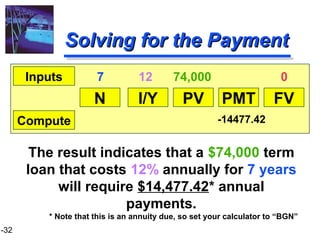

The document discusses term loans, provisions of loan agreements, equipment financing, and lease financing. It provides examples and explanations of different types of term loans, costs and benefits, provisions that are frequently included in loan agreements, sources and types of equipment financing, different types of leasing arrangements, and how to evaluate leases versus debt financing by calculating the present value of cash flows for each. It also includes an example comparing the present value of cash outflows for leasing versus purchasing a new machine.