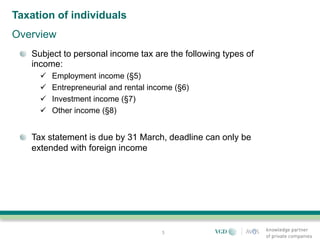

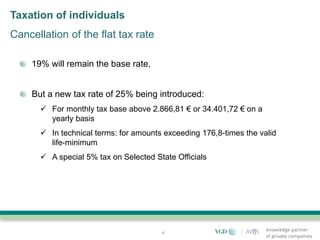

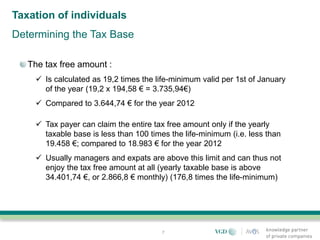

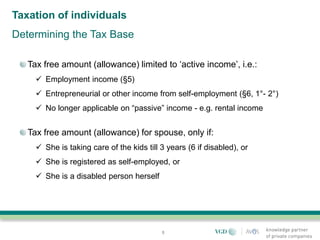

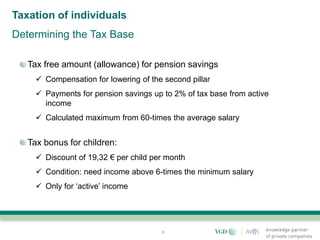

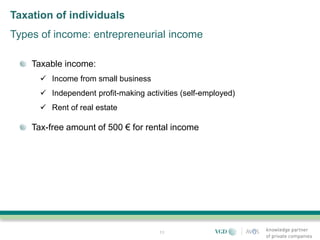

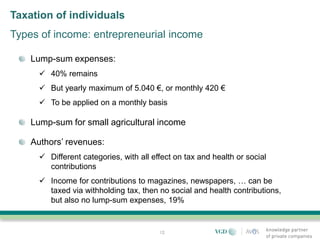

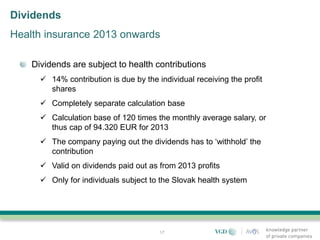

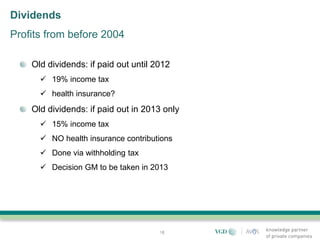

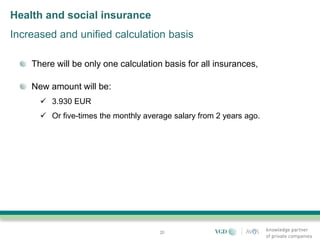

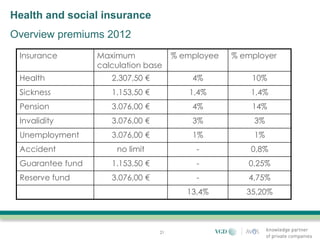

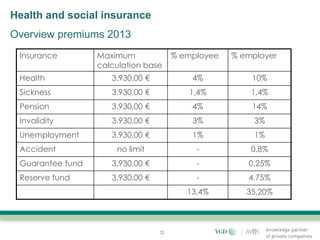

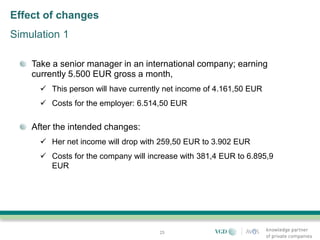

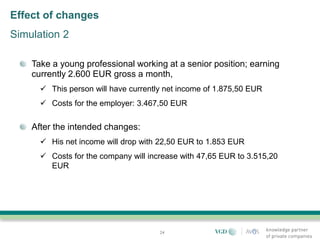

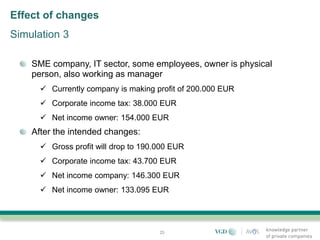

The document outlines changes to income tax regulations for individuals, including a new progressive tax rate of 25% and changes to health and social contributions effective in 2013. Key updates include adjustments to the calculation of tax-free amounts, redefinitions of taxable income types, and increased contributions for self-employed individuals. It emphasizes the impact of these changes on various income scenarios and the overall tax landscape for physical persons.