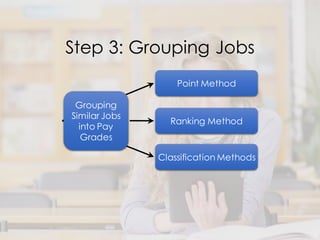

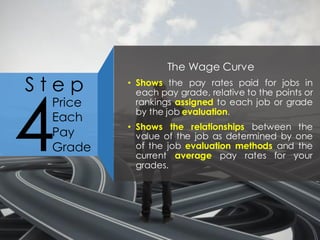

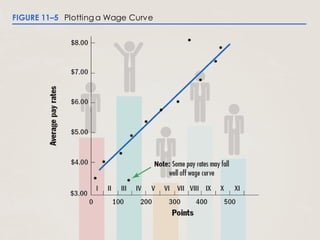

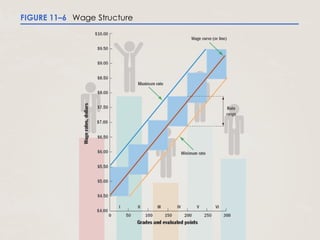

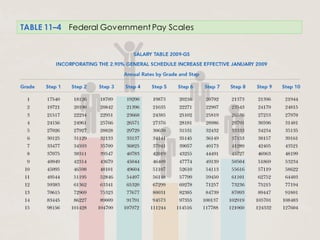

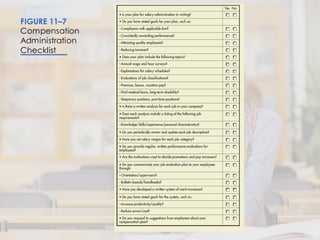

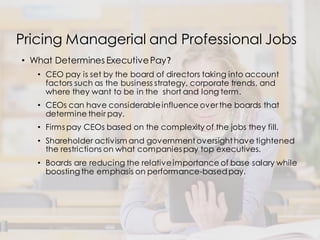

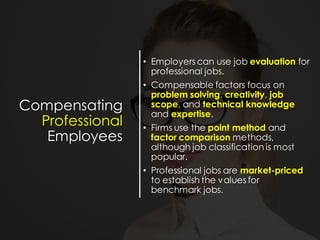

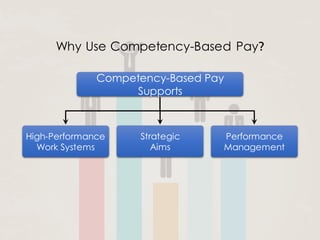

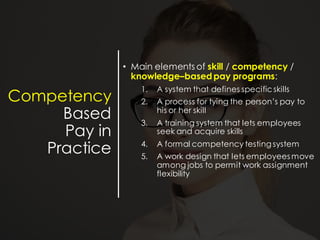

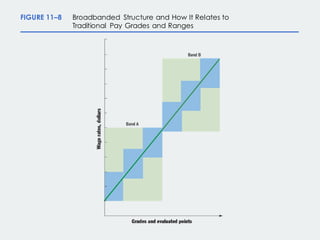

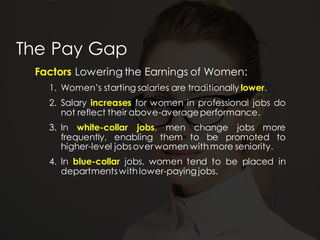

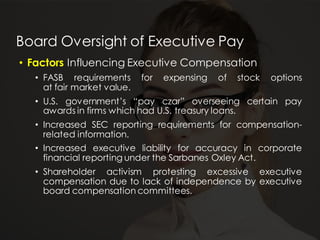

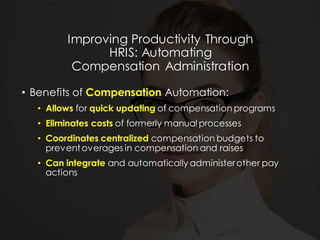

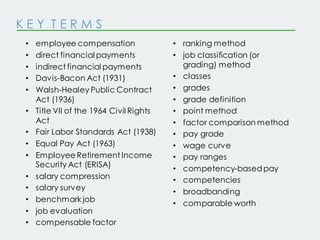

This document discusses how to create a market-competitive pay plan. It outlines a 5-step process for establishing pay rates: 1) conducting a salary survey, 2) evaluating jobs, 3) grouping similar jobs into pay grades, 4) pricing each pay grade, and 5) fine-tuning pay rates. It also covers topics like competency-based pay, executive compensation, the gender pay gap, and using HRIS systems to automate compensation administration. The overall goal is to develop a pay structure that attracts and retains employees while remaining fiscally responsible.

![Welcome toHUMAN RESOURCES

MANAGEMENT

HOW TO CREATE A MARKET-

COMPETITIVE PAY PLAN

Dyah Pramanik, MM

[ ]

Copyright © 2011 Pearson Education,

Inc. publishing as Prentice Hall](https://image.slidesharecdn.com/topic7-161125124712/75/Topic7-1c-compensation-how_to_createa_market-competitive_payplannew-1-2048.jpg)