The document provides information about changes to IRS Form 1023 for organizations applying for tax-exempt status under Section 501(c)(3). Specifically, it outlines changes to:

1) The mailing address for submitting Form 1023 applications.

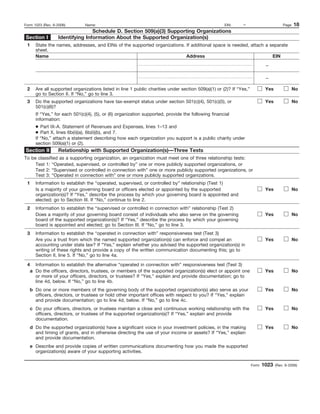

2) Parts IX, X, and XI of Form 1023 regarding financial data reporting requirements and public charity status designations, removing the requirement to request an advance ruling.

3) User fees for Form 1023 applications, which have been increased.