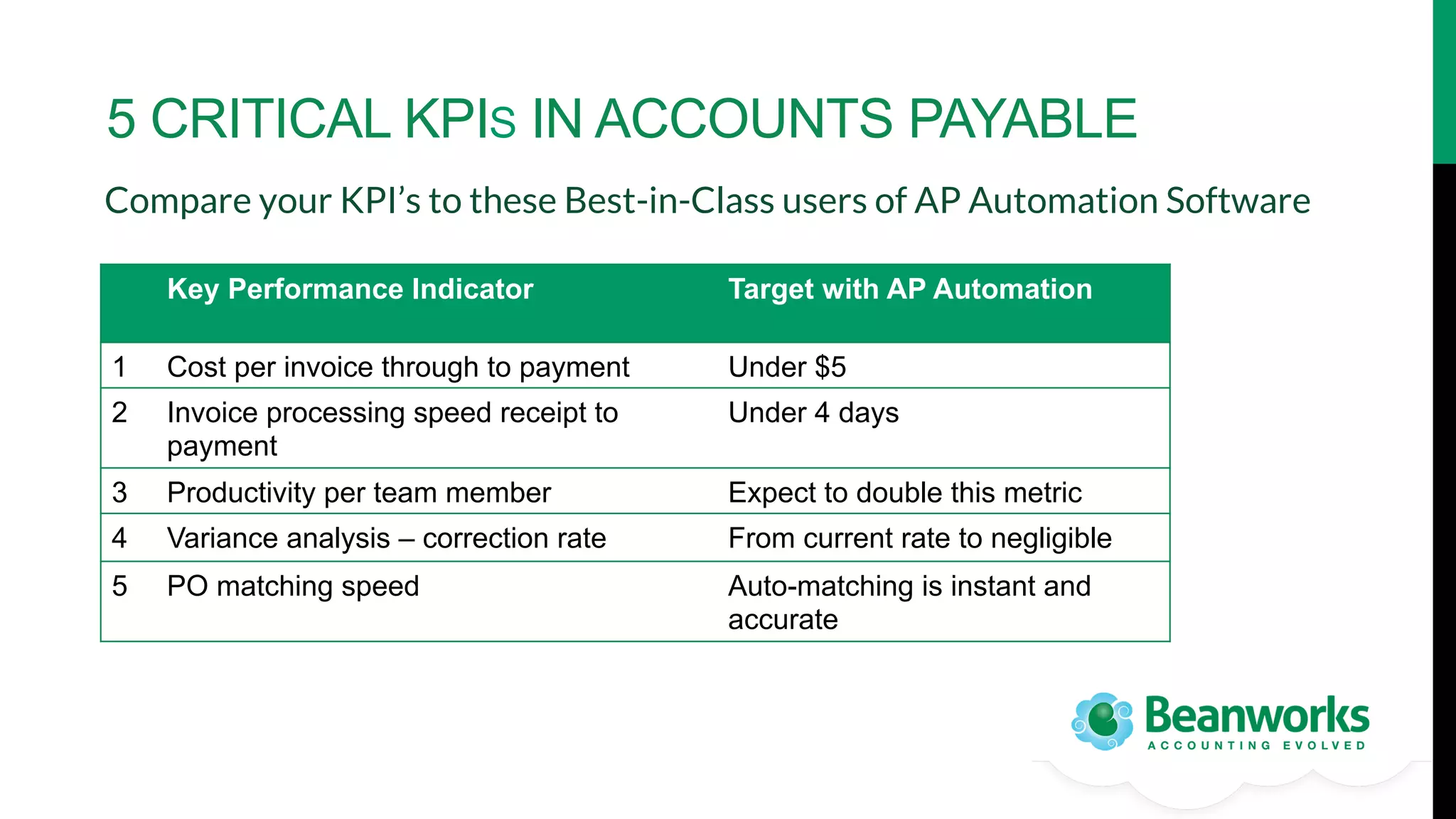

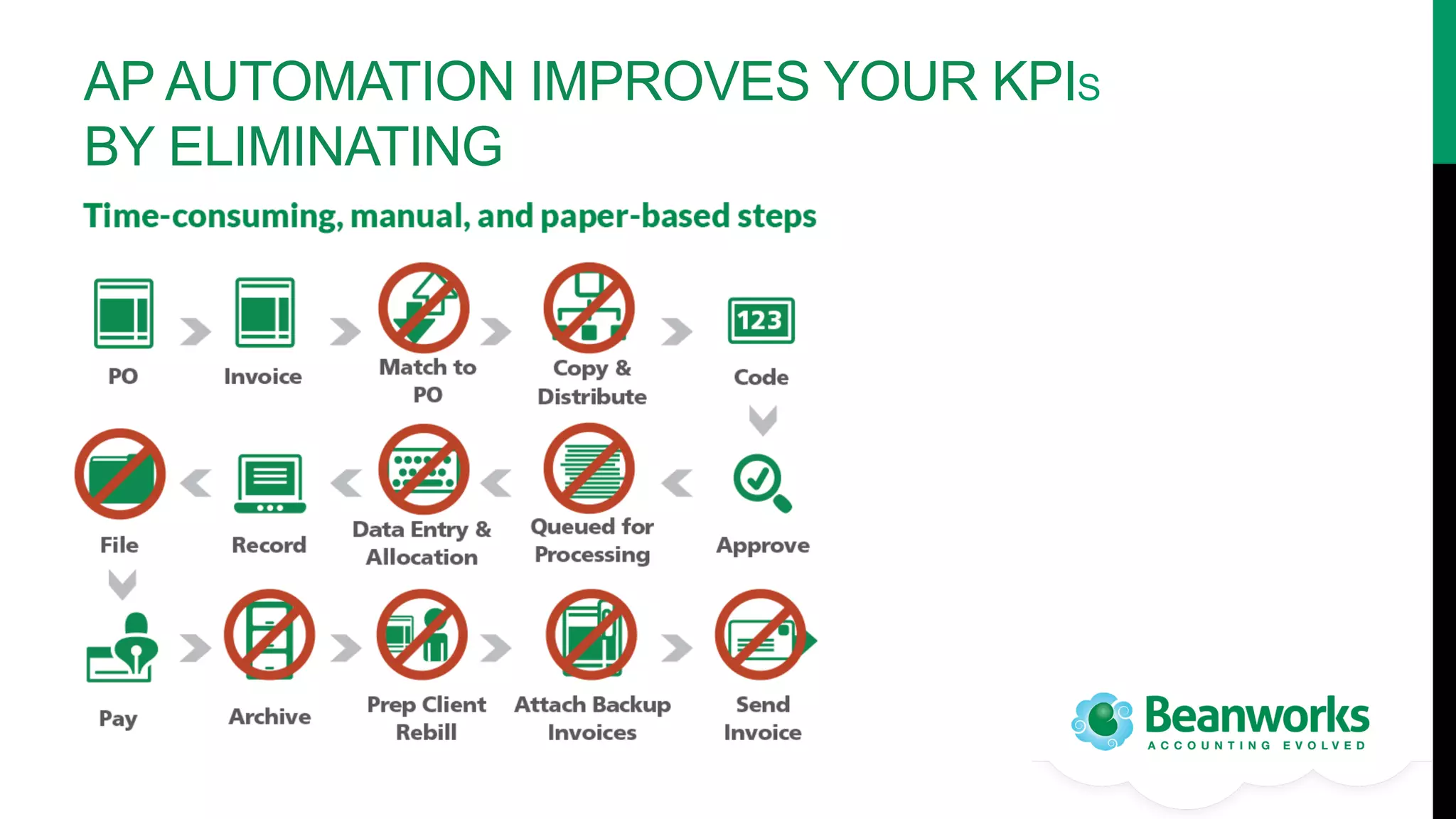

The document discusses the strategic importance of accounts payable (AP) automation, detailing five key performance indicators (KPIs) that organizations should measure to improve efficiency, including cost per invoice, processing speed, productivity per team member, variance analysis, and purchase order matching speed. It emphasizes that empowering the AP function with technology can significantly reduce costs and enhance productivity, positioning AP as a strategic asset rather than a cost center. Additionally, it suggests that organizations adopting AP automation can achieve best-in-class results and provides considerations for selecting automation solutions.