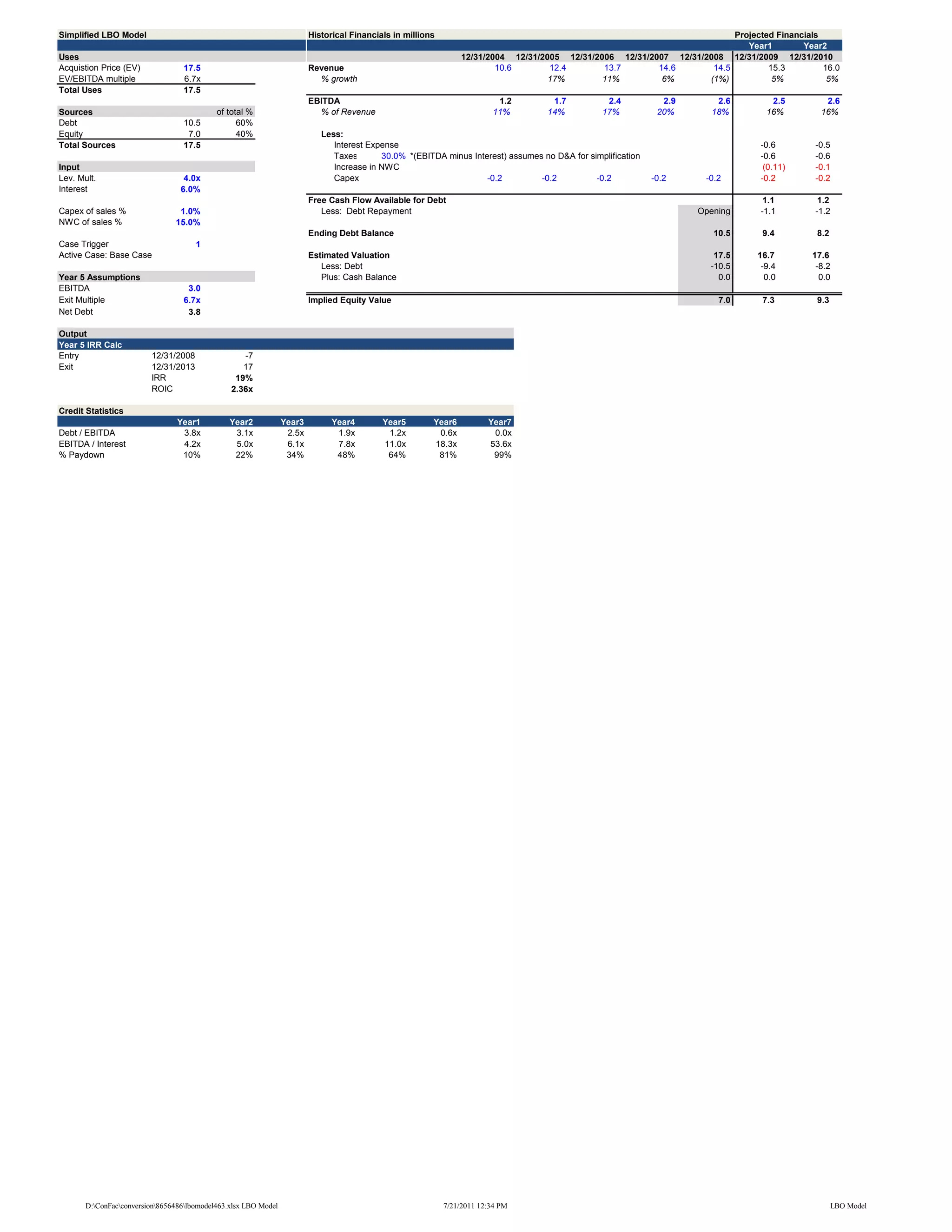

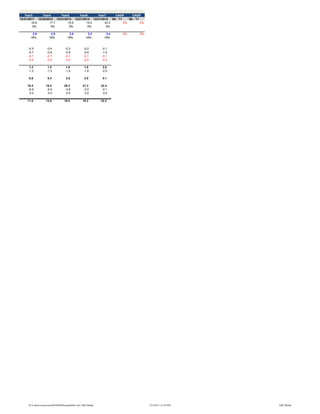

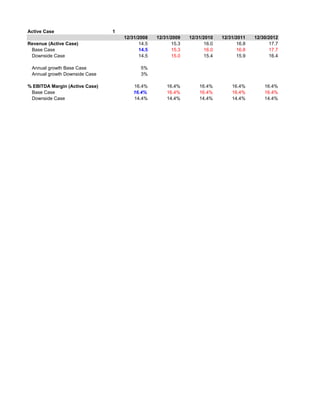

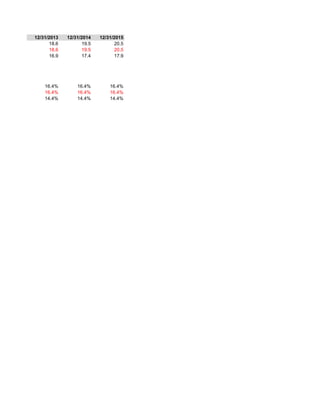

The document presents a simplified LBO model for acquiring a company for $17.5 million. It shows historical and projected financials including revenue, EBITDA, debt levels, and implied equity value over time. The acquisition is expected to generate a 19% IRR and pay down debt aggressively over 7 years until the company is eventually sold for an estimated $22.3 million, implying a 2.36x return on invested capital.