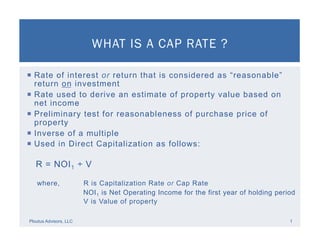

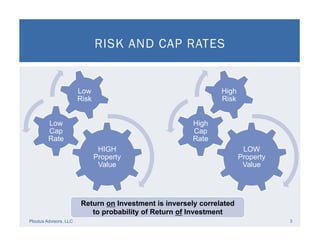

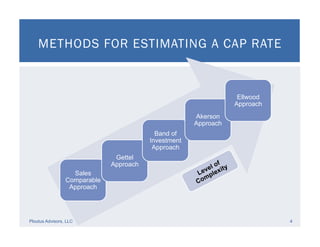

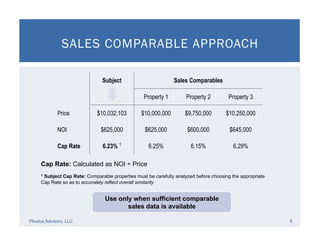

The document provides a detailed guide on understanding capitalization rates (cap rates), which are crucial for estimating property value and risk in real estate investments. It explains the relationship between cap rates and discount rates, outlines various methods for estimating cap rates, and presents different approaches such as sales comparable, Ronald Gettel, and Charles Akerson methods. Additionally, it emphasizes the need for careful analysis of comparable properties when determining cap rates and includes a disclaimer regarding the accuracy of the information presented.