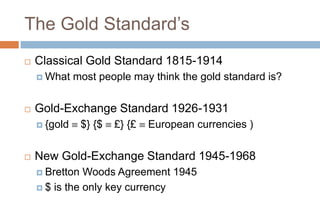

The document discusses the history and mechanics of the gold standard. It describes the classical gold standard from 1815-1914 where currency was pegged to a fixed amount of gold. It then explains the gold-exchange standards from 1926-1931 and 1945-1968 where the US dollar was pegged to gold which other currencies were pegged to. The document outlines pros and cons of the gold standard, such as its role in controlling inflation but also how it favors storing value over using money and can cause deflationary crashes. It questions whether returning to the gold standard would be appropriate today.