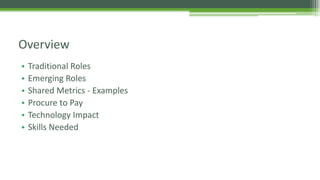

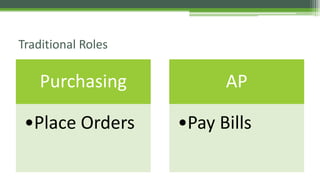

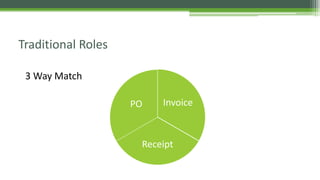

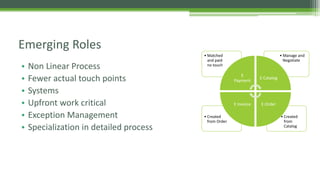

The document discusses the evolving relationship between purchasing and accounts payable (AP), highlighting the blurring of traditional roles due to technology, globalization, and a focus on electronic payments. It outlines the challenges and opportunities this transformation brings, including the need for new skills and shared metrics while emphasizing the importance of accurate purchase orders and effective communication between teams. The document suggests that a unified approach could enhance efficiency and collaboration, ultimately leading to better management of finances and supplier relationships.