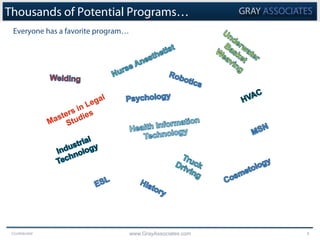

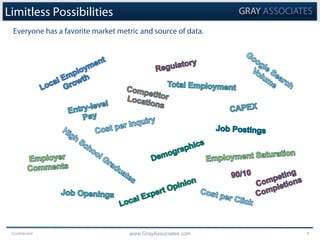

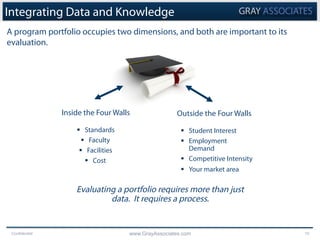

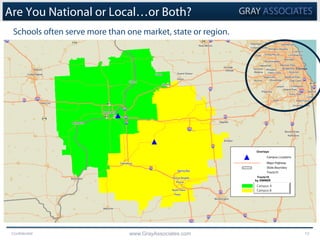

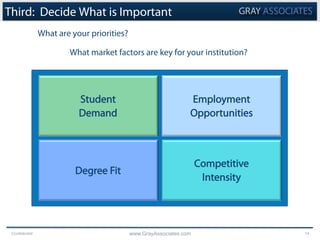

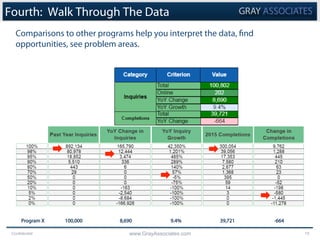

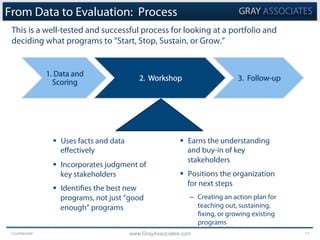

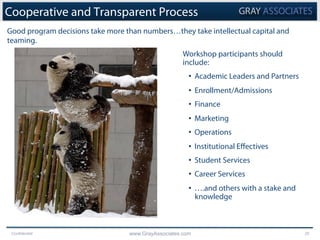

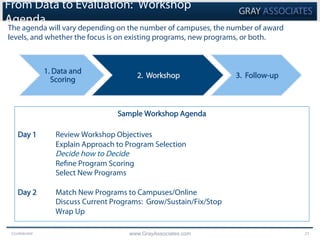

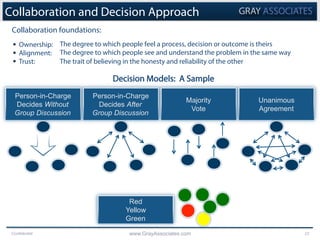

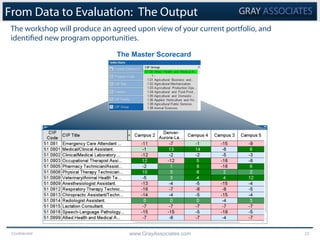

The document outlines an integrated program portfolio evaluation process aimed at helping organizations make informed decisions about academic programs to start, stop, sustain, or grow. It emphasizes the importance of data, stakeholder collaboration, and alignment with institutional strategy throughout the evaluation process. Key takeaways include considering student demand, job opportunities, and competitive intensity while respecting both data and institutional knowledge in decision-making.