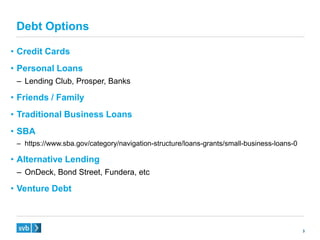

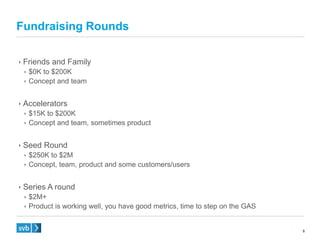

The document discusses various options for fundraising for startups, including equity fundraising through friends and family rounds, accelerator programs, seed rounds, and Series A rounds, as well as debt options like personal loans, SBA loans, and venture debt. It provides advice on developing access to investors through personal networks and events rather than cold calls, and outlines what materials are needed for fundraising pitches, including the team, pitch deck, product demo, and financial projections. Valuation ranges for different fundraising rounds are also presented.