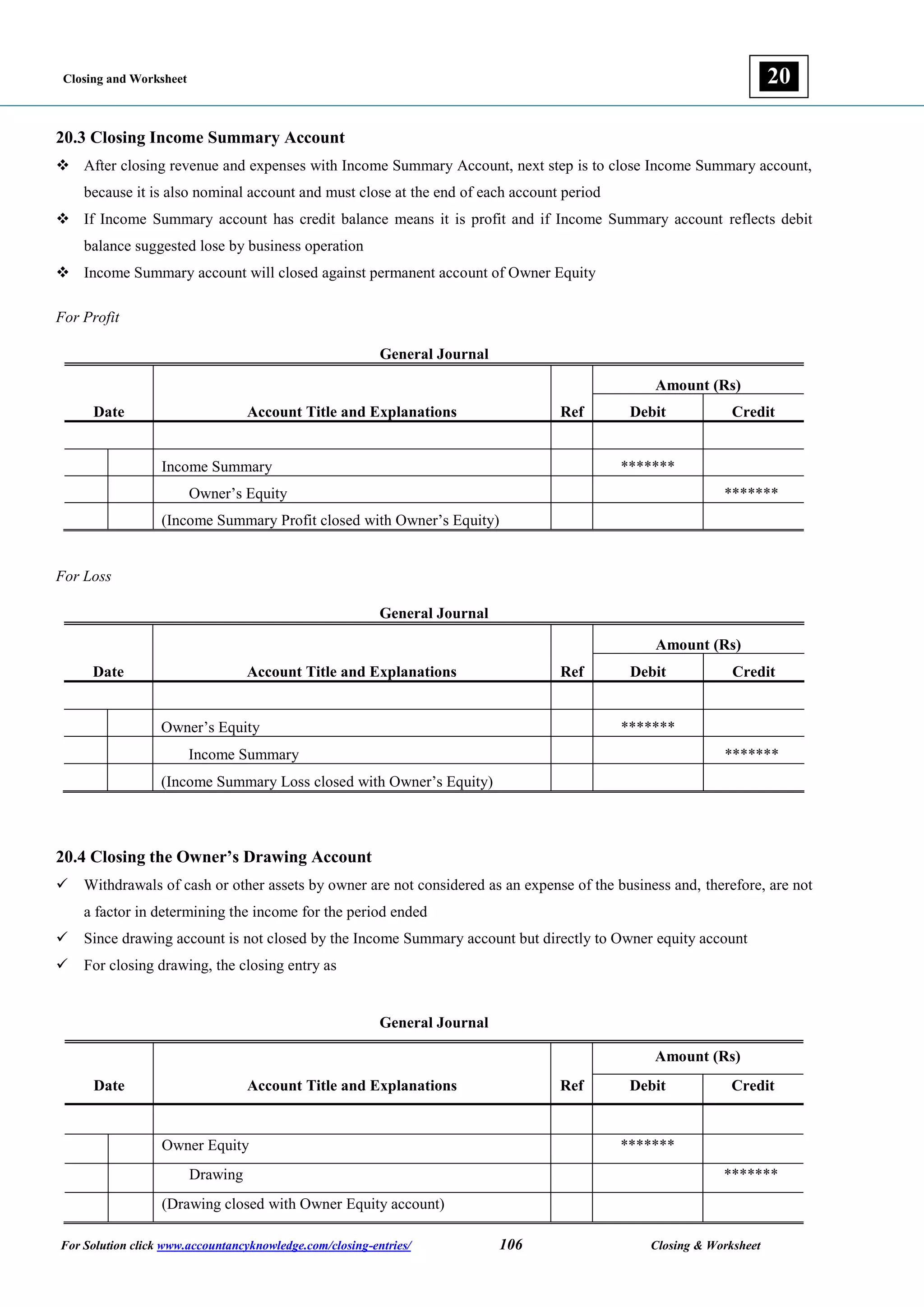

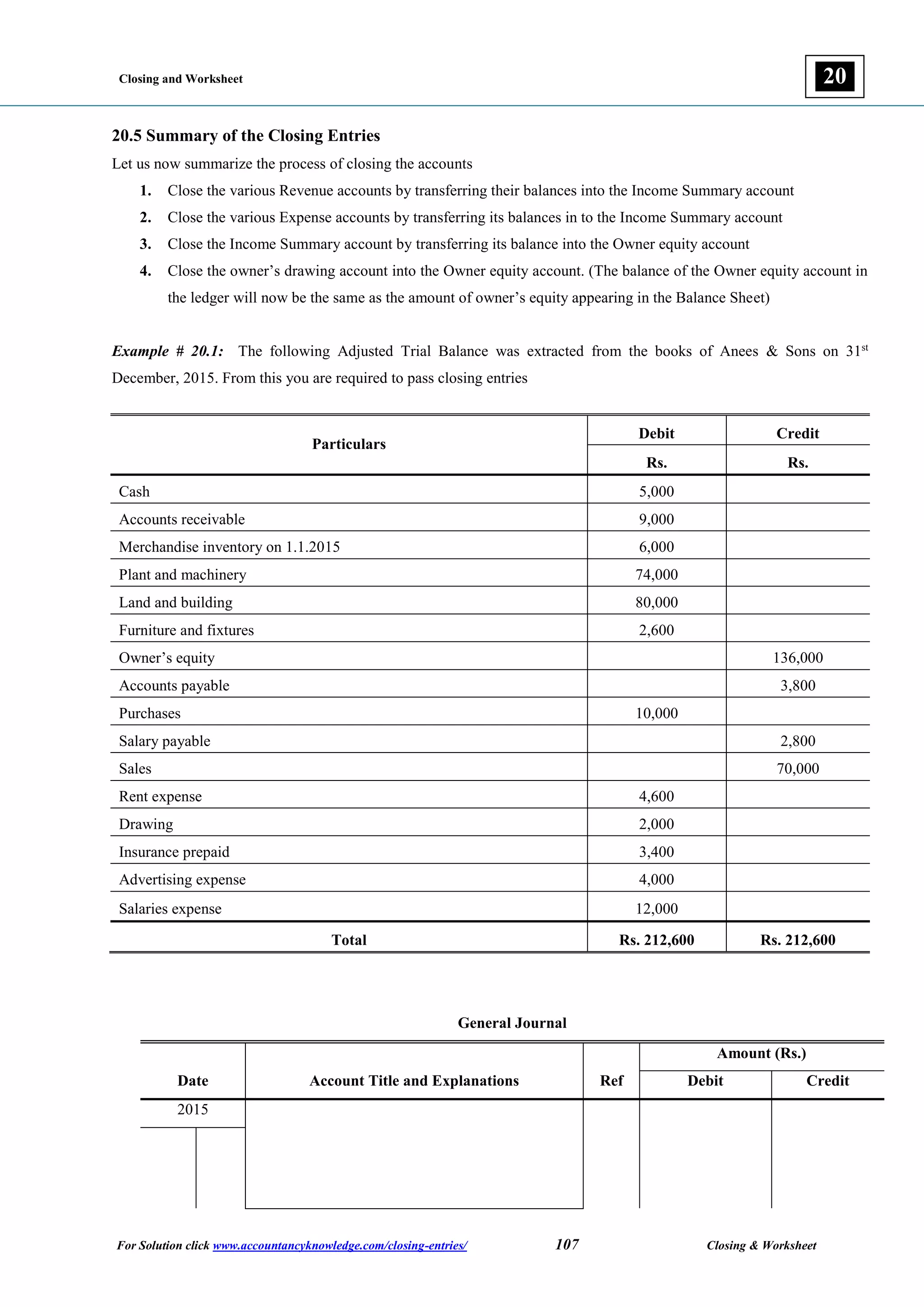

The document provides a detailed overview of the accounting process for closing temporary accounts, including revenues, expenses, and drawings, at the end of a financial period. It explains the necessary journal entries to close these accounts into an income summary account and ultimately into owner equity, highlighting the permanence of real accounts versus the temporariness of nominal accounts. Additionally, it includes examples of closing entries and discusses the importance of preparing a post-closing trial balance and utilizing worksheets for summarizing financial data.