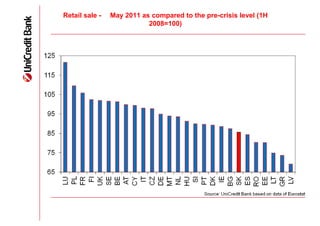

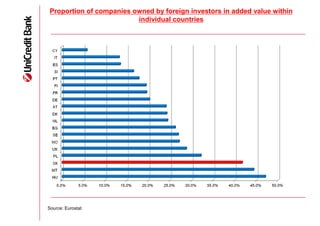

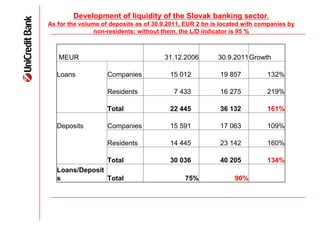

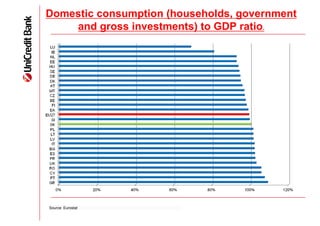

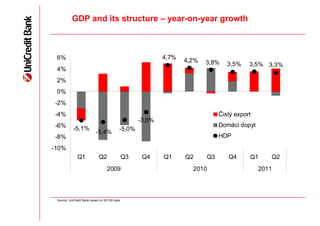

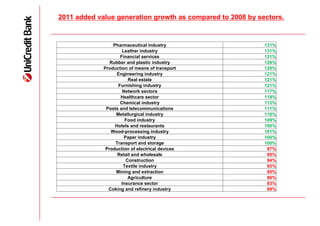

The document discusses the impacts of foreign investment on Slovakia's economy. It notes that foreign investments generate resources, provide employment for one third of Slovak citizens, and pay higher average wages. They also focus production on export and extend development possibilities given Slovakia's limited domestic financial assets. Foreign investors help diversify GDP generation and lower Slovakia's domestic demand dependence. Charts show trends in foreign employment, wages, retail sales, banking sector liquidity, GDP composition and other economic indicators.