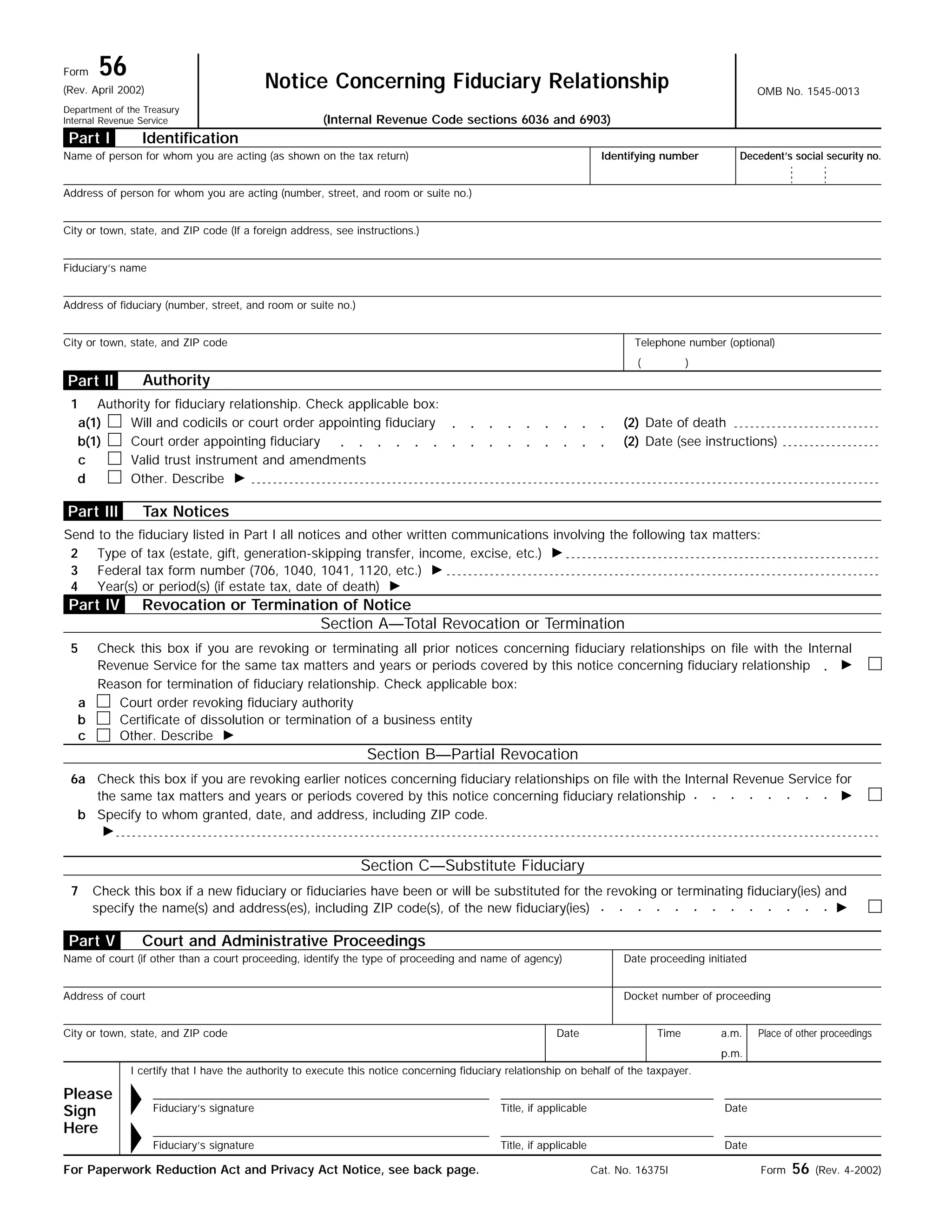

This document is an IRS Form 56 for notifying the IRS of a fiduciary relationship. It provides instructions for completing the form. The form has five parts: Part I requests identification information for the person and fiduciary; Part II requires the fiduciary to specify the authority under which they are acting; Part III allows the fiduciary to request tax notices; Part IV covers revoking a prior notice; and Part V is for court proceedings information. The summary provides an overview of the purpose and contents of the IRS form and instructions.