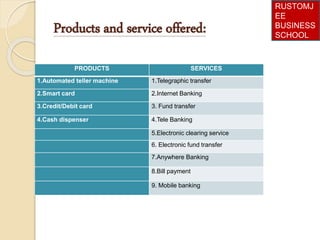

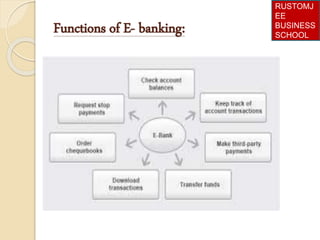

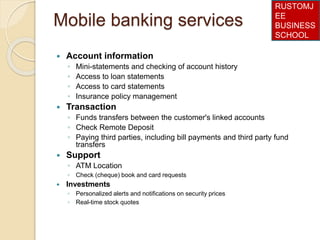

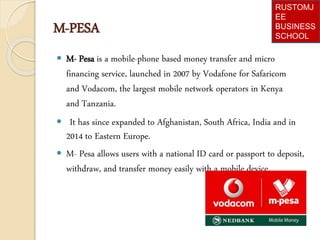

The document discusses the impact of technology on the banking sector in India, highlighting the rise of e-banking and various forms of electronic banking services such as mobile and internet banking. It also emphasizes the competitive advantage gained through technology and the transformation of banking operations and customer engagement. Additionally, it covers specific tools and services within mobile banking, along with examples like M-Pesa and Bitcoin.