tax.utah.gov forms current tc tc-98

•

1 like•238 views

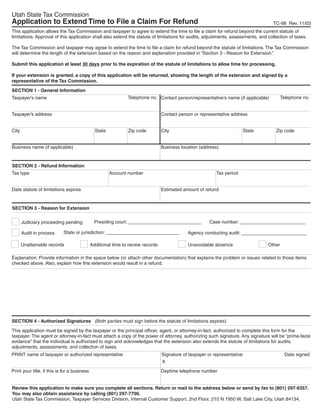

This document is an application to extend the statute of limitations for filing a claim for refund with the Utah State Tax Commission. It allows the taxpayer and Tax Commission to agree to extend the deadline for filing a refund claim beyond the current legal deadline. If approved, the extension also applies to audits, adjustments, assessments and tax collection. The application requires information about the taxpayer, the refund amount and tax period, and an explanation for why more time is needed to file the refund claim. If granted, the Tax Commission will return a copy of the approved application with the new deadline.

Report

Share

Report

Share

Download to read offline

Recommended

Taxmann's Tax Practice Manual

Tax Practice Manual is an exhaustive (2,100+ pages), amended (by the Finance Act, 2021) & practical guide (330+ case studies) for Tax Professionals.

This book will be helpful for the Chartered Accountants, Lawyers/Advocates, Tax Practitioners to assist them in their day-to-day tax works.

This book is divided into two parts:

• Law Relating to Tax Procedures (covering 25+ topics)

• Case Studies (covering 35+ topics)

The Present Publication is the 7th Edition, authored by Gabhawala & Gabhawala, as amended by the Finance Act 2021, with the following noteworthy features:

• Law Relating to Tax Procedures

◦ [Lucid Explanation, in a Practical Manner, with Checklists & necessary Tips] for the law relating to Tax Procedure

◦ [Exhaustive Coverage of Case Laws]

◦ [Fine Prints & Unwritten Lines] are explained in a lucid manner

• Tax Practice

◦ [Elaborated & Threadbare Analysis] of every aspect of Tax Practice

• Case Studies

◦ [330+ Case Studies] to deal with real-life animated situations/problems faced by tax practitioners

• Draft Replies

◦ For the Notices sent by the Department

◦ Petitions to the Department

• Drafting & Conveyancing

◦ [Complete Guide to Drafting of Deeds & Documents] covering

◦ Affidavits

◦ Wills

◦ Special Business Arrangements

◦ Family Arrangements

◦ Power of Attorney

◦ Lease, Rent & Leave and Licenses

◦ Indemnity and Guarantee

◦ Charitable Trust Deeds, etc.

The contents of this book are as follows:

• Law Relating to Tax Procedures

◦ Tax Practice

◦ Pre-assessment Procedures

◦ Assessment

◦ Appeals

◦ Interest, Fees, Penalty and Prosecution

◦ Refunds

◦ Settlement Commission – ITSC, Interim Board for Settlement

◦ Summons, Survey, Search

◦ TDS and TCS

◦ Recovery of Tax

◦ Special Procedures

◦ Approvals

◦ STT, DDT, Tax on Liquidation, Reduction and Buy Back, MAT, AMT and WT

RTI, Ombudsman

◦ Drafting of Deeds

◦ Agreement, MoU

◦ Gifts, Wills, Family Arrangements

◦ Power of Attorney, etc.

◦ Lease, Rent, License, etc.

◦ Sale/Transfer of Properties

◦ Tax Audit

◦ Income Computation & Disclosure Standards

◦ Real Estate (Regulation and Development) Act, 2016 (RERA)

◦ E-Proceedings under the Income Tax Act, 1961

◦ Prohibition of Benami Property Transactions Act, 1988

• Case Studies

◦ Tax Practice

◦ Pre-Assessment Procedures

◦ Assessment – Principles and Issues

◦ Rectification of Mistake

◦ Revision

◦ Appeals to CIT (Appeals)

◦ Appeals to – ITAT – High Court – Supreme Court

◦ Interest Payable by Assessee

◦ Penalties

◦ Prosecution

◦ Refunds

◦ Settlement of Cases

◦ Survey

◦ Search & Seizure

◦ Tax Deduction at Source

◦ Recovery of Tax

◦ Trust, Mutuality, Charity

◦ Firm

◦ LLP – Limited Liability Partnership

◦ Right to Information – RTI

◦ Agreement, MoU

◦ AOP – Association of Persons

◦ HUF – Hindu Undivided Family

◦ Gifts

◦ Wills

◦ Family Arrangements

◦ Power of Attorney

◦ Indemnity and Guarantee

◦ Lease, Rent, Leave and License

◦ Sale/Transfer of Properties

◦ Tax Audit

Issues in vivad se vishwas scheme 2020

OBJECTIVE

The Direct Tax Vivad se Vishwas Bill, 2020 was introduced in the Parliament on 5th February, 2020 and subsequently amended. The webinar shall deal with the frequently asked questions relating to the scheme. It shall discuss the issues faced by the taxpayers in the dispute resolution scheme.

Vivad se Vishwas Scheme 2020

Guided by “Sabka Saath, Sabka Vikas, Sabka Vishwas”, the Finance Minister Smt. Nirmala Sitharaman had introduced a new No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ in the Budget 2020 in the Lok Sabha on 5th February, 2020. Expectations are that the new scheme will work better than erstwhile similar scheme “The Direct Tax Dispute Resolution Scheme, 2016”, given the kind of cases that are in appeal.

To know more:https://itatorders.in/blog/eligible-person-under-vivad-se-vishwas-scheme-2020/

Get consultation under the VSV scheme and calculate your taxes : https://www.itatorders.in/vsvcalculator

Regular requirements of income tax to be complied be companies branch office-...

Regular requirements of Income Tax required to comply by a company/Branch office/Liaison office/Bank/Non-Banking Financial Institutions/Insurance company/NGOs etc. according to the Income Tax Ordinance and Income Tax Rules 1984

Refund under GST

<a>GST Software</a> with reconciliation, excel/ ERP import functionality @ Rs. 4999. Manage GST compliance with our GST software easily. GST APIs available.

For More Details:

Visit below given links:

https://www.legalraasta.com/gst-software/

https://www.taxraahi.com/gst.php

https://www.legalraasta.com/gst-return/

https://www.legalraasta.com/gst-registration/

Reverse Charge under GST

OBJECTIVE

Under GST, the supplier of goods or services is liable to pay the tax to the Government. However, under the reverse charge mechanism (RCM), the liability to pay GST is cast on the recipient of the goods or services. Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply. In this webinar, we shall understand the applicability and provisions of RCM under GST.

Recommended

Taxmann's Tax Practice Manual

Tax Practice Manual is an exhaustive (2,100+ pages), amended (by the Finance Act, 2021) & practical guide (330+ case studies) for Tax Professionals.

This book will be helpful for the Chartered Accountants, Lawyers/Advocates, Tax Practitioners to assist them in their day-to-day tax works.

This book is divided into two parts:

• Law Relating to Tax Procedures (covering 25+ topics)

• Case Studies (covering 35+ topics)

The Present Publication is the 7th Edition, authored by Gabhawala & Gabhawala, as amended by the Finance Act 2021, with the following noteworthy features:

• Law Relating to Tax Procedures

◦ [Lucid Explanation, in a Practical Manner, with Checklists & necessary Tips] for the law relating to Tax Procedure

◦ [Exhaustive Coverage of Case Laws]

◦ [Fine Prints & Unwritten Lines] are explained in a lucid manner

• Tax Practice

◦ [Elaborated & Threadbare Analysis] of every aspect of Tax Practice

• Case Studies

◦ [330+ Case Studies] to deal with real-life animated situations/problems faced by tax practitioners

• Draft Replies

◦ For the Notices sent by the Department

◦ Petitions to the Department

• Drafting & Conveyancing

◦ [Complete Guide to Drafting of Deeds & Documents] covering

◦ Affidavits

◦ Wills

◦ Special Business Arrangements

◦ Family Arrangements

◦ Power of Attorney

◦ Lease, Rent & Leave and Licenses

◦ Indemnity and Guarantee

◦ Charitable Trust Deeds, etc.

The contents of this book are as follows:

• Law Relating to Tax Procedures

◦ Tax Practice

◦ Pre-assessment Procedures

◦ Assessment

◦ Appeals

◦ Interest, Fees, Penalty and Prosecution

◦ Refunds

◦ Settlement Commission – ITSC, Interim Board for Settlement

◦ Summons, Survey, Search

◦ TDS and TCS

◦ Recovery of Tax

◦ Special Procedures

◦ Approvals

◦ STT, DDT, Tax on Liquidation, Reduction and Buy Back, MAT, AMT and WT

RTI, Ombudsman

◦ Drafting of Deeds

◦ Agreement, MoU

◦ Gifts, Wills, Family Arrangements

◦ Power of Attorney, etc.

◦ Lease, Rent, License, etc.

◦ Sale/Transfer of Properties

◦ Tax Audit

◦ Income Computation & Disclosure Standards

◦ Real Estate (Regulation and Development) Act, 2016 (RERA)

◦ E-Proceedings under the Income Tax Act, 1961

◦ Prohibition of Benami Property Transactions Act, 1988

• Case Studies

◦ Tax Practice

◦ Pre-Assessment Procedures

◦ Assessment – Principles and Issues

◦ Rectification of Mistake

◦ Revision

◦ Appeals to CIT (Appeals)

◦ Appeals to – ITAT – High Court – Supreme Court

◦ Interest Payable by Assessee

◦ Penalties

◦ Prosecution

◦ Refunds

◦ Settlement of Cases

◦ Survey

◦ Search & Seizure

◦ Tax Deduction at Source

◦ Recovery of Tax

◦ Trust, Mutuality, Charity

◦ Firm

◦ LLP – Limited Liability Partnership

◦ Right to Information – RTI

◦ Agreement, MoU

◦ AOP – Association of Persons

◦ HUF – Hindu Undivided Family

◦ Gifts

◦ Wills

◦ Family Arrangements

◦ Power of Attorney

◦ Indemnity and Guarantee

◦ Lease, Rent, Leave and License

◦ Sale/Transfer of Properties

◦ Tax Audit

Issues in vivad se vishwas scheme 2020

OBJECTIVE

The Direct Tax Vivad se Vishwas Bill, 2020 was introduced in the Parliament on 5th February, 2020 and subsequently amended. The webinar shall deal with the frequently asked questions relating to the scheme. It shall discuss the issues faced by the taxpayers in the dispute resolution scheme.

Vivad se Vishwas Scheme 2020

Guided by “Sabka Saath, Sabka Vikas, Sabka Vishwas”, the Finance Minister Smt. Nirmala Sitharaman had introduced a new No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ in the Budget 2020 in the Lok Sabha on 5th February, 2020. Expectations are that the new scheme will work better than erstwhile similar scheme “The Direct Tax Dispute Resolution Scheme, 2016”, given the kind of cases that are in appeal.

To know more:https://itatorders.in/blog/eligible-person-under-vivad-se-vishwas-scheme-2020/

Get consultation under the VSV scheme and calculate your taxes : https://www.itatorders.in/vsvcalculator

Regular requirements of income tax to be complied be companies branch office-...

Regular requirements of Income Tax required to comply by a company/Branch office/Liaison office/Bank/Non-Banking Financial Institutions/Insurance company/NGOs etc. according to the Income Tax Ordinance and Income Tax Rules 1984

Refund under GST

<a>GST Software</a> with reconciliation, excel/ ERP import functionality @ Rs. 4999. Manage GST compliance with our GST software easily. GST APIs available.

For More Details:

Visit below given links:

https://www.legalraasta.com/gst-software/

https://www.taxraahi.com/gst.php

https://www.legalraasta.com/gst-return/

https://www.legalraasta.com/gst-registration/

Reverse Charge under GST

OBJECTIVE

Under GST, the supplier of goods or services is liable to pay the tax to the Government. However, under the reverse charge mechanism (RCM), the liability to pay GST is cast on the recipient of the goods or services. Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply. In this webinar, we shall understand the applicability and provisions of RCM under GST.

The Direct Tax Vivad se Vishwas Bill, 2020

OBJECTIVE

Honourable Finance Minister Nirmala Sitharaman, in the Speech of Budget 2020-21, proposed to introduce The Direct Tax Vivad se Vishwas Act, 2020 for

dispute resolution related to direct taxes. Similar scheme known as the 'Sabka Vishwas' was introduced in 2019 for dispute resolution under Legacy Indirect Taxes. The Direct Tax Vivad se Vishwas Bill, 2020 was introduced in the parliament on 5th February, 2020. In this webinar, we shall under the provisions of the Bill and the Rationale for its Introduction.

Public notice regarding e-BIN and guidelines for filing information in online...

Public notice for updating e-BIN information in IVAS system or taking new VAT registration/Turnover enlistment number by 31 July 2019 upon filing required information of Mushak-2.1. and guidelines for filling Mushak-2.1.

TDS and TCS provisions in GST

Provisions of TDS and TCS in GST made applicable w.e.f 1st October, 2018 explained in a presentable format.

Consequences of Fake Invoices under Income Tax Act and GST

Key Takeaways:

- Rationale for Introducing Penalty Provisions

- Consequences of Fake Invoicing under Income Tax Act and GST

- Legal Proceedings and Compounding of Offences

- Judicial Precedents

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...DVSResearchFoundatio

Key Takeaways:

- Facts of the Case

- Rulings by the Lower Authorities for Quantum Assessment

- Penalty Proceedings

- Supreme Court Ruling

- Conclusion and Key TakeawaysTax Deduction or Collection at Source TDS or TCS under GST

K.Vijaya Kumar

Asst.Commissioner, Central Tax, Belgaum

Offences, Penalty & Prosecution provisions under GST Regime

Discusses offences, penalty and prosecution provisions under GST regime. Covers Chapter XIX of CGST Act, 2017 and CGST Rules, 2017

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular require...

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular requirements of Income Tax required to be complied by a company/Branch office/Liaison office/Bank/Non-Banking Financial Institutions/Insurance companies/NGOs etc. (where applicable)

Assessment under GST Regime

Presentation on procedures relating to Assessment under GST Regime. Covers Chapter XI of the CGST Rules, 2017, as updated from time to time

E-Filing of Income Tax Returns

This presentation takes one through the basic e-filing procedures under the Income Tax Rules prevailing in India. It explains the concepts in a very simplified manner.

More Related Content

What's hot

The Direct Tax Vivad se Vishwas Bill, 2020

OBJECTIVE

Honourable Finance Minister Nirmala Sitharaman, in the Speech of Budget 2020-21, proposed to introduce The Direct Tax Vivad se Vishwas Act, 2020 for

dispute resolution related to direct taxes. Similar scheme known as the 'Sabka Vishwas' was introduced in 2019 for dispute resolution under Legacy Indirect Taxes. The Direct Tax Vivad se Vishwas Bill, 2020 was introduced in the parliament on 5th February, 2020. In this webinar, we shall under the provisions of the Bill and the Rationale for its Introduction.

Public notice regarding e-BIN and guidelines for filing information in online...

Public notice for updating e-BIN information in IVAS system or taking new VAT registration/Turnover enlistment number by 31 July 2019 upon filing required information of Mushak-2.1. and guidelines for filling Mushak-2.1.

TDS and TCS provisions in GST

Provisions of TDS and TCS in GST made applicable w.e.f 1st October, 2018 explained in a presentable format.

Consequences of Fake Invoices under Income Tax Act and GST

Key Takeaways:

- Rationale for Introducing Penalty Provisions

- Consequences of Fake Invoicing under Income Tax Act and GST

- Legal Proceedings and Compounding of Offences

- Judicial Precedents

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...DVSResearchFoundatio

Key Takeaways:

- Facts of the Case

- Rulings by the Lower Authorities for Quantum Assessment

- Penalty Proceedings

- Supreme Court Ruling

- Conclusion and Key TakeawaysTax Deduction or Collection at Source TDS or TCS under GST

K.Vijaya Kumar

Asst.Commissioner, Central Tax, Belgaum

Offences, Penalty & Prosecution provisions under GST Regime

Discusses offences, penalty and prosecution provisions under GST regime. Covers Chapter XIX of CGST Act, 2017 and CGST Rules, 2017

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular require...

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular requirements of Income Tax required to be complied by a company/Branch office/Liaison office/Bank/Non-Banking Financial Institutions/Insurance companies/NGOs etc. (where applicable)

Assessment under GST Regime

Presentation on procedures relating to Assessment under GST Regime. Covers Chapter XI of the CGST Rules, 2017, as updated from time to time

E-Filing of Income Tax Returns

This presentation takes one through the basic e-filing procedures under the Income Tax Rules prevailing in India. It explains the concepts in a very simplified manner.

What's hot (20)

Voluntary compliance encouragement scheme under service tax laws

Voluntary compliance encouragement scheme under service tax laws

Public notice regarding e-BIN and guidelines for filing information in online...

Public notice regarding e-BIN and guidelines for filing information in online...

Service tax negative concept icai final - Lakshminarayan.G

Service tax negative concept icai final - Lakshminarayan.G

Consequences of Fake Invoices under Income Tax Act and GST

Consequences of Fake Invoices under Income Tax Act and GST

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...

Consideration of Penalty Proceedings Order for Quantum Assessment: Analysis o...

Tax Deduction or Collection at Source TDS or TCS under GST

Tax Deduction or Collection at Source TDS or TCS under GST

Offences, Penalty & Prosecution provisions under GST Regime

Offences, Penalty & Prosecution provisions under GST Regime

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular require...

TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular require...

Viewers also liked

Viewers also liked (20)

gov revenue formsandresources forms PT-STM_fill-in

gov revenue formsandresources forms PT-STM_fill-in

Similar to tax.utah.gov forms current tc tc-98

Texas Inheritance Tax Forms-17-110 Generation-Skipping Transfer Tax Return fo...

Texas Inheritance Tax Forms-17-110 Generation-Skipping Transfer Tax Return for Terminations -- Federal Generation-Skipping Transfer Tax Credit

Similar to tax.utah.gov forms current tc tc-98 (20)

Texas Inheritance Tax Forms-17-110 Generation-Skipping Transfer Tax Return fo...

Texas Inheritance Tax Forms-17-110 Generation-Skipping Transfer Tax Return fo...

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Improving profitability for small business

In this comprehensive presentation, we will explore strategies and practical tips for enhancing profitability in small businesses. Tailored to meet the unique challenges faced by small enterprises, this session covers various aspects that directly impact the bottom line. Attendees will learn how to optimize operational efficiency, manage expenses, and increase revenue through innovative marketing and customer engagement techniques.

Meas_Dylan_DMBS_PB1_2024-05XX_Revised.pdf

Personal Brand Statement:

As an Army veteran dedicated to lifelong learning, I bring a disciplined, strategic mindset to my pursuits. I am constantly expanding my knowledge to innovate and lead effectively. My journey is driven by a commitment to excellence, and to make a meaningful impact in the world.

Tata Group Dials Taiwan for Its Chipmaking Ambition in Gujarat’s Dholera

The Tata Group, a titan of Indian industry, is making waves with its advanced talks with Taiwanese chipmakers Powerchip Semiconductor Manufacturing Corporation (PSMC) and UMC Group. The goal? Establishing a cutting-edge semiconductor fabrication unit (fab) in Dholera, Gujarat. This isn’t just any project; it’s a potential game changer for India’s chipmaking aspirations and a boon for investors seeking promising residential projects in dholera sir.

Visit : https://www.avirahi.com/blog/tata-group-dials-taiwan-for-its-chipmaking-ambition-in-gujarats-dholera/

The effects of customers service quality and online reviews on customer loyal...

The effects of customers service quality and online reviews on customer loyal...balatucanapplelovely

Research Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey through Full Sail University. Below, you’ll find a collection of my work showcasing my skills and expertise in digital marketing, event planning, and media production.

Digital Transformation and IT Strategy Toolkit and Templates

This Digital Transformation and IT Strategy Toolkit was created by ex-McKinsey, Deloitte and BCG Management Consultants, after more than 5,000 hours of work. It is considered the world's best & most comprehensive Digital Transformation and IT Strategy Toolkit. It includes all the Frameworks, Best Practices & Templates required to successfully undertake the Digital Transformation of your organization and define a robust IT Strategy.

Editable Toolkit to help you reuse our content: 700 Powerpoint slides | 35 Excel sheets | 84 minutes of Video training

This PowerPoint presentation is only a small preview of our Toolkits. For more details, visit www.domontconsulting.com

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

The world of search engine optimization (SEO) is buzzing with discussions after Google confirmed that around 2,500 leaked internal documents related to its Search feature are indeed authentic. The revelation has sparked significant concerns within the SEO community. The leaked documents were initially reported by SEO experts Rand Fishkin and Mike King, igniting widespread analysis and discourse. For More Info:- https://news.arihantwebtech.com/search-disrupted-googles-leaked-documents-rock-the-seo-world/

一比一原版加拿大渥太华大学毕业证(uottawa毕业证书)如何办理

一模一样【q/微:1954292140】【加拿大渥太华大学毕业证(uottawa毕业证书)成绩单Offer】【q/微:1954292140】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【q/微:1954292140】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【q/微:1954292140】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

3.0 Project 2_ Developing My Brand Identity Kit.pptx

A personal brand exploration presentation summarizes an individual's unique qualities and goals, covering strengths, values, passions, and target audience. It helps individuals understand what makes them stand out, their desired image, and how they aim to achieve it.

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Have you ever heard that user-generated content or video testimonials can take your brand to the next level? We will explore how you can effectively use video testimonials to leverage and boost your sales, content strategy, and increase your CRM data.🤯

We will dig deeper into:

1. How to capture video testimonials that convert from your audience 🎥

2. How to leverage your testimonials to boost your sales 💲

3. How you can capture more CRM data to understand your audience better through video testimonials. 📊

Premium MEAN Stack Development Solutions for Modern Businesses

Stay ahead of the curve with our premium MEAN Stack Development Solutions. Our expert developers utilize MongoDB, Express.js, AngularJS, and Node.js to create modern and responsive web applications. Trust us for cutting-edge solutions that drive your business growth and success.

Know more: https://www.synapseindia.com/technology/mean-stack-development-company.html

5 Things You Need To Know Before Hiring a Videographer

Dive into this presentation to discover the 5 things you need to know before hiring a videographer in Toronto.

Memorandum Of Association Constitution of Company.ppt

www.seribangash.com

A Memorandum of Association (MOA) is a legal document that outlines the fundamental principles and objectives upon which a company operates. It serves as the company's charter or constitution and defines the scope of its activities. Here's a detailed note on the MOA:

Contents of Memorandum of Association:

Name Clause: This clause states the name of the company, which should end with words like "Limited" or "Ltd." for a public limited company and "Private Limited" or "Pvt. Ltd." for a private limited company.

https://seribangash.com/article-of-association-is-legal-doc-of-company/

Registered Office Clause: It specifies the location where the company's registered office is situated. This office is where all official communications and notices are sent.

Objective Clause: This clause delineates the main objectives for which the company is formed. It's important to define these objectives clearly, as the company cannot undertake activities beyond those mentioned in this clause.

www.seribangash.com

Liability Clause: It outlines the extent of liability of the company's members. In the case of companies limited by shares, the liability of members is limited to the amount unpaid on their shares. For companies limited by guarantee, members' liability is limited to the amount they undertake to contribute if the company is wound up.

https://seribangash.com/promotors-is-person-conceived-formation-company/

Capital Clause: This clause specifies the authorized capital of the company, i.e., the maximum amount of share capital the company is authorized to issue. It also mentions the division of this capital into shares and their respective nominal value.

Association Clause: It simply states that the subscribers wish to form a company and agree to become members of it, in accordance with the terms of the MOA.

Importance of Memorandum of Association:

Legal Requirement: The MOA is a legal requirement for the formation of a company. It must be filed with the Registrar of Companies during the incorporation process.

Constitutional Document: It serves as the company's constitutional document, defining its scope, powers, and limitations.

Protection of Members: It protects the interests of the company's members by clearly defining the objectives and limiting their liability.

External Communication: It provides clarity to external parties, such as investors, creditors, and regulatory authorities, regarding the company's objectives and powers.

https://seribangash.com/difference-public-and-private-company-law/

Binding Authority: The company and its members are bound by the provisions of the MOA. Any action taken beyond its scope may be considered ultra vires (beyond the powers) of the company and therefore void.

Amendment of MOA:

While the MOA lays down the company's fundamental principles, it is not entirely immutable. It can be amended, but only under specific circumstances and in compliance with legal procedures. Amendments typically require shareholder

Business Valuation Principles for Entrepreneurs

This insightful presentation is designed to equip entrepreneurs with the essential knowledge and tools needed to accurately value their businesses. Understanding business valuation is crucial for making informed decisions, whether you're seeking investment, planning to sell, or simply want to gauge your company's worth.

RMD24 | Retail media: hoe zet je dit in als je geen AH of Unilever bent? Heid...

Grote partijen zijn al een tijdje onderweg met retail media. Ondertussen worden in dit domein ook de kansen zichtbaar voor andere spelers in de markt. Maar met die kansen ontstaan ook vragen: Zelf retail media worden of erop adverteren? In welke fase van de funnel past het en hoe integreer je het in een mediaplan? Wat is nu precies het verschil met marketplaces en Programmatic ads? In dit half uur beslechten we de dilemma's en krijg je antwoorden op wanneer het voor jou tijd is om de volgende stap te zetten.

Recently uploaded (20)

Tata Group Dials Taiwan for Its Chipmaking Ambition in Gujarat’s Dholera

Tata Group Dials Taiwan for Its Chipmaking Ambition in Gujarat’s Dholera

The effects of customers service quality and online reviews on customer loyal...

The effects of customers service quality and online reviews on customer loyal...

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey throu...

Digital Transformation and IT Strategy Toolkit and Templates

Digital Transformation and IT Strategy Toolkit and Templates

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

3.0 Project 2_ Developing My Brand Identity Kit.pptx

3.0 Project 2_ Developing My Brand Identity Kit.pptx

LA HUG - Video Testimonials with Chynna Morgan - June 2024

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Premium MEAN Stack Development Solutions for Modern Businesses

Premium MEAN Stack Development Solutions for Modern Businesses

5 Things You Need To Know Before Hiring a Videographer

5 Things You Need To Know Before Hiring a Videographer

Memorandum Of Association Constitution of Company.ppt

Memorandum Of Association Constitution of Company.ppt

RMD24 | Retail media: hoe zet je dit in als je geen AH of Unilever bent? Heid...

RMD24 | Retail media: hoe zet je dit in als je geen AH of Unilever bent? Heid...

tax.utah.gov forms current tc tc-98

- 1. Clear form Print Form Utah State Tax Commission Application to Extend Time to File a Claim For Refund TC-98 Rev. 11/03 This application allows the Tax Commission and taxpayer to agree to extend the time to file a claim for refund beyond the current statute of limitations. Approval of this application shall also extend the statute of limitations for audits, adjustments, assessments, and collection of taxes. The Tax Commission and taxpayer may agree to extend the time to file a claim for refund beyond the statute of limitations. The Tax Commission will determine the length of the extension based on the reason and explanation provided in “Section 3 - Reason for Extension.” Submit this application at least 30 days prior to the expiration of the statute of limitations to allow time for processing. If your extension is granted, a copy of this application will be returned, showing the length of the extension and signed by a representative of the Tax Commission. SECTION 1 - General Information Telephone no. Contact person/representative’s name (if applicable) Telephone no. Taxpayer’s name Taxpayer’s address Contact person or representative address City State Zip code City State Zip code Business name (if applicable) Business location (address) SECTION 2 - Refund Information Tax type Account number Tax period Date statute of limitations expires Estimated amount of refund SECTION 3 - Reason for Extension Presiding court: ____________________________ Case number: _________________________ Judiciary proceeding pending State or jurisdiction: ____________________________ Agency conducting audit: _________________________ Audit in process Unattainable records Additional time to review records Unavoidable absence Other Explanation: Provide information in the space below (or attach other documentation) that explains the problem or issues related to those items checked above. Also, explain how this extension would result in a refund. SECTION 4 - Authorized Signatures (Both parties must sign before the statute of limitations expires) This application must be signed by the taxpayer or the principal officer, agent, or attorney-in-fact, authorized to complete this form for the taxpayer. The agent or attorney-in-fact must attach a copy of the power of attorney, authorizing such signature. Any signature will be “prima-facie evidence” that the individual is authorized to sign and acknowledges that the extension also extends the statute of limitations for audits, adjustments, assessments, and collection of taxes. PRINT name of taxpayer or authorized representative Signature of taxpayer or representative Date signed X Print Form Print your title, if this is for a business Daytime telephone number Review this application to make sure you complete all sections. Return or mail to the address below or send by fax to (801) 297-6357. You may also obtain assistance by calling (801) 297-7790. Utah State Tax Commission, Taxpayer Services Division, Internal Customer Support, 2nd Floor, 210 N 1950 W, Salt Lake City, Utah 84134. IMPORTANT: To protect your privacy, use the quot;Clear formquot; button when you are finished. Clear form

- 2. SECTION 5 - For Office Use Only PRINT Name, title, and telephone number of Tax Commission Representative Signature of Tax Commission representative Date signed Signature of Supervisor (if applicable) Date signed X X Length of extension granted This extension is granted from ______/______/______ to expire on ______/______/______ OR _______________________________________________________________________ Instructions to Claim a Refund This application is NOT your Claim for Refund - it is only an application to receive an extension of time to file a claim for refund. All refund claims must be filed on or before the extension expiration date and include the information listed below and a copy of this approved application. All claims for refunds must include the following information: 1. Requestor’s name 2. Requestor’s account number, social security number, or federal identification number 3. Tax paid 4. Dates of remittance to the Utah State Tax Commission 5. Basis for the refund request If the claim for refund is Sales Tax related, you must also include the following information: 6. Vendor name 7. Vendor account number 8. Vendor location 9. Date of sale/purchase 10. Description of item(s) sold/purchased 11. Taxable amount 12. Basis for exemption from sales and use tax 13. Sales tax rate