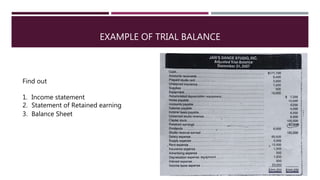

1. The document discusses the accounting cycle which includes preparing an adjusted trial balance, closing entries, and financial analysis and decision making.

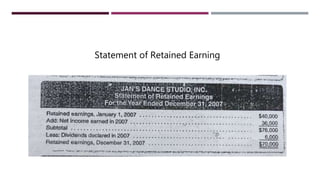

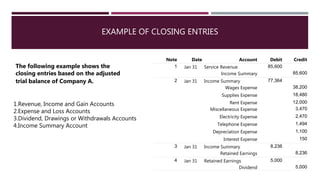

2. Closing entries are journal entries made at the end of an accounting period that transfer the balances of temporary accounts like revenues and expenses to permanent accounts.

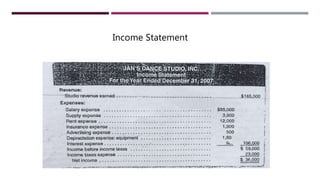

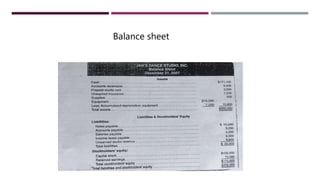

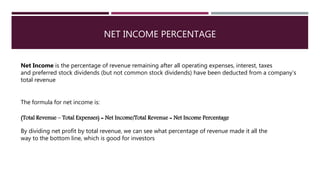

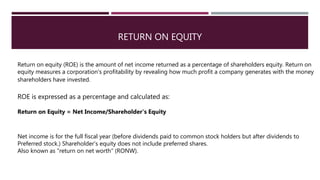

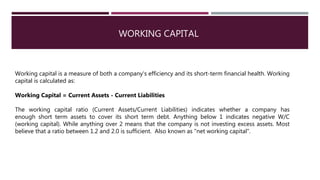

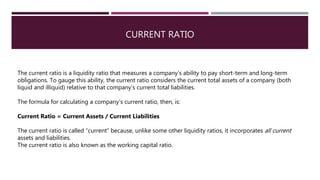

3. Financial analysis and decision making involves calculating key ratios from the financial statements like net income percentage, return on equity, working capital, and current ratio to evaluate the company's performance and financial health.