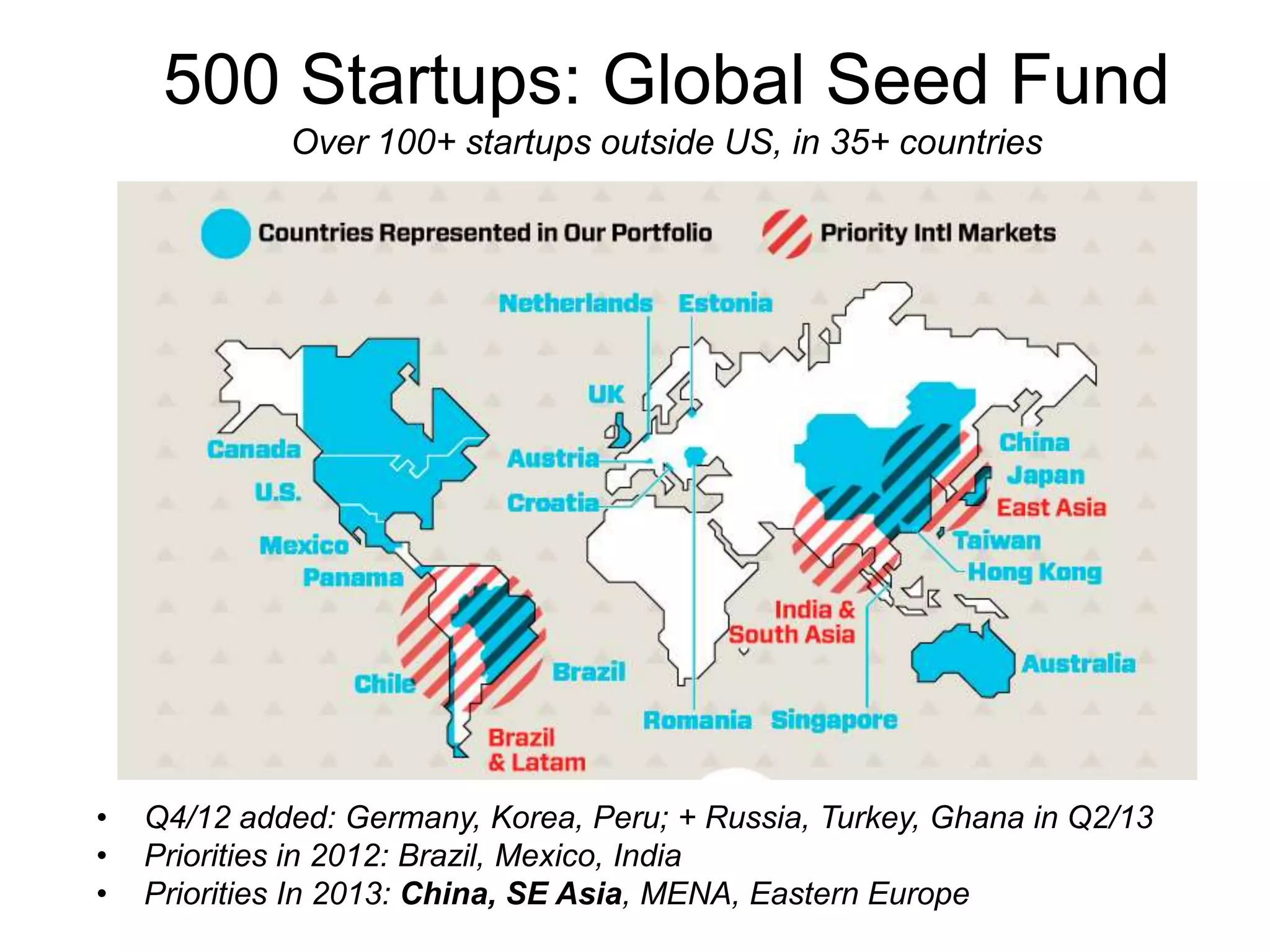

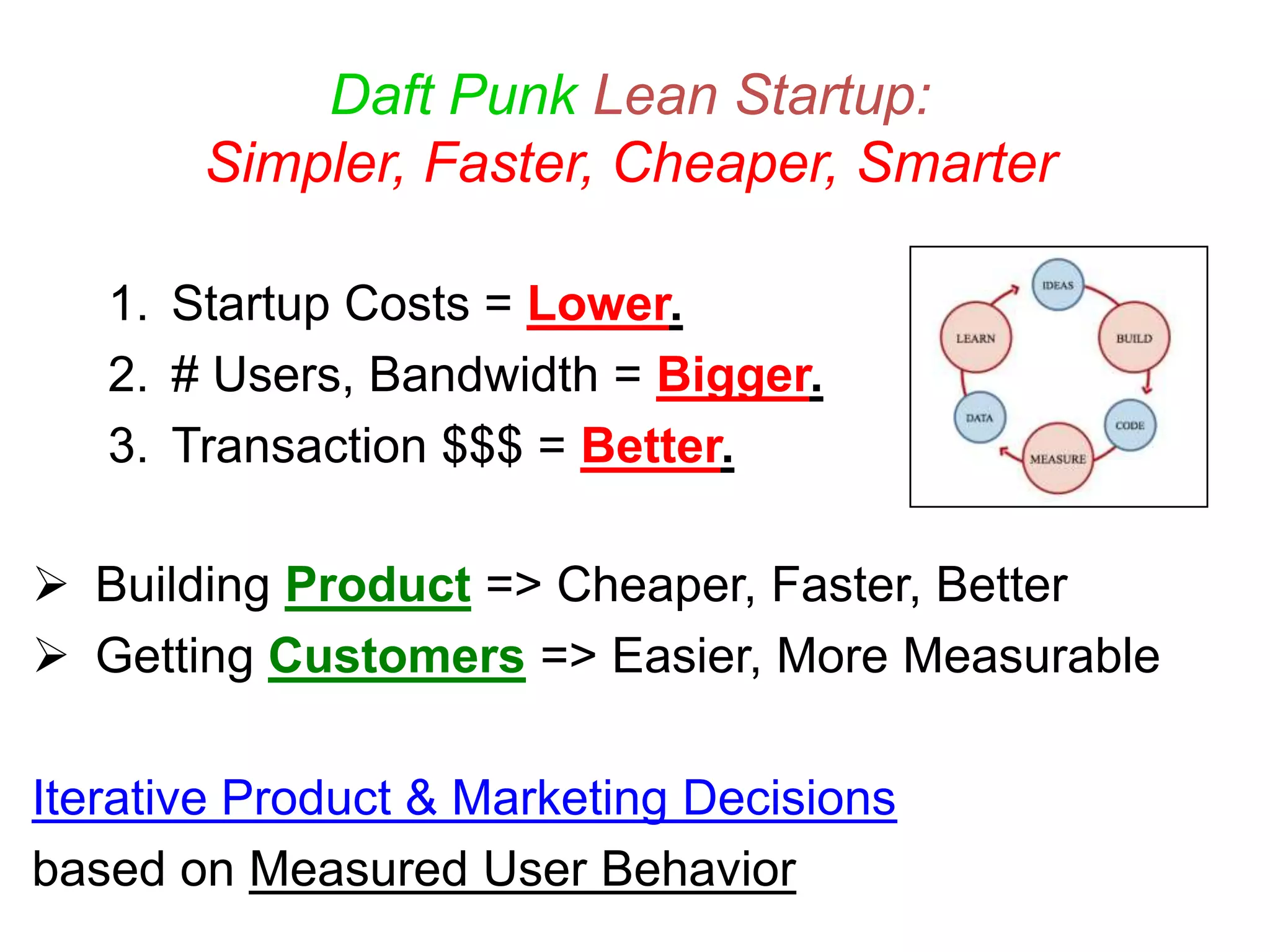

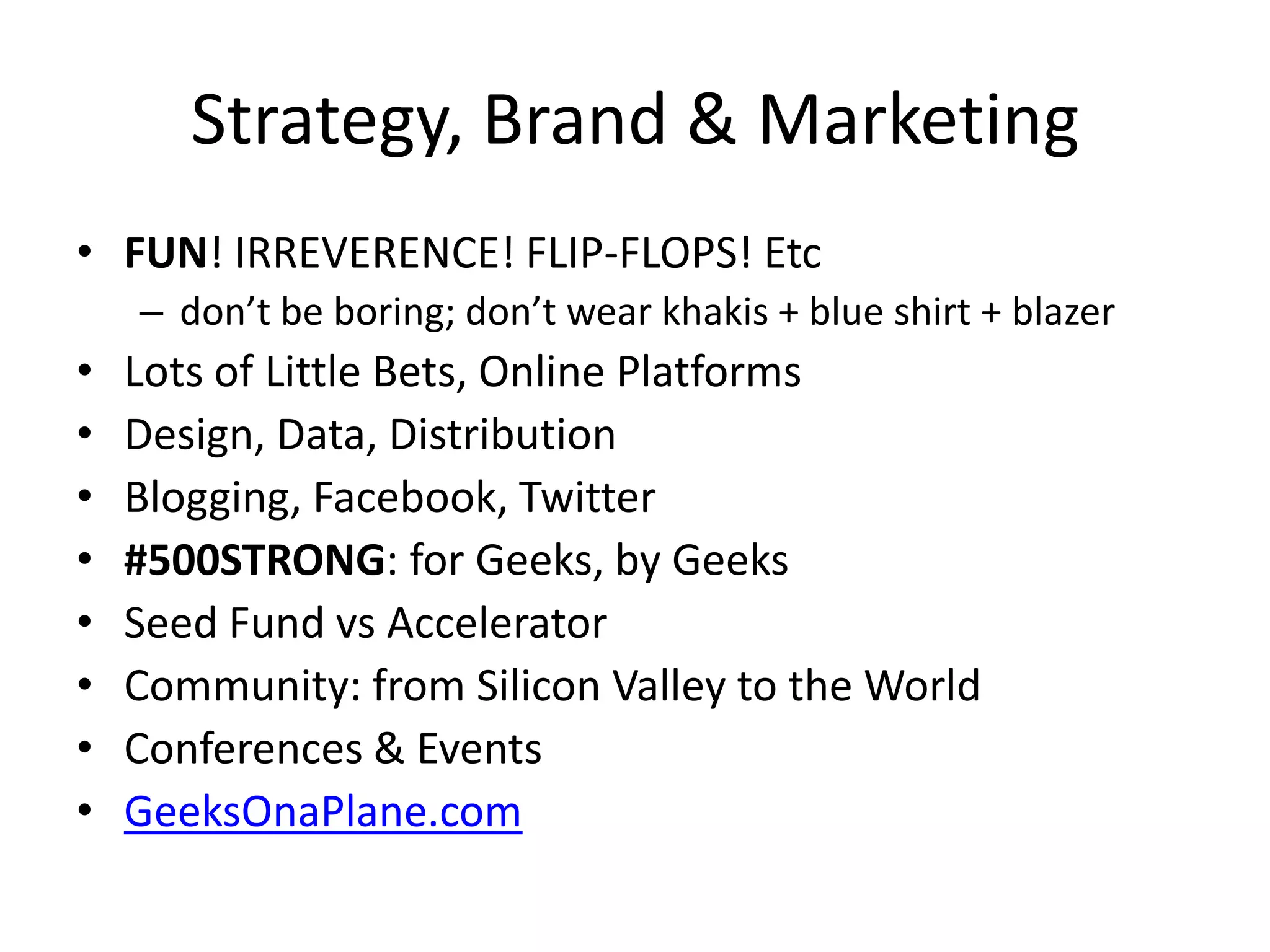

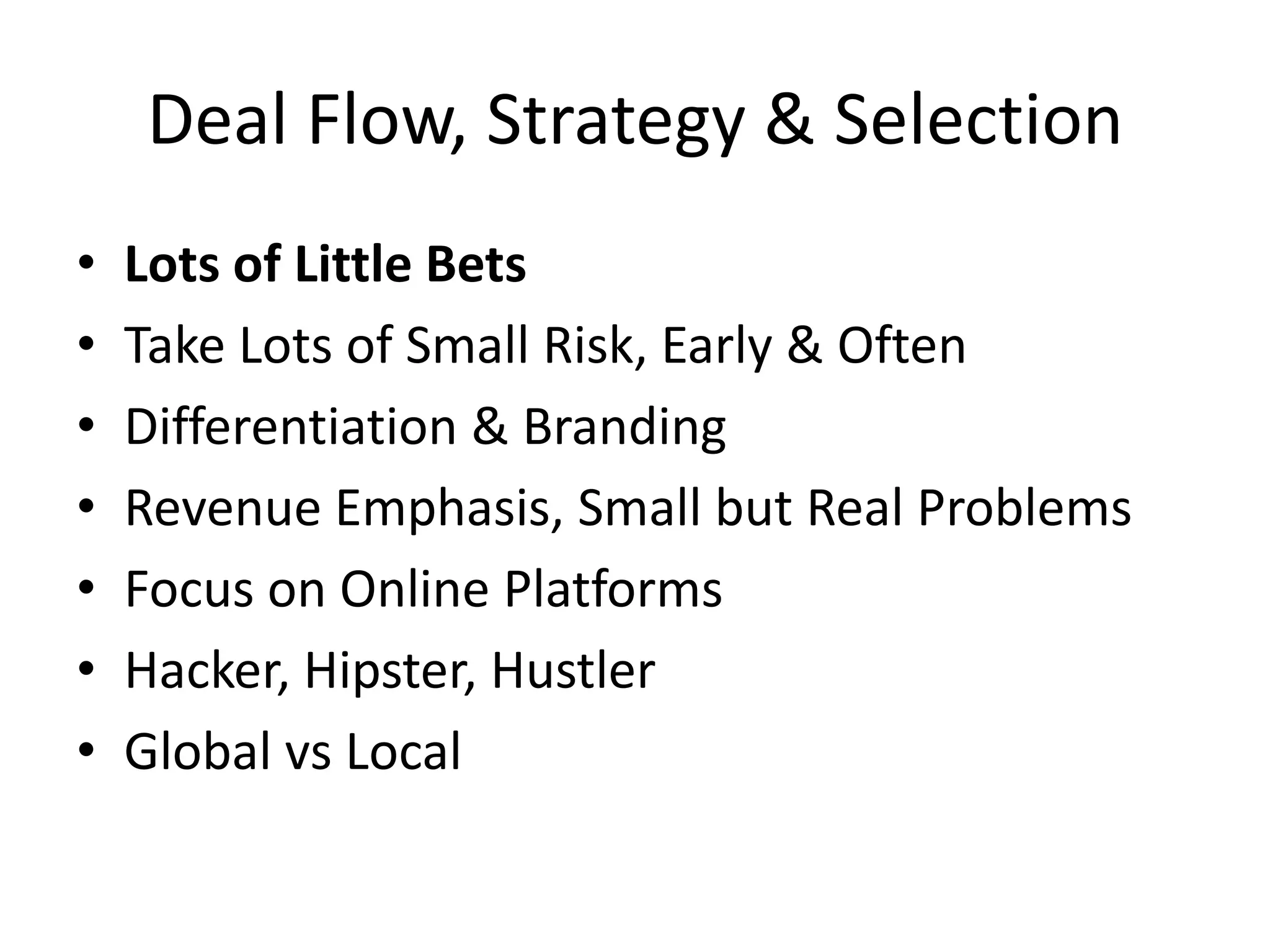

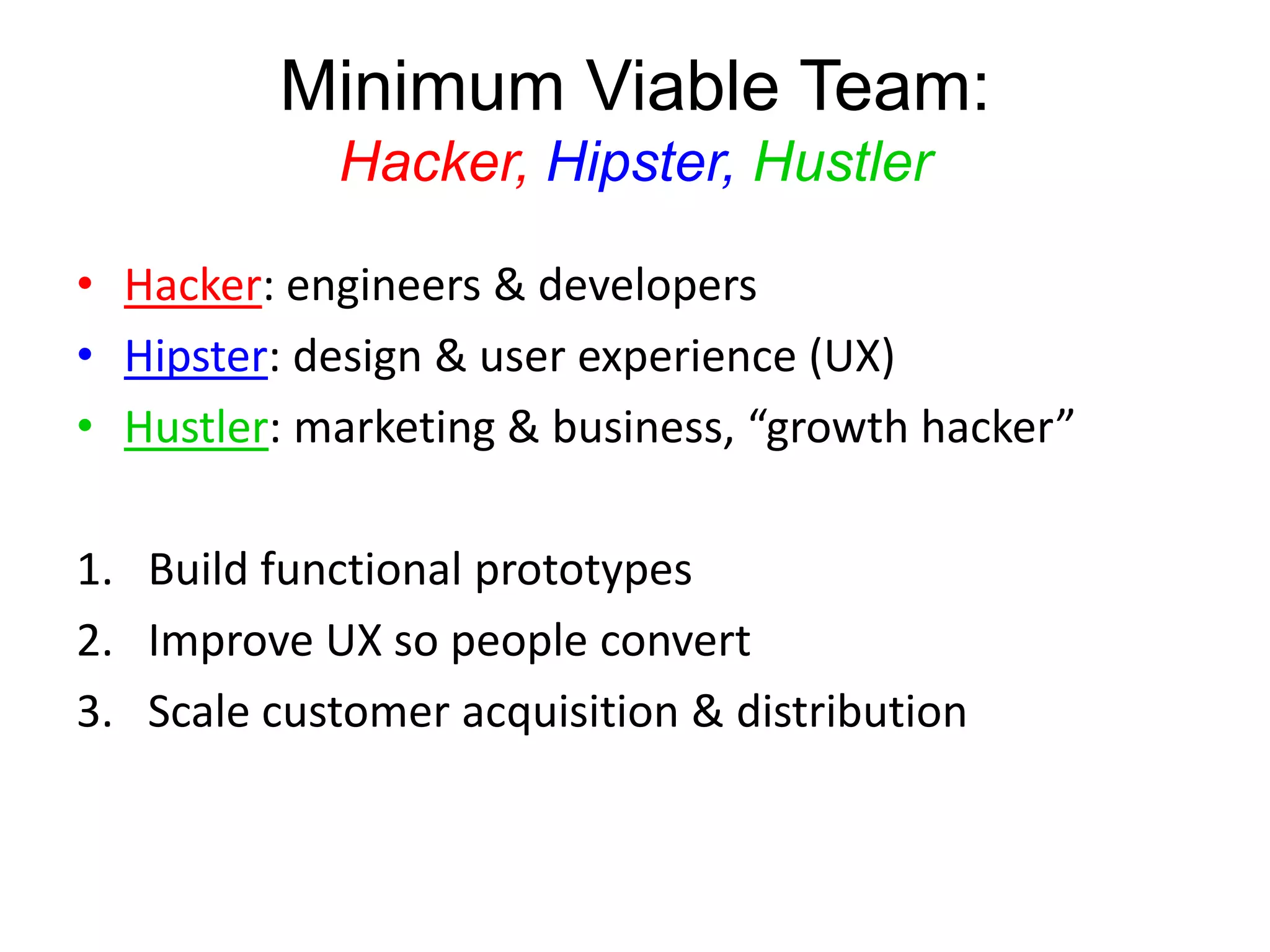

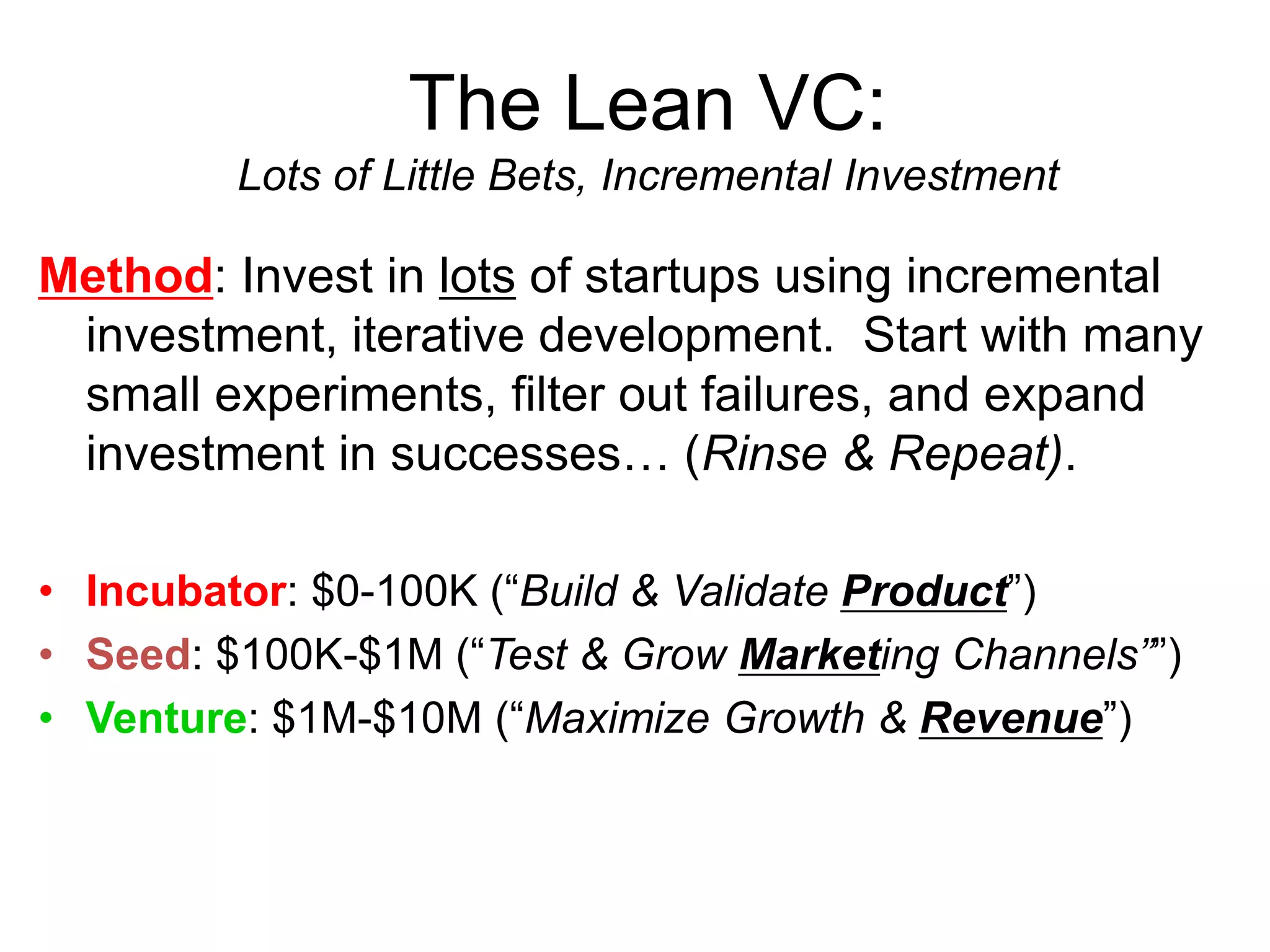

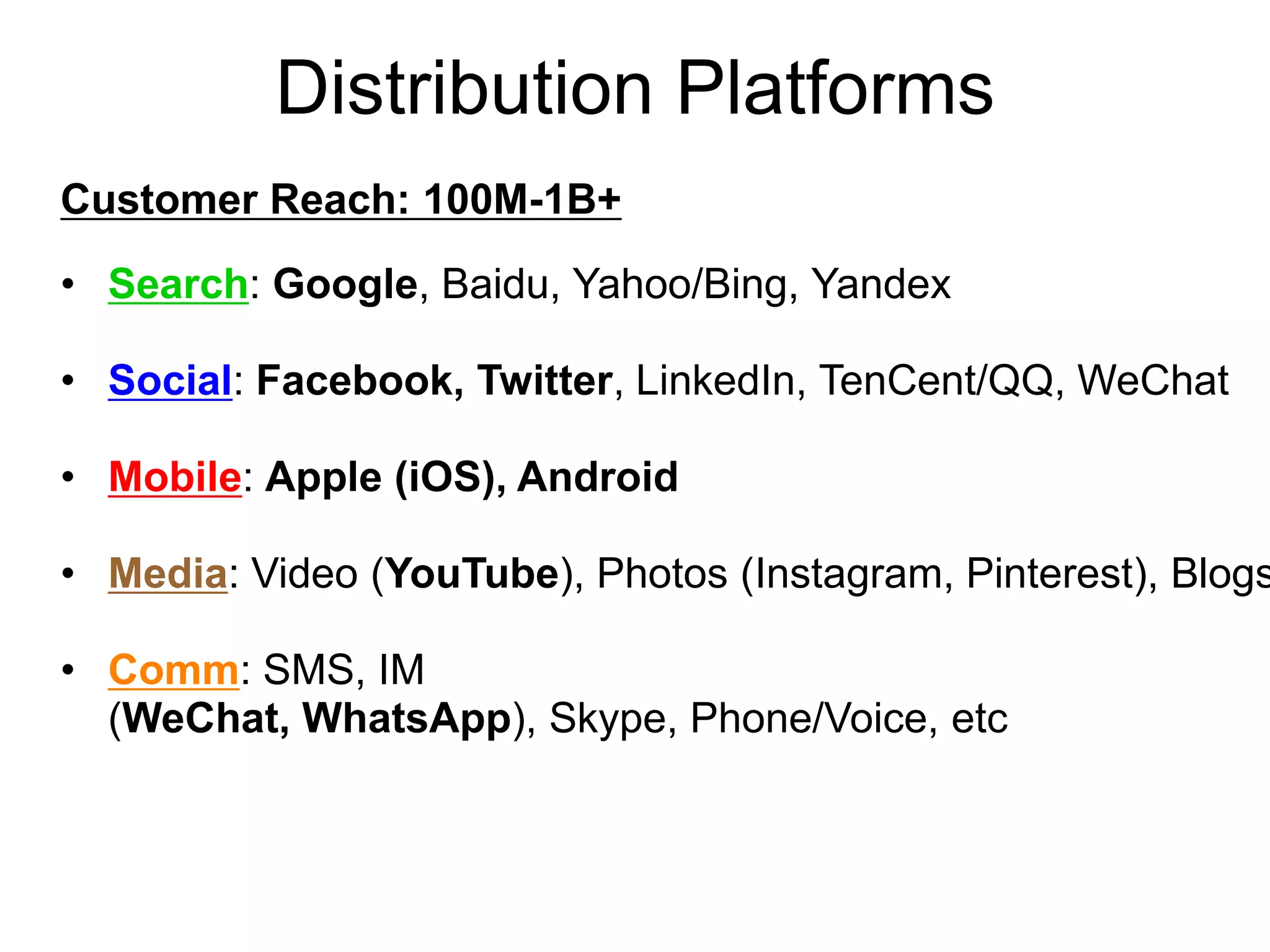

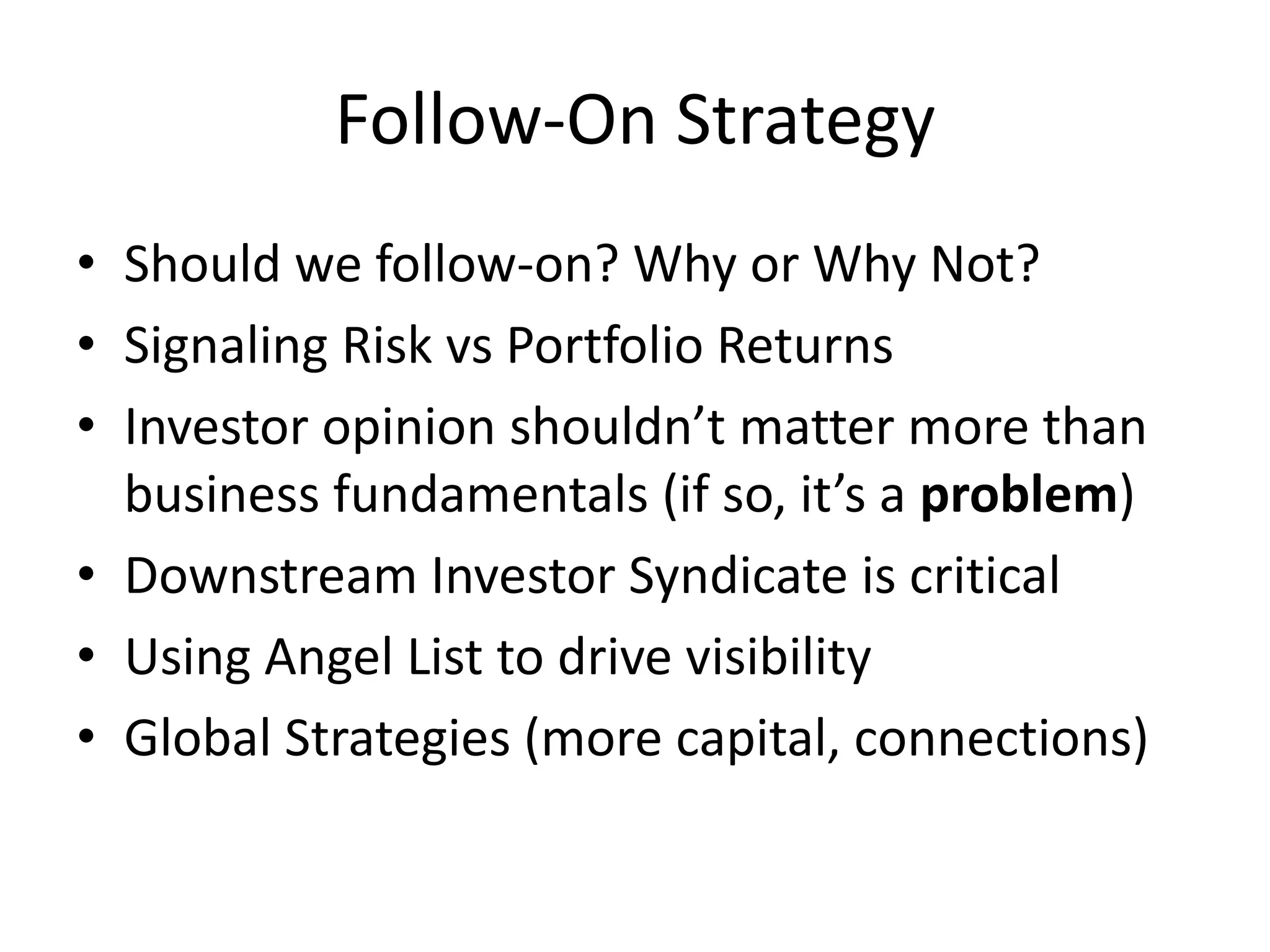

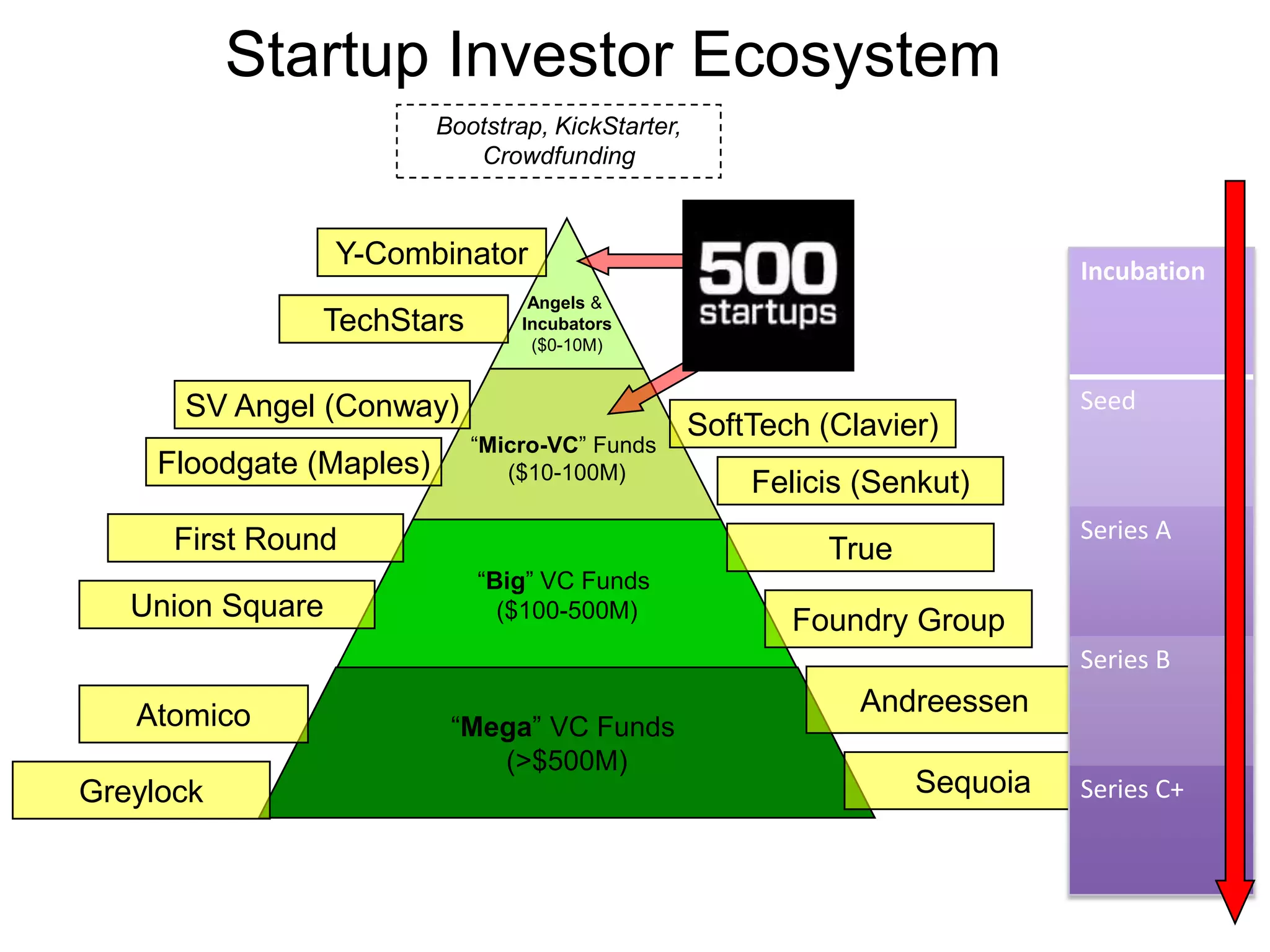

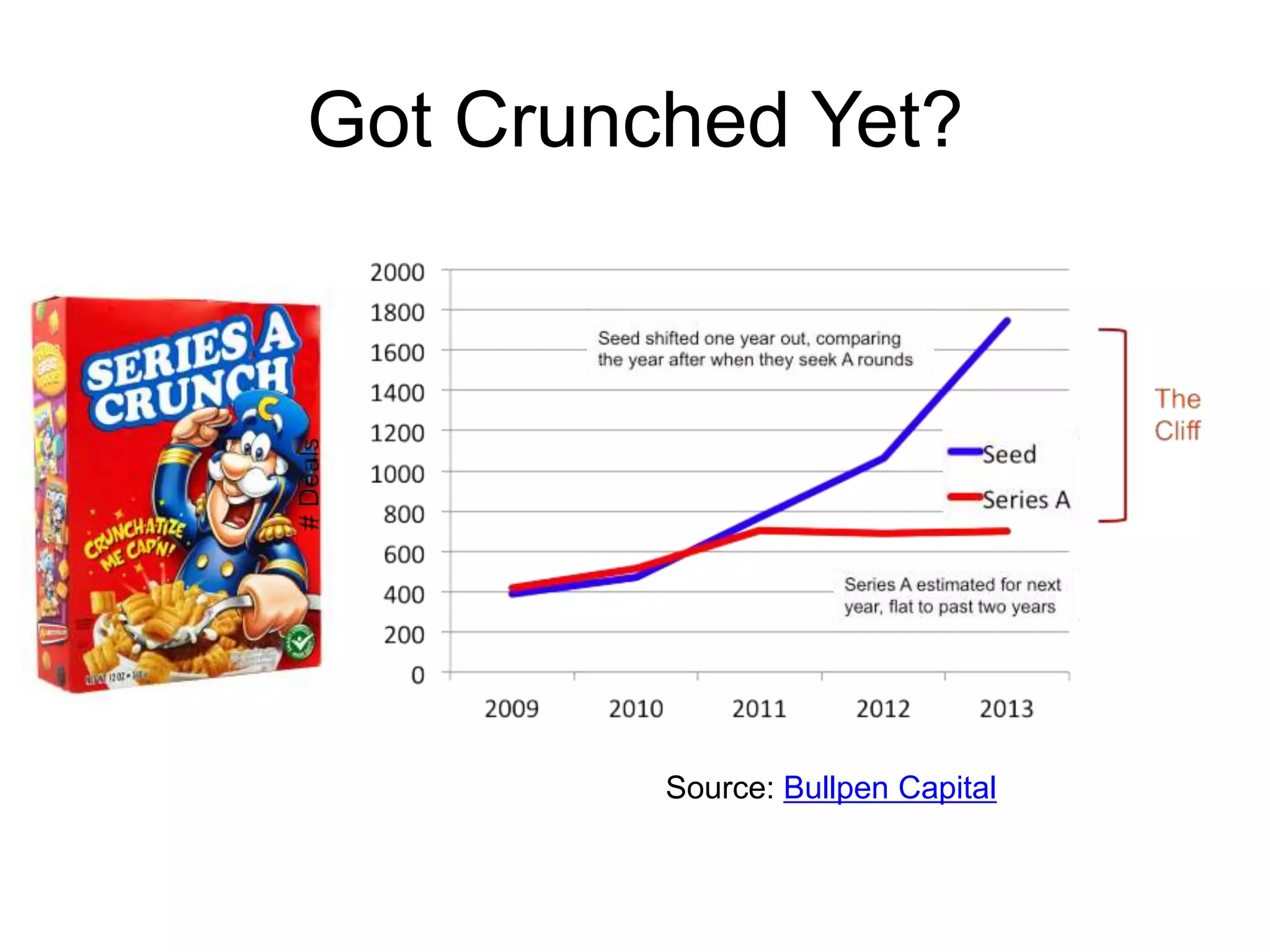

Dave McClure outlines his strategy for building 500 Startups into a global seed fund and startup accelerator. He discusses making many small, early-stage investments and filtering out failures while doubling down on successes. McClure also covers selecting startups focused on online platforms, developing community resources like mentors and conferences, using quantitative metrics to evaluate performance, and expanding globally over time. The goal is to create a large portfolio with the potential for some major exits worth $50-100 million or more through this "lots of little bets" approach.