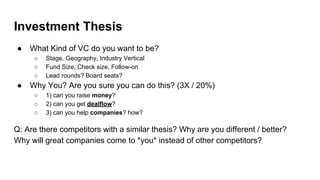

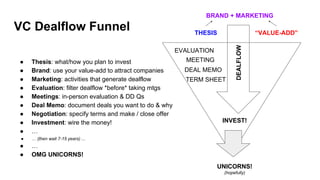

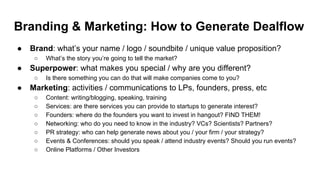

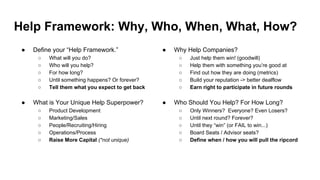

This document provides advice on how venture capital firms can position themselves competitively through branding, marketing, and clearly communicating their value proposition. It emphasizes defining an investment thesis focused on specific industries, stages of funding, and deal sizes. It also stresses developing a unique value-add service that portfolio companies need and marketing activities to generate dealflow. Finally, it discusses fundraising by targeting the right limited partner profiles and addressing their needs and motivations for alternative investments.

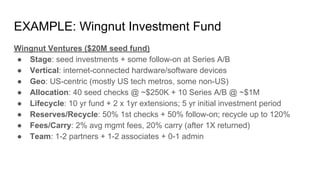

![Fundraising: Key Slides in Your Pitch Deck

Core Deck (10 slides)

● Cover: Name / Brand / Image

● Thesis: Basic Fund Concept + Goals

● Team: Bios / Academic / Work Experience

● Track Record: Prev Portfolio / Top 3 Deals

● Superpower: Services / Value-Add

● Competition: Differentiation / SWOT analysis

● Dealflow: Marketing / How to Get Deals

● Selection: Criteria / DD / Process

● Fund Model: [spreadsheet]

● Capital: AUM / Current LPs / Fundraising

Appendix Slides

● Investment Thesis / More Details

● Winners / Case Studies (1 slide per win)

● Team Bios (1 slide per GP)

● Advisors / Mentor Network profiles

● Examples of dealflow-generating activity

● Sample Deal Memo

● Fund Terms / Legal

* emphasize items in blue if you have “hot”

thesis, pedigree, experience, track record

* emphasize items in red if you don’t](https://image.slidesharecdn.com/thehelpfulvcdec2018-181210230103/85/The-Helpful-VC-8-320.jpg)