This document provides information about 2015 income tax rates for single individuals, married filing jointly/separately, head of household, trusts and estates, and corporations. It also includes information about capital gains tax rates, the additional Medicare tax on investment income, standard deductions, personal exemptions, Social Security earnings limits and taxation of Social Security benefits.

![2

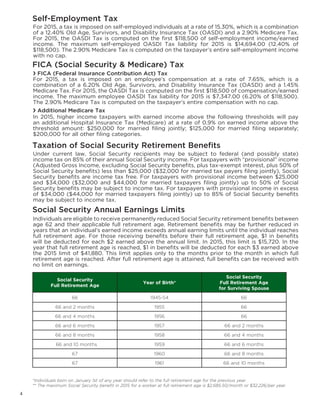

2015 Income Tax Rates

** For domestic corporations other than qualified personal service corporations.

A qualified personal service corporation [as defined in Code Sec. 448(d)(2)] is taxed at a flat 35% of its taxable income.

Head of Household

Taxable Income: Your Tax Is:

Above To Tax Rate on Excess

0 13,150 10% of taxable income N/A

13,150 50,200 1,315 plus 15% over 13,150

50,200 129,600 6,873 plus 25% over 50,200

129,600 209,850 26,723 plus 28% over 129,600

209,850 411,500 49,193 plus 33% over 209,850

411,500 439,000 115,737 plus 35% over 411,500

439,000 --- 125,362 plus 39.6% over 439,000

$ $

$ $

Trusts and Estates

Taxable Income: Your Tax Is:

Above To Tax Rate on Excess

0 2,500 15% of taxable income N/A

2,500 5,900 375 plus 25% over 2,500

5,900 9,050 1,225 plus 28% over 5,900

9,050 12,300 2,107 plus 33% over 9,050

12,300 --- 3,180 plus 39.6% over 12,300

$ $

$ $

Corporate**

Taxable Income: Your Tax Is:

Above To Tax Rate on Excess

0 50,000 15% of taxable income N/A

50,000 75,000 7,500 plus 25% over 50,000

75,000 100,000 13,750 plus 34% over 75,000

100,000 335,000 22,250 plus 39% over 100,000

335,000 10,000,000 113,900 plus 34% over 335,000

10,000,000 15,000,000 3,400,000 plus 35% over 10,000,000

15,000,000 18,333,333 5,150,000 plus 38% over 15,000,000

18,333,333 --- 6,416,666 plus 35% over 18,333,333

$ $

$ $](https://image.slidesharecdn.com/a98738d7-30f6-488a-8a8a-7e637abcdbca-150128093937-conversion-gate02/85/DDunwody-2015-Tax-Planning-Guide-2-3-320.jpg)