1. The document discusses the management information systems used at ICICI Bank. It describes how ICICI Bank has evolved over time from being formed in 1955 to becoming a diversified financial services group today.

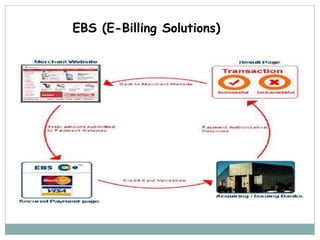

2. It outlines the key information systems used at different levels of the bank, including transaction processing systems, management information systems, and enterprise information systems that support functions like deposits, loans, payments, and online services.

3. The document also summarizes some of the major software and technologies used at ICICI Bank to power its information systems and enable key operations like customer relationship management, risk management, and remote monitoring of infrastructure.