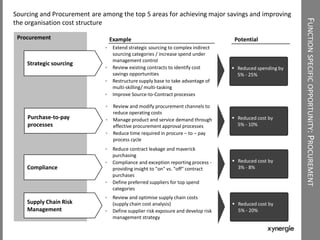

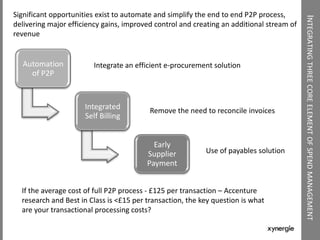

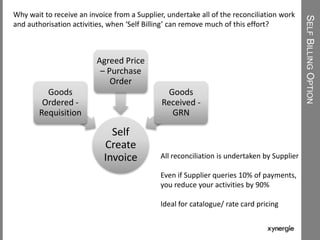

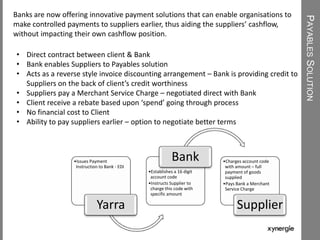

The document outlines strategies for enhancing procurement and purchase-to-pay (P2P) operations, focusing on cost reduction, efficiency, and compliance through various methods including strategic sourcing and supplier management. It emphasizes the potential for automation in the P2P process, proposing self-billing and e-procurement solutions that streamline operations and improve supplier cash flow. The text highlights the importance of managing supplier risk and offers insights into payment solutions that benefit both suppliers and clients.