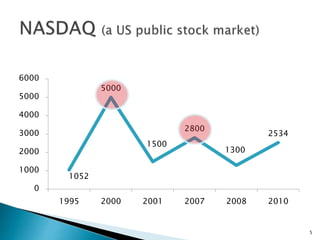

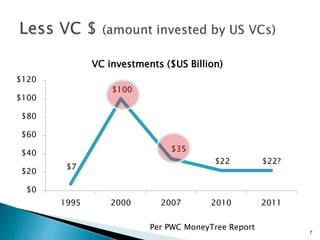

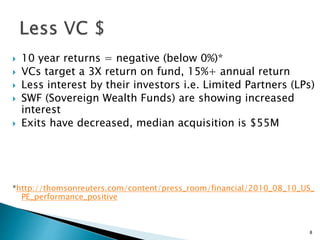

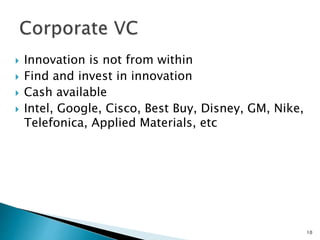

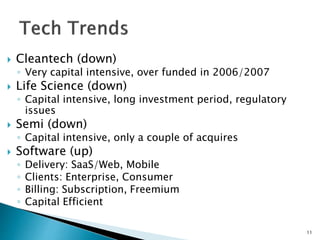

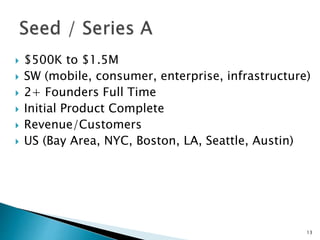

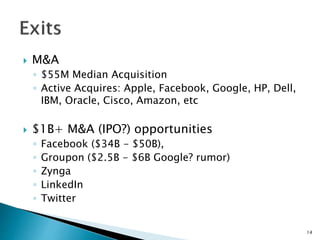

The document presents an overview of Silicon Valley Bank's focus on venture debt amidst a changing investment landscape, highlighting reduced venture capital availability and shifting interests towards software sectors. It illustrates the role of venture debt in extending the financial runway of startups and mentions the decreasing interest in cleantech and life sciences. Furthermore, it analyzes current market trends, including mergers and acquisitions, and emphasizes the demand from smaller venture funds and strategic investments from major corporations.