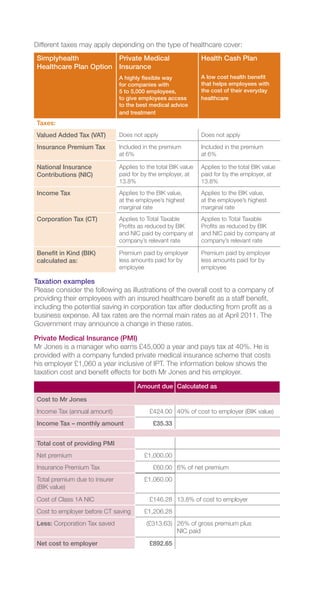

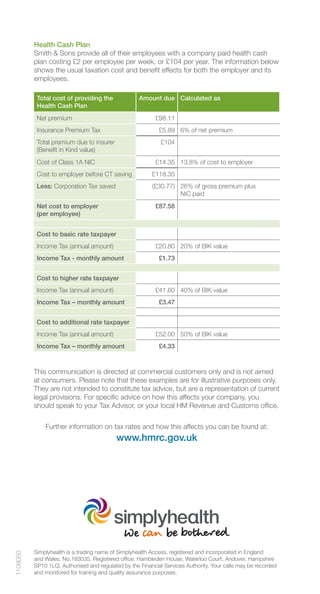

This document discusses the various taxation implications of company-paid healthcare in the UK, including:

- Insurance Premium Tax of 6% is included in insurance premiums and cannot be reclaimed.

- Employers pay Class 1A National Insurance Contributions of 13.8% on the cost of employees' healthcare benefits.

- Employees pay income tax on the value of their benefits at their marginal tax rate of 20%, 40%, or 50%.

- Companies can deduct the costs of providing employee benefits from profits for corporation tax purposes.

It provides examples of the tax treatment for private medical insurance and health cash plans.