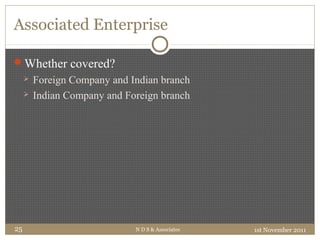

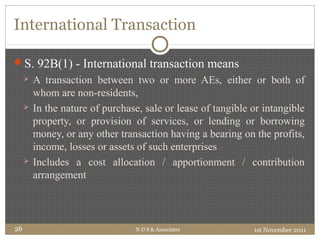

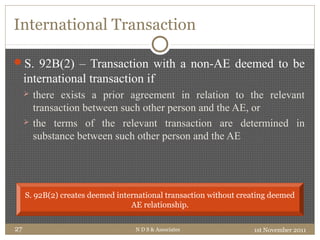

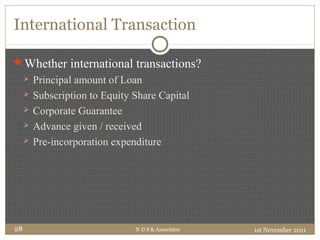

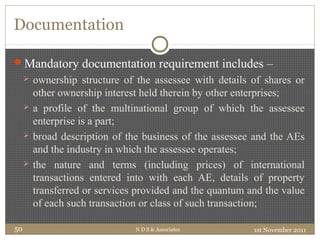

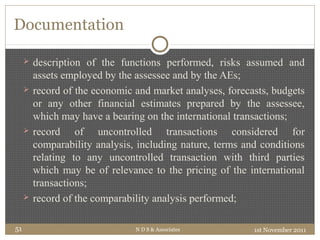

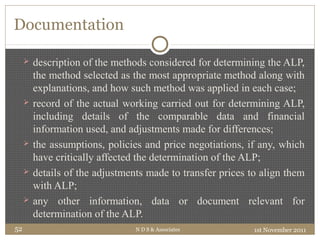

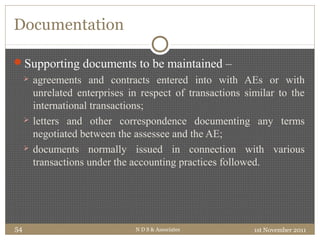

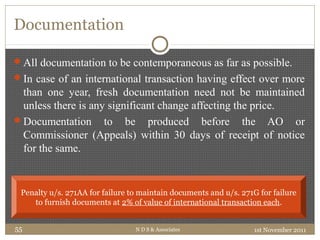

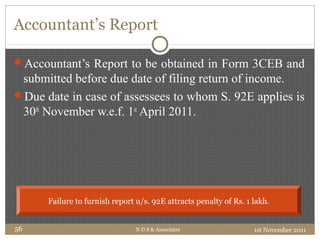

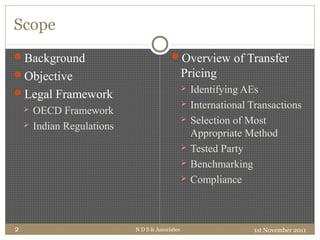

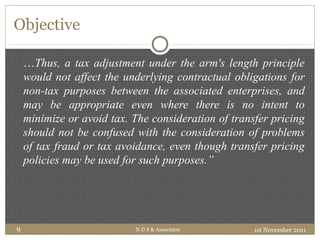

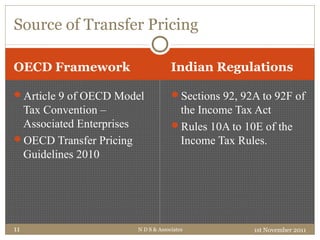

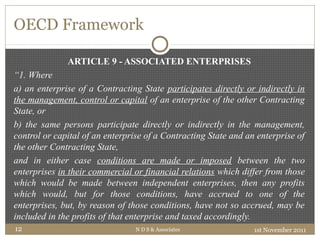

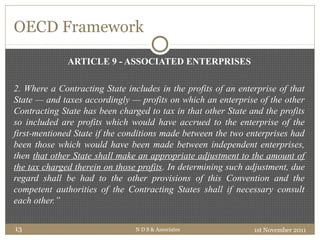

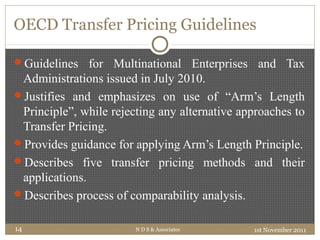

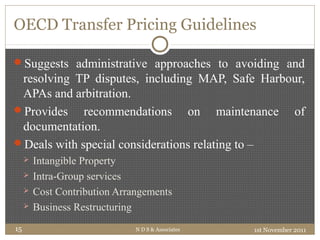

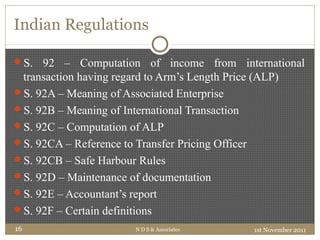

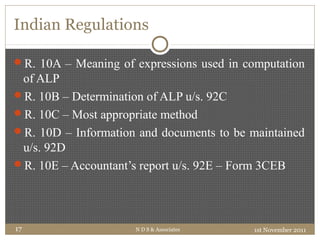

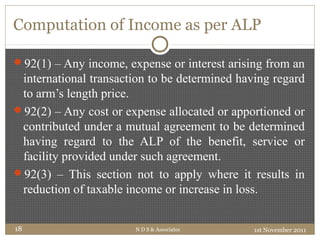

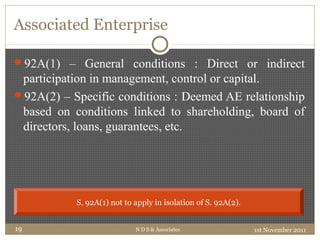

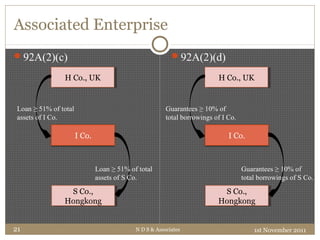

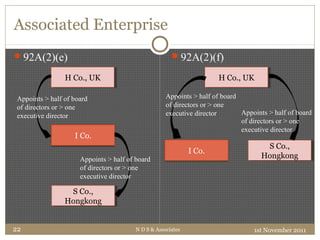

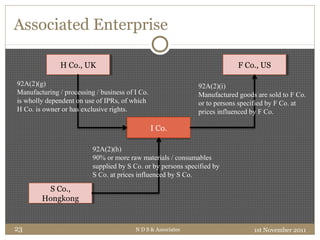

This document provides an overview of transfer pricing and the related legal framework in India. It discusses how transfer pricing regulations were introduced to address profit shifting among multinational enterprises. The objectives of the regulations are to compute taxable income based on the arm's length principle outlined in the OECD guidelines. The legal framework draws from Article 9 of the OECD Model Tax Convention and Sections 92-92F of the Indian Income Tax Act. Key concepts covered include associated enterprises, international transactions, appropriate transfer pricing methods, and documentation requirements.

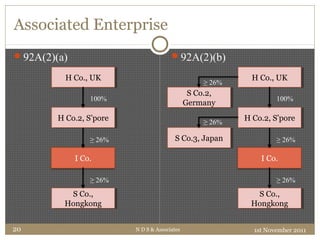

![Associated Enterprise

92A(2)(j) and 92A(2)(k) 92A(2)(l)

1st November 2011N D S & Associates24

I Co. H Co., UKH Co., UK

Control by Mr.

A / A(HUF)

Control by –

Mr. A and/or his

relative;

Member of A(HUF)

and/or his relative

I & Co.

[Firm / AOP / BOI]

H Co., UKH Co., UK

≥ 10% interest](https://image.slidesharecdn.com/basicsoftransferpricing-150529110713-lva1-app6892/85/Basics-of-Transfer-Pricing-24-320.jpg)