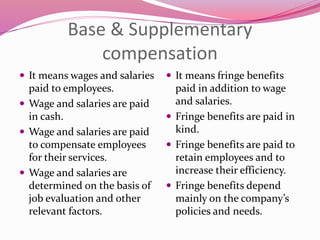

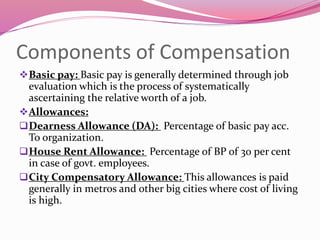

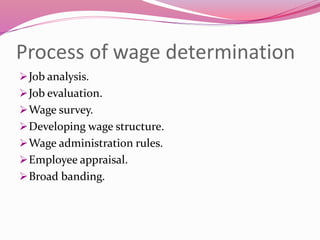

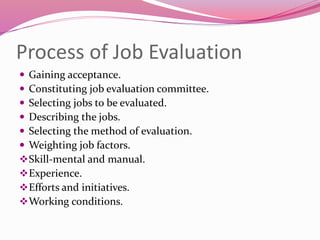

The document discusses compensation and job evaluation. It defines compensation as consisting of base pay, supplementary compensation like benefits, and incentive pay. It describes the process of job evaluation which involves analyzing and ranking jobs based on factors like skills, effort, responsibilities to determine appropriate pay levels. Job evaluation seeks to establish a fair and equitable compensation system and provide a basis for pay decisions. Common methods of job evaluation include ranking, grading, and point-based systems.