The document summarizes changes to the Slovakian Income Tax Act that took effect on January 1, 2015. Key changes include:

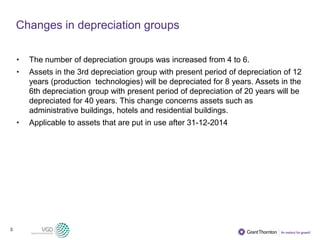

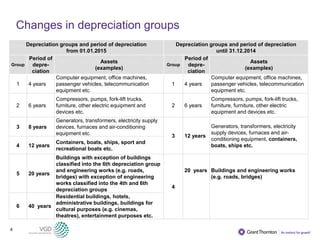

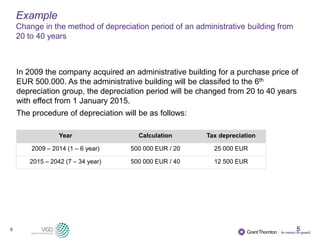

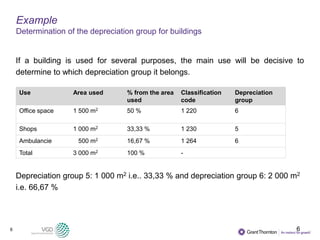

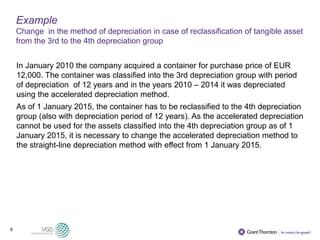

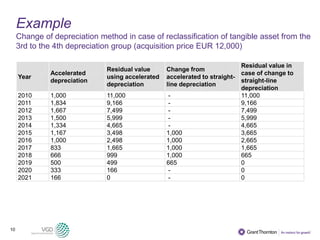

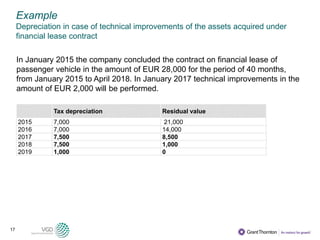

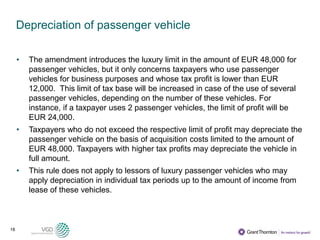

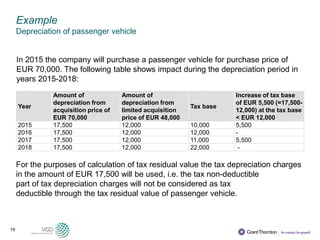

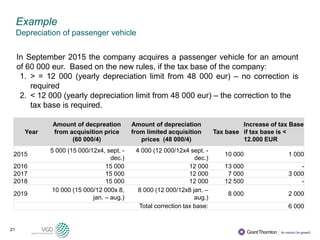

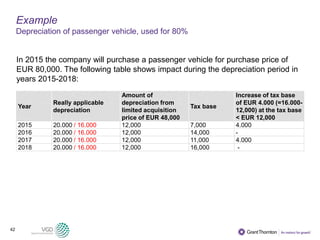

1) New asset depreciation groups were introduced, changing depreciation periods for some assets. Buildings are now depreciated over 40 years instead of 20 years.

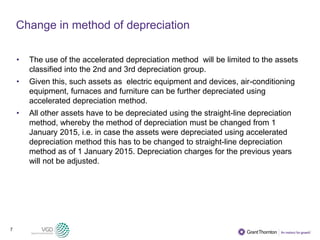

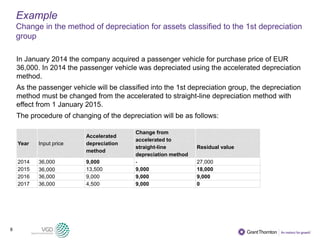

2) The use of accelerated depreciation was limited to assets in the 2nd and 3rd groups.

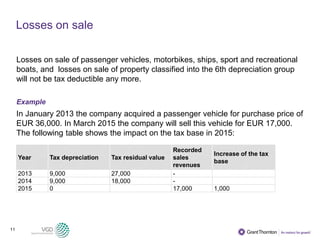

3) Losses from the sale of certain assets like cars are no longer tax deductible.

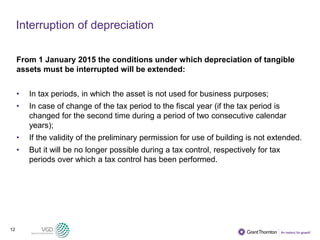

4) Conditions for interrupting depreciation of assets were expanded.

That covers the high level summary of the key changes discussed in the document in 3 sentences.