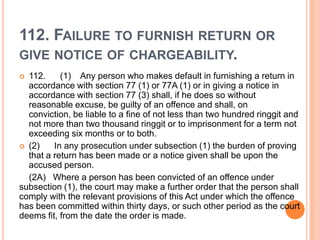

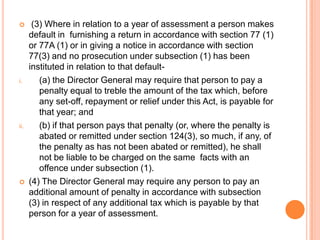

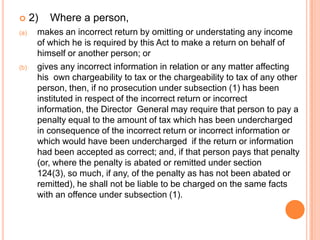

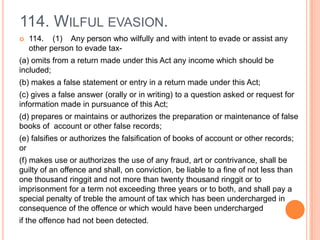

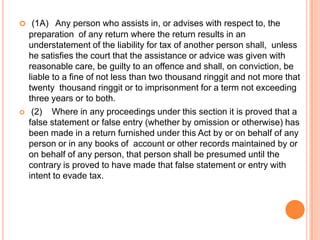

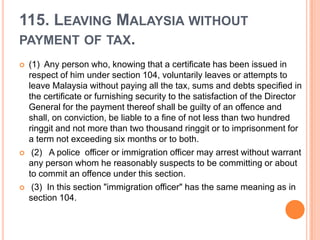

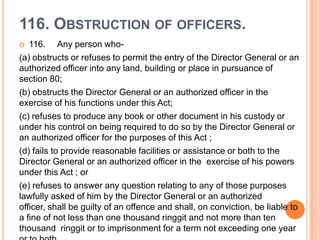

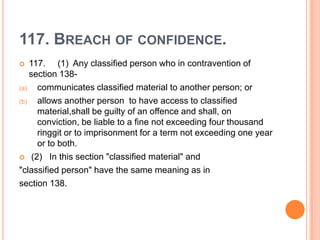

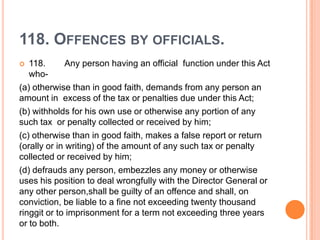

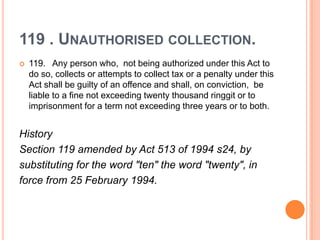

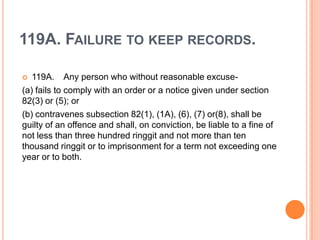

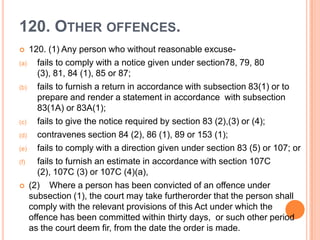

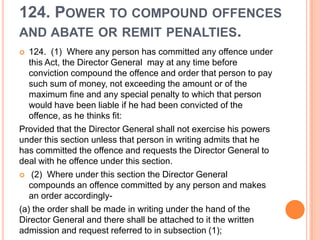

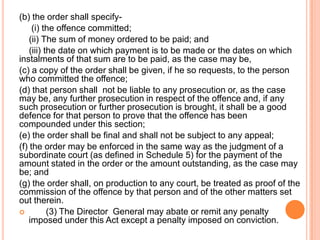

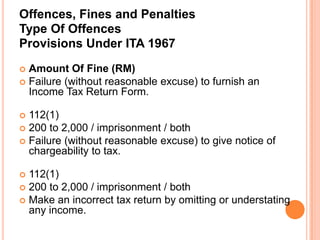

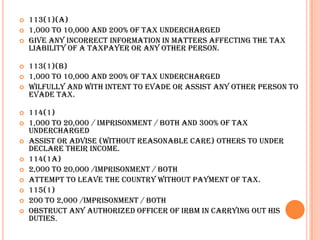

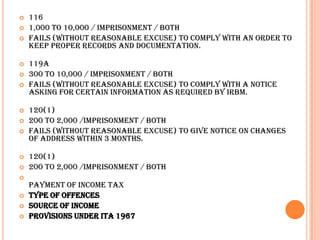

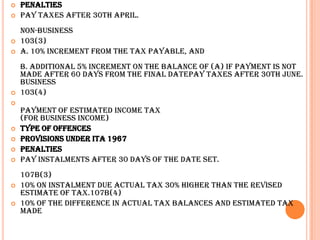

This document outlines various offences and penalties under the Malaysian Income Tax Act 1967. It describes offenses such as failure to file a tax return, making an incorrect return, willfully evading tax, obstructing tax officers, and failing to comply with record keeping requirements. The penalties for convictions range from fines between RM200 to RM20,000 depending on the offense, and can also include imprisonment terms and payment of unpaid taxes. The Director General is authorized to compound offenses by accepting a monetary payment in lieu of criminal prosecution.