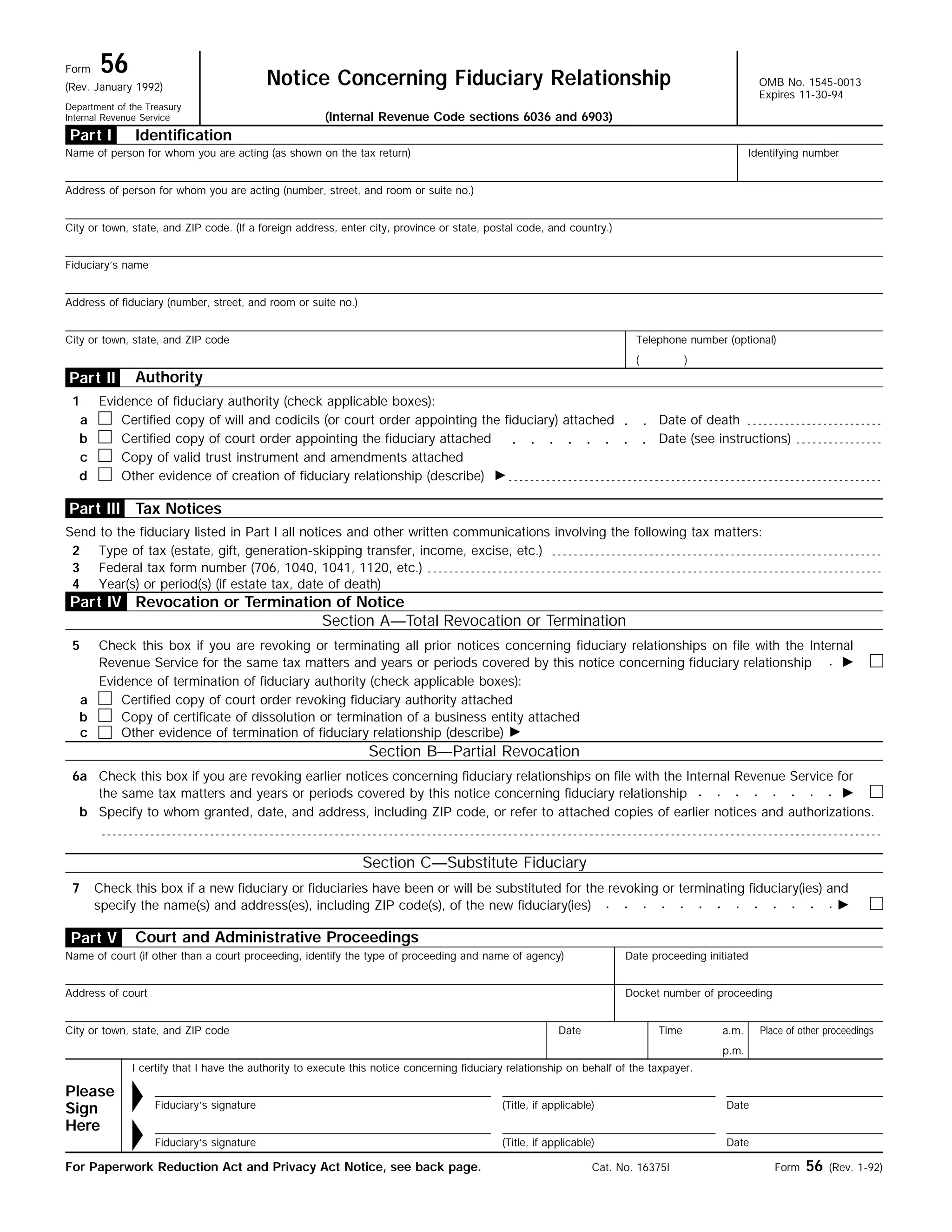

This document is an IRS Form 56 that provides instructions for notifying the IRS of the creation or termination of a fiduciary relationship. Key details:

1. The form is used by fiduciaries like executors, trustees, or guardians to establish that they have authority to act on tax matters for another person or entity.

2. It allows the fiduciary to receive tax notices and communicate with the IRS regarding tax returns and liabilities.

3. Parts of the form provide spaces to identify the taxpayer and fiduciary, describe the fiduciary authority, specify tax years involved, and revoke or terminate previous notices.