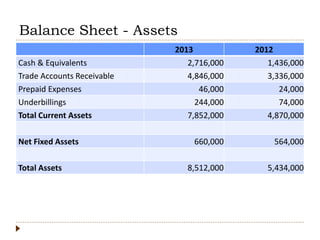

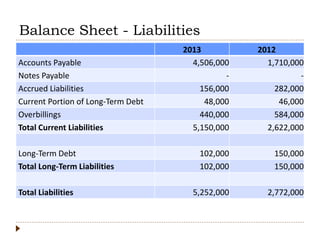

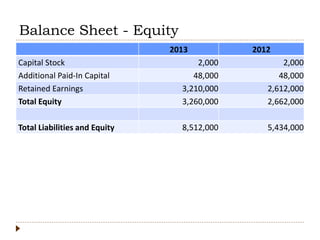

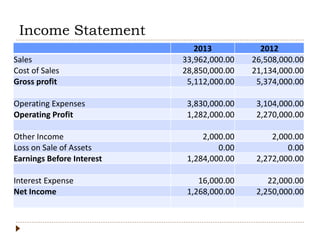

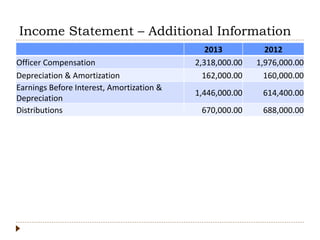

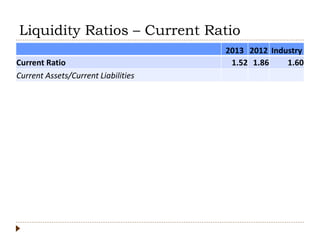

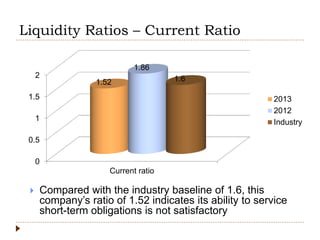

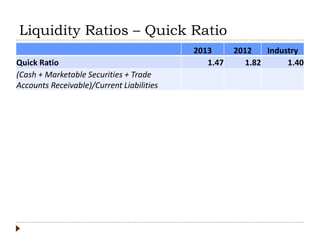

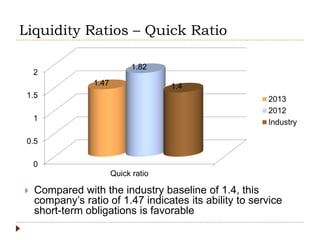

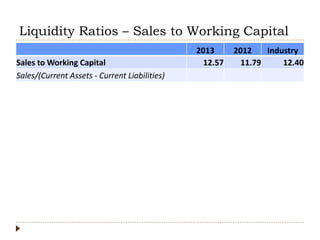

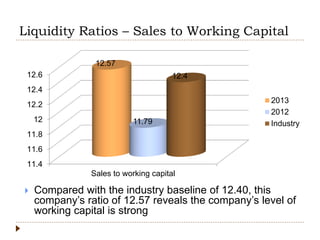

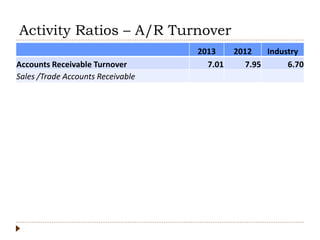

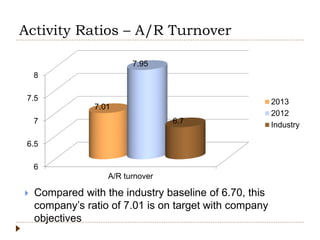

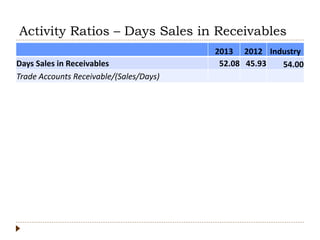

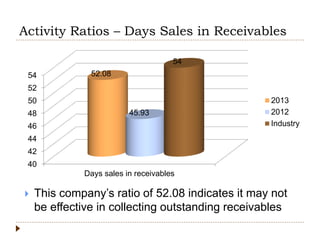

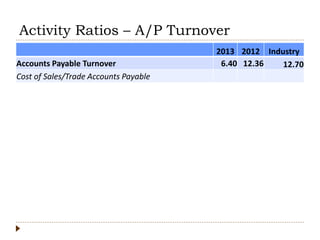

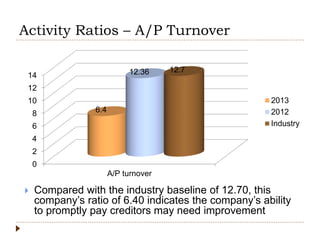

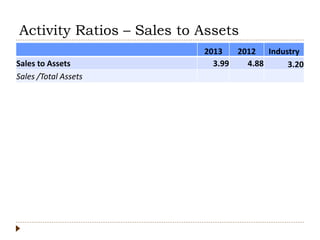

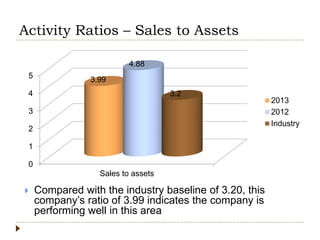

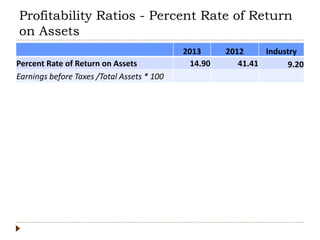

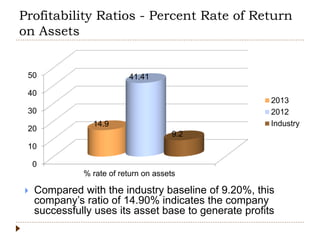

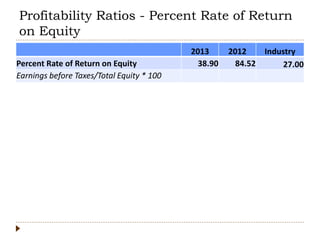

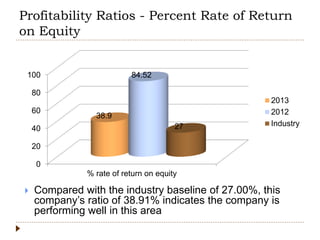

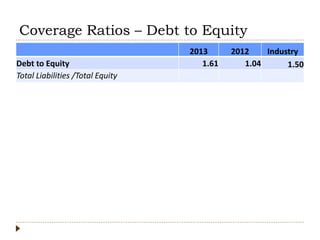

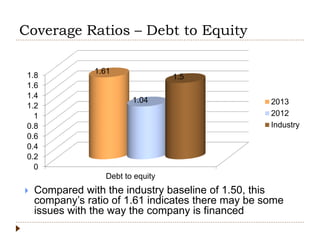

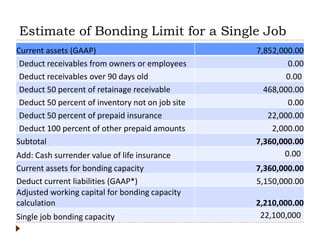

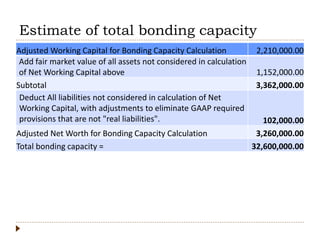

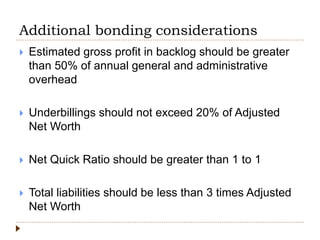

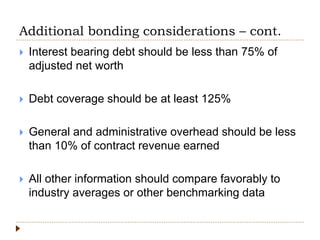

The document discusses financial ratios and bonding capacity calculations for a construction company. It provides the company's balance sheets and income statements for 2013 and 2012, calculates various financial ratios to analyze liquidity, activity, profitability, and coverage, and estimates the company's total bonding capacity based on its adjusted working capital and net worth. While some ratios indicate issues with receivables collection and accounts payable turnover, other ratios show the company is performing well in areas like return on assets and equity. The estimated total bonding capacity is $32.6 million. Future session topics could include job costing, internal controls, and loan covenant compliance.