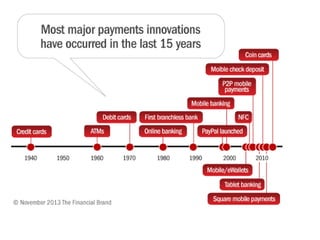

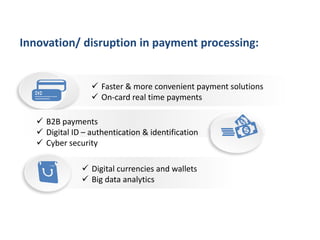

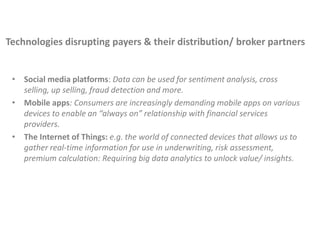

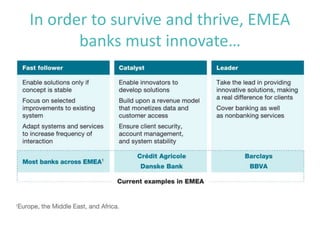

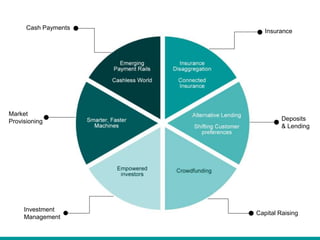

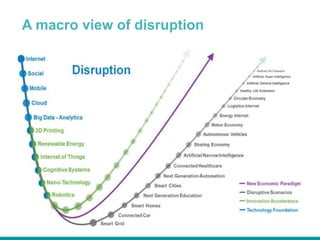

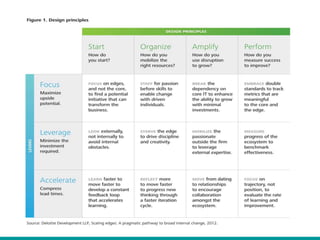

The document summarizes key points from a conference on mobile banking and payment solutions in Ghana. It discusses how disruptive technologies will impact payment solutions and mobile payments. Some of the technologies discussed include digital currencies, big data analytics, digital IDs, and the internet of things. The document emphasizes that banks must innovate and transform their IT systems to remain competitive. It also outlines strategies for successful mobile banking, such as increasing enrollment, integrating across channels, and using mobile for marketing and cross-selling. The conclusion is that mobile banking will become increasingly important and banks need to execute optimized mobile strategies to position themselves for the future of banking.