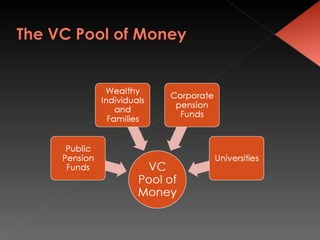

Venture capital refers to financing provided to startup companies with exceptional growth potential. Venture capitalists provide funding in exchange for equity in companies and often provide managerial and technical expertise as well. Venture capital investments typically involve high risks but also promise high returns through a liquidity event like an IPO or acquisition. Venture capital funds raise capital from various sources to finance new and rapidly growing companies.