This document discusses transfer pricing services for companies with international transactions. It provides an overview of key transfer pricing concepts and requirements in India, including:

1) Calculating arm's length pricing and preparing transfer pricing documentation for tax authorities.

2) Common transfer pricing methods like comparable uncontrolled price, resale price, and cost plus.

3) What constitutes an international transaction and associated enterprises according to Indian law.

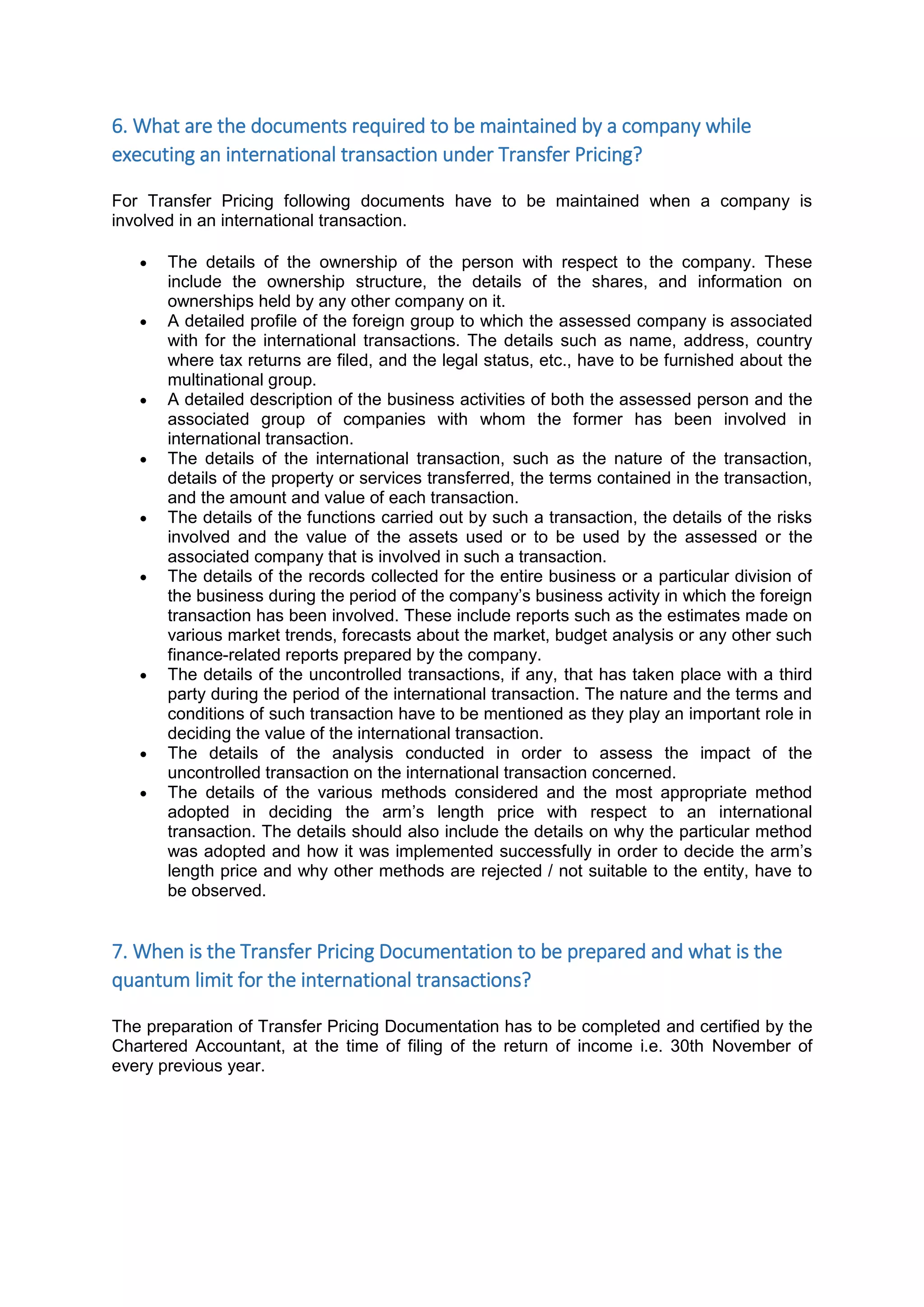

4) Documentation requirements like ownership details and foreign group profiles that must be maintained for international deals.