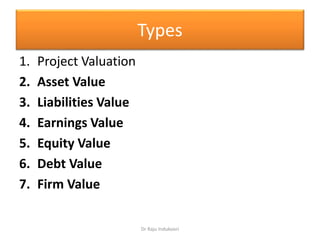

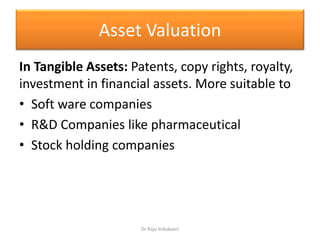

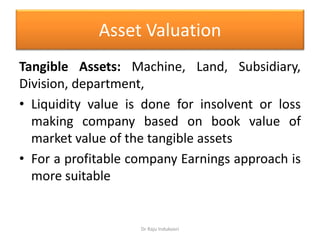

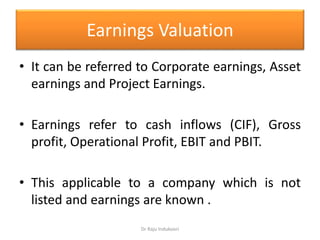

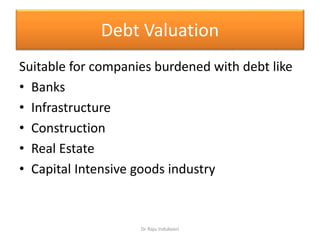

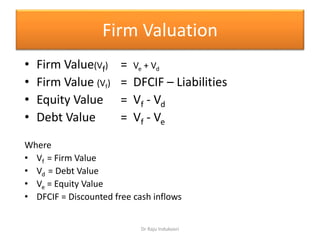

This document discusses different approaches to valuation, including project valuation, asset valuation, liabilities valuation, earnings valuation, equity valuation, debt valuation, and firm valuation. It provides details on each approach, including what types of companies each approach is most suitable for. For example, asset valuation looks at tangible and intangible assets and is suitable for software, R&D, and holding companies, while debt valuation is appropriate for banks, infrastructure, construction, and capital-intensive industries. The document also provides key valuation formulas and definitions.