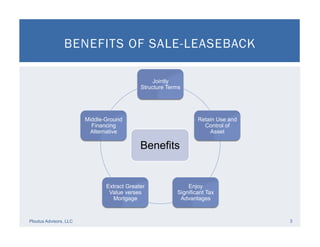

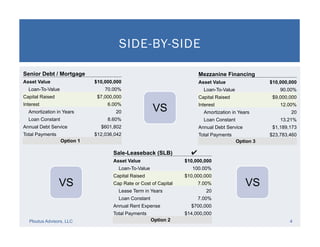

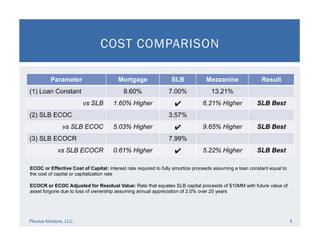

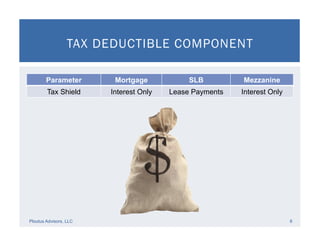

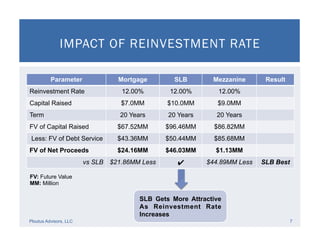

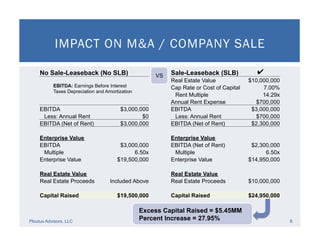

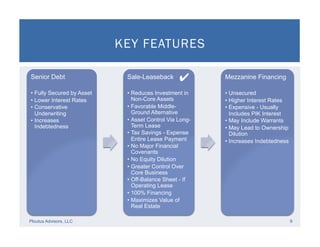

The document discusses the advantages of sale-leaseback (SLB) financing as an alternative to traditional mortgage or mezzanine financing, highlighting its potential benefits such as tax advantages, asset control, and increased capital for business operations. It provides a comparative analysis of financing options, illustrating how SLB can optimize capital raised and reduce annual debt service costs. Additionally, it emphasizes that SLB can enhance enterprise value while allowing businesses to retain control over their assets.