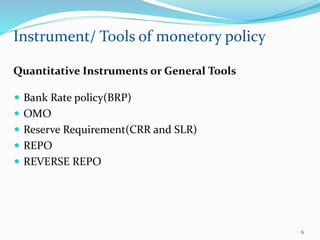

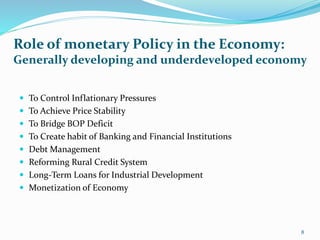

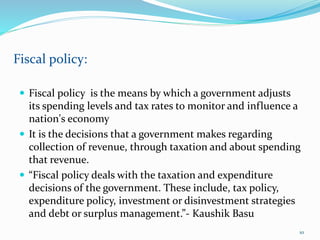

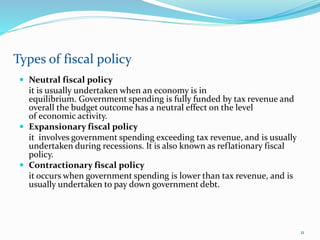

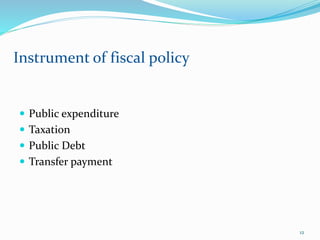

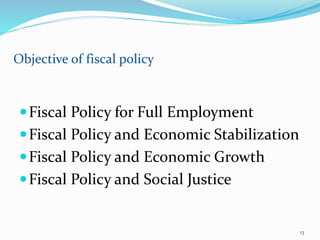

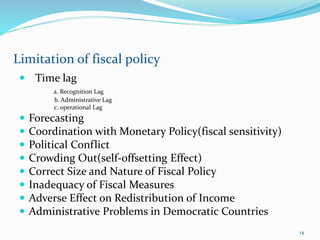

The document provides information about monetary policy and fiscal policy. It defines monetary policy as actions by a central bank that determine the money supply and interest rates. It discusses the objectives, tools, and limitations of both monetary policy and fiscal policy. Monetary policy tools include interest rates, reserve requirements, and open market operations. Fiscal policy tools include taxation, government spending, and public debt. Both policies aim to achieve objectives like price stability and economic growth but face challenges like time lags and crowding out effects.