Tax Day Charts 2015

•

2 likes•630 views

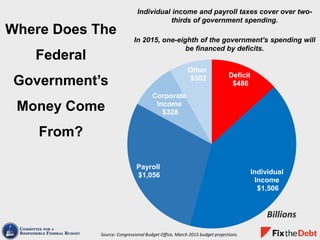

Individual income and payroll taxes cover over two-thirds of government spending. In 2015, one-eighth of the government’s spending will be financed by deficits. The top 20% of households pay almost 70% of the nation’s taxes, with the top 1% paying nearly a quarter. Tax expenditures have grown over time and now equal over a quarter of total government spending.

Report

Share

Report

Share

Download to read offline

Recommended

U.S. Taxes in Charts

Where do your tax dollars go? Who pays federal taxes? What are tax expenditures? We explain the U.S. federal tax system in a few easy-to-understand charts. See more resources at http://www.fixthedebt.org/tax-reform-resource-page

Fiscal condition of the states 2012 a

This document presents information from the National Association of State Budget Officers on the fiscal condition of US states from 1982 to 2012. It finds that in recent years, fewer states have had budget balances below 1% of expenditures, with the average balance being around 6% for fiscal years 2010 to 2012. To reduce budget gaps in 2012, many states increased taxes and fees, cut employment costs, or reduced programmatic spending.

Elmhurst college thomasjohnson-taxpresentation 1 26 11 updated

This document discusses the fiscal challenges facing Illinois, including large budget deficits, unpaid bills, and underfunded pensions. It analyzes factors like declining tax revenues, high spending growth rates, and the state's debt obligations. Several reform proposals are presented, such as consolidating programs, reducing prison populations, privatizing higher education, and reengineering relationships between state and local governments. Overall, the document examines Illinois' budget shortfalls in detail and offers ideas for cutting costs and improving the state's fiscal situation.

Tax Chartbook 2016

Where does your tax dollars go? Who pays federal taxes? What are tax expenditures? We explain the U.S. federal tax system in a few easy-to-understand charts. See more resources at http://www.fixthedebt.org/tax-reform-resource-page

Infographic: Revenues in 2013

The federal budget in 2013 collected $2.8 trillion in revenues. Individual income taxes were the largest source at $1.3 trillion. Social insurance (payroll) taxes were the second highest at $948 billion. Mandatory spending, such as Social Security and Medicare, accounted for $2 trillion of the $3.5 trillion in total spending. Revenues as a percentage of GDP were 16.7% in 2013, below the average of 17.2% between 1993 and 2012.

State of Working Vermont 2019 grew only 1.2% Gross State Product = GDP

From 2010—the first full year after the official end of the Great Recession—to 2018, Vermont’s economy, as measured by gross state product, grew at less than one-third the rate of the country’s overall. Vermont’s annual growth rate, after adjusting for inflation, averaged 0.7 percent per year, compared with 2.3 percent for the U.S. That was also slower than Vermont’s own annual growth rate during the previous recovery (2002-07), which was 1.8 percent. From 2017 to 2018 Vermont’s real GSP grew by 1.2 percent.

12

The document discusses the design of the U.S. tax system. It describes the various taxes that raise revenue for the federal and state/local governments. The federal government collects most of its revenue from individual income taxes and payroll taxes, while state and local governments collect most from sales taxes and property taxes. The two main objectives in designing a tax system are efficiency and equity. Efficiency refers to minimizing the costs imposed on taxpayers, while equity concerns fair distribution of the tax burden.

Who pays Report?

" The lower one’s income, the higher one’s overall effective state and local tax rate. Combining all state and local income, property, sales and excise taxes that Americans pay, the nationwide average effective state and local tax rates by income group are 10.9 percent for the poorest 20 percent of individuals and families, 9.4 percent for the middle 20 percent and 5.4 percent for the top 1 percent."

Recommended

U.S. Taxes in Charts

Where do your tax dollars go? Who pays federal taxes? What are tax expenditures? We explain the U.S. federal tax system in a few easy-to-understand charts. See more resources at http://www.fixthedebt.org/tax-reform-resource-page

Fiscal condition of the states 2012 a

This document presents information from the National Association of State Budget Officers on the fiscal condition of US states from 1982 to 2012. It finds that in recent years, fewer states have had budget balances below 1% of expenditures, with the average balance being around 6% for fiscal years 2010 to 2012. To reduce budget gaps in 2012, many states increased taxes and fees, cut employment costs, or reduced programmatic spending.

Elmhurst college thomasjohnson-taxpresentation 1 26 11 updated

This document discusses the fiscal challenges facing Illinois, including large budget deficits, unpaid bills, and underfunded pensions. It analyzes factors like declining tax revenues, high spending growth rates, and the state's debt obligations. Several reform proposals are presented, such as consolidating programs, reducing prison populations, privatizing higher education, and reengineering relationships between state and local governments. Overall, the document examines Illinois' budget shortfalls in detail and offers ideas for cutting costs and improving the state's fiscal situation.

Tax Chartbook 2016

Where does your tax dollars go? Who pays federal taxes? What are tax expenditures? We explain the U.S. federal tax system in a few easy-to-understand charts. See more resources at http://www.fixthedebt.org/tax-reform-resource-page

Infographic: Revenues in 2013

The federal budget in 2013 collected $2.8 trillion in revenues. Individual income taxes were the largest source at $1.3 trillion. Social insurance (payroll) taxes were the second highest at $948 billion. Mandatory spending, such as Social Security and Medicare, accounted for $2 trillion of the $3.5 trillion in total spending. Revenues as a percentage of GDP were 16.7% in 2013, below the average of 17.2% between 1993 and 2012.

State of Working Vermont 2019 grew only 1.2% Gross State Product = GDP

From 2010—the first full year after the official end of the Great Recession—to 2018, Vermont’s economy, as measured by gross state product, grew at less than one-third the rate of the country’s overall. Vermont’s annual growth rate, after adjusting for inflation, averaged 0.7 percent per year, compared with 2.3 percent for the U.S. That was also slower than Vermont’s own annual growth rate during the previous recovery (2002-07), which was 1.8 percent. From 2017 to 2018 Vermont’s real GSP grew by 1.2 percent.

12

The document discusses the design of the U.S. tax system. It describes the various taxes that raise revenue for the federal and state/local governments. The federal government collects most of its revenue from individual income taxes and payroll taxes, while state and local governments collect most from sales taxes and property taxes. The two main objectives in designing a tax system are efficiency and equity. Efficiency refers to minimizing the costs imposed on taxpayers, while equity concerns fair distribution of the tax burden.

Who pays Report?

" The lower one’s income, the higher one’s overall effective state and local tax rate. Combining all state and local income, property, sales and excise taxes that Americans pay, the nationwide average effective state and local tax rates by income group are 10.9 percent for the poorest 20 percent of individuals and families, 9.4 percent for the middle 20 percent and 5.4 percent for the top 1 percent."

Exploring the Growth of Medicaid Managed Care

This document summarizes a Congressional Budget Office presentation on exploring the growth of Medicaid managed care. It finds that while Medicaid managed care enrollment has grown significantly, spending attributed to managed care has grown even more. It also finds variation between states in how they structure their managed care programs and which eligibility groups and services they cover through managed care. The presentation aims to improve understanding of whether managed care is the predominant delivery system and to inform expectations for its future growth.

There is a better way (9.18.2017)

IF Alaska needs to raise new government revenues, there is a much better way to do it than through PFD cuts or the other current proposals.

Oregon Economic and Revenue Forecast, September 2019

The Oregon Office of Economic Analysis forecasts the state economy and General Fund and Lottery Fund revenues. This slide presentation is a part of the September 2019 forecast (released August 28th).

Debt trajectory data hf

This is a PPT that I created for a discussion of the US Federal Budget, the Deficit, and the Debt. Many of the slides are public domain items for Heritage Foundation and Concord Coalition. It led to some very good non-partisan discussions. There is hope!

Infographic: The Federal Budget in 2013

The federal budget deficit grew during the 2008-2009 recession and remained larger in 2013 than in 2008, amounting to $680 billion or 4.1% of GDP. Federal spending was 20.8% of GDP in 2013, slightly above the 40-year average, while revenues were 16.7% of GDP. Large budget deficits in recent years substantially increased federal debt held by the public to 72% of GDP in 2013, the highest level in over 60 years, which could negatively impact long-term economic growth.

Progressive conservatives vs Liberal Government for Ontario

This presentation will look at 13+ years of governments led by Mike Harris (PC) as well as Liberals (Kathleen Wynne and Dalton McGuinty)

Ontario debt has double since 2003 and yet we have seen a deterioration in terms of the quality of services as well as the economy.

Progressive Conservatives vs Liberal Government for Ontario - April 2017

This presentation looks at government finances as well as other factors that are driving GDP growth in Ontario.

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

15th Annual Meeting of the Network on Fiscal Relations Across Levels of Government, OECD, 2-3 December 2019

Veh Web Pres V9 24 08

Vermonters for Economic Health (VEH) is a non-partisan organization that examines Vermont's economic health by looking at tax burdens, spending, job growth, and demographics. They find that Vermont has the highest tax burden in the country, spending is growing much faster than inflation while private sector jobs are declining, and the state is losing young people. VEH proposes growing the private sector through reducing obstacles to job growth, containing spending increases, and electing officials committed to improving Vermont's economic health.

Growing Healthcare Costsandthe Federal Debt

The document discusses growing healthcare costs and the federal debt. It notes that social security, Medicare and Medicaid currently make up 42% of the federal budget and are projected to continue increasing significantly. If current policies continue, large sustained deficits of over $14 trillion are projected by 2019. Rising healthcare costs that outpace economic growth are a major driver of these deficits and threaten long-term economic stability and growth. Healthcare reform is needed to control costs and improve the sustainability of federal spending.

Oregon Economic and Revenue Forecast, September 2021

The Oregon Office of Economic Analysis forecasts the state's economy, General Fund, and Lottery Fund revenues. This slide presentation is part of the September 2021 forecast, released August 25th.

Healthcare Reform: Next Steps

Health care reform in the United States: Next Steps. Now that Republican legislative reform efforts have failed, what's next?

Ch9 updated

The document discusses the economic impacts and principles of taxation. It outlines three basic economic impacts of taxes: resource allocation, behavior adjustment, and impact on productivity and growth. It also discusses two principles of taxation: the benefit principle and ability-to-pay principle. Finally, it describes the three main types of taxes in the US: proportional, progressive, and regressive taxes.

Oregon Economic and Revenue Forecast, May 2021

The Oregon Office of Economic Analysis forecasts the state's economy, General Fund, and Lottery Fund revenues. This slide presentation is part of the May 2021 forecast, released May 19th.

Rich States, Poor States 2015 Edition

This document provides an executive summary of the 2015 edition of the report "Rich States, Poor States" by Arthur Laffer, Stephen Moore, and Jonathan Williams. The report analyzes state economic policies and provides the 2015 ALEC-Laffer State Economic Competitiveness Index, which ranks states based on past economic performance and future economic outlook. Some of the best practices identified for states include lowering taxes, reducing regulations, and controlling spending and debt. The report also discusses important state policy developments since the previous edition and warns against the pitfalls of "tax cronyism." Chapters analyze specific state policy issues and economic reforms in Kansas in more depth. The state rankings aim to identify which state policies have led to greater economic opportunity

The 2020 Budget and Economic Outlook

CBO estimates that the federal budget deficit in 2020 will be $1.0 trillion, or 4.6 percent of gross domestic product (GDP). It would increase to 5.4 percent of GDP in 2030 if current law did not change. In CBO’s projections, federal debt held by the public reaches $17.9 trillion at the end of 2020. That amount equals 81 percent of GDP—more than twice its average over the past 50 years. By 2030, debt is projected to reach $31.4 trillion, or 98 percent of GDP, a larger percentage than at any time since just after World War II. It would continue to grow after 2030, reaching 180 percent of GDP by 2050.

Inflation-adjusted GDP is projected to grow by 2.2 percent this year, largely because of continued strength in consumer spending and a rebound in business fixed investment. Output is projected to be higher than the economy’s maximum sustainable output in 2020 to a greater degree than it has been in recent years, leading to higher inflation and interest rates after a period in which both were low, on average. CBO projects that continued strength in the demand for labor will keep the unemployment rate low and drive employment and wages higher. Then over the coming decade, the economy is projected to expand at an average annual rate of 1.7 percent, roughly the same rate as its potential rate of growth.

Rich States, Poor States Rankings, 9th Edition

The 2016 state economic rankings for the ninth edition of Rich States, Poor States from the American Legislative Exchange Council (ALEC) track economic trends across the country.

For more information, visit alec.org

OpenSky Policy Institute - Funding Our Priorities 8.28.14

"Protecting Our Revenue Base - Fund Our Priorities" Presentation by Dylan Grundman, OpenSky Policy Institute, August 28, 2014

Avoiding Budget Gimmicks Chartbook 2015

Washington has some budget tricks to avoid making tough decisions. These gimmicks will add to the national debt and should be avoided.

The President's Fiscal Year 2016 Budget in Charts

The document summarizes projections from the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB) on revenues, spending, deficits, and debt under current law and the President's budget. It shows that:

- Revenues have averaged 17.4% of GDP over the past 50 years while spending has averaged 20.1%, leading to growing budget deficits and debt levels.

- Under current policies, debt is projected to continue rising to over 80% of GDP by 2025 according to CBO and OMB estimates.

- The President's budget proposes new initiatives, tax cuts, and health care and other reforms aimed at stabilizing the debt slightly below current levels through 2025

Chartbook: The President's FY 2016 Budget

The document summarizes projections from the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB) on revenues, spending, deficits, and debt under current law and the President's budget. It shows that:

- Revenues have averaged 17.4% of GDP over the past 50 years while spending has averaged 20.1%, leading to growing budget deficits and debt levels.

- Under current policies, debt is projected to continue rising to over 80% of GDP by 2025 according to CBO and OMB estimates.

- The President's budget proposes new initiatives, tax cuts, and health care and other reforms to reduce deficits by around $930 billion compared to a baseline that

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"Committee for a Responsible Federal Budget

The document discusses the history and future of "doc fixes" - legislative actions to prevent cuts to Medicare physician payments resulting from the Sustainable Growth Rate (SGR) formula. It notes that while the SGR failed to control costs, doc fixes have led to over $165 billion in deficit reduction through offsets. It describes the bipartisan "Tricommittee" reform package and proposes a "PREP Plan" to permanently replace SGR with value-based payments while fully offsetting costs through delivery system and beneficiary reforms estimated to save over $200 billion.More Related Content

What's hot

Exploring the Growth of Medicaid Managed Care

This document summarizes a Congressional Budget Office presentation on exploring the growth of Medicaid managed care. It finds that while Medicaid managed care enrollment has grown significantly, spending attributed to managed care has grown even more. It also finds variation between states in how they structure their managed care programs and which eligibility groups and services they cover through managed care. The presentation aims to improve understanding of whether managed care is the predominant delivery system and to inform expectations for its future growth.

There is a better way (9.18.2017)

IF Alaska needs to raise new government revenues, there is a much better way to do it than through PFD cuts or the other current proposals.

Oregon Economic and Revenue Forecast, September 2019

The Oregon Office of Economic Analysis forecasts the state economy and General Fund and Lottery Fund revenues. This slide presentation is a part of the September 2019 forecast (released August 28th).

Debt trajectory data hf

This is a PPT that I created for a discussion of the US Federal Budget, the Deficit, and the Debt. Many of the slides are public domain items for Heritage Foundation and Concord Coalition. It led to some very good non-partisan discussions. There is hope!

Infographic: The Federal Budget in 2013

The federal budget deficit grew during the 2008-2009 recession and remained larger in 2013 than in 2008, amounting to $680 billion or 4.1% of GDP. Federal spending was 20.8% of GDP in 2013, slightly above the 40-year average, while revenues were 16.7% of GDP. Large budget deficits in recent years substantially increased federal debt held by the public to 72% of GDP in 2013, the highest level in over 60 years, which could negatively impact long-term economic growth.

Progressive conservatives vs Liberal Government for Ontario

This presentation will look at 13+ years of governments led by Mike Harris (PC) as well as Liberals (Kathleen Wynne and Dalton McGuinty)

Ontario debt has double since 2003 and yet we have seen a deterioration in terms of the quality of services as well as the economy.

Progressive Conservatives vs Liberal Government for Ontario - April 2017

This presentation looks at government finances as well as other factors that are driving GDP growth in Ontario.

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

15th Annual Meeting of the Network on Fiscal Relations Across Levels of Government, OECD, 2-3 December 2019

Veh Web Pres V9 24 08

Vermonters for Economic Health (VEH) is a non-partisan organization that examines Vermont's economic health by looking at tax burdens, spending, job growth, and demographics. They find that Vermont has the highest tax burden in the country, spending is growing much faster than inflation while private sector jobs are declining, and the state is losing young people. VEH proposes growing the private sector through reducing obstacles to job growth, containing spending increases, and electing officials committed to improving Vermont's economic health.

Growing Healthcare Costsandthe Federal Debt

The document discusses growing healthcare costs and the federal debt. It notes that social security, Medicare and Medicaid currently make up 42% of the federal budget and are projected to continue increasing significantly. If current policies continue, large sustained deficits of over $14 trillion are projected by 2019. Rising healthcare costs that outpace economic growth are a major driver of these deficits and threaten long-term economic stability and growth. Healthcare reform is needed to control costs and improve the sustainability of federal spending.

Oregon Economic and Revenue Forecast, September 2021

The Oregon Office of Economic Analysis forecasts the state's economy, General Fund, and Lottery Fund revenues. This slide presentation is part of the September 2021 forecast, released August 25th.

Healthcare Reform: Next Steps

Health care reform in the United States: Next Steps. Now that Republican legislative reform efforts have failed, what's next?

Ch9 updated

The document discusses the economic impacts and principles of taxation. It outlines three basic economic impacts of taxes: resource allocation, behavior adjustment, and impact on productivity and growth. It also discusses two principles of taxation: the benefit principle and ability-to-pay principle. Finally, it describes the three main types of taxes in the US: proportional, progressive, and regressive taxes.

Oregon Economic and Revenue Forecast, May 2021

The Oregon Office of Economic Analysis forecasts the state's economy, General Fund, and Lottery Fund revenues. This slide presentation is part of the May 2021 forecast, released May 19th.

Rich States, Poor States 2015 Edition

This document provides an executive summary of the 2015 edition of the report "Rich States, Poor States" by Arthur Laffer, Stephen Moore, and Jonathan Williams. The report analyzes state economic policies and provides the 2015 ALEC-Laffer State Economic Competitiveness Index, which ranks states based on past economic performance and future economic outlook. Some of the best practices identified for states include lowering taxes, reducing regulations, and controlling spending and debt. The report also discusses important state policy developments since the previous edition and warns against the pitfalls of "tax cronyism." Chapters analyze specific state policy issues and economic reforms in Kansas in more depth. The state rankings aim to identify which state policies have led to greater economic opportunity

The 2020 Budget and Economic Outlook

CBO estimates that the federal budget deficit in 2020 will be $1.0 trillion, or 4.6 percent of gross domestic product (GDP). It would increase to 5.4 percent of GDP in 2030 if current law did not change. In CBO’s projections, federal debt held by the public reaches $17.9 trillion at the end of 2020. That amount equals 81 percent of GDP—more than twice its average over the past 50 years. By 2030, debt is projected to reach $31.4 trillion, or 98 percent of GDP, a larger percentage than at any time since just after World War II. It would continue to grow after 2030, reaching 180 percent of GDP by 2050.

Inflation-adjusted GDP is projected to grow by 2.2 percent this year, largely because of continued strength in consumer spending and a rebound in business fixed investment. Output is projected to be higher than the economy’s maximum sustainable output in 2020 to a greater degree than it has been in recent years, leading to higher inflation and interest rates after a period in which both were low, on average. CBO projects that continued strength in the demand for labor will keep the unemployment rate low and drive employment and wages higher. Then over the coming decade, the economy is projected to expand at an average annual rate of 1.7 percent, roughly the same rate as its potential rate of growth.

Rich States, Poor States Rankings, 9th Edition

The 2016 state economic rankings for the ninth edition of Rich States, Poor States from the American Legislative Exchange Council (ALEC) track economic trends across the country.

For more information, visit alec.org

OpenSky Policy Institute - Funding Our Priorities 8.28.14

"Protecting Our Revenue Base - Fund Our Priorities" Presentation by Dylan Grundman, OpenSky Policy Institute, August 28, 2014

What's hot (18)

Oregon Economic and Revenue Forecast, September 2019

Oregon Economic and Revenue Forecast, September 2019

Progressive conservatives vs Liberal Government for Ontario

Progressive conservatives vs Liberal Government for Ontario

Progressive Conservatives vs Liberal Government for Ontario - April 2017

Progressive Conservatives vs Liberal Government for Ontario - April 2017

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

Oregon Economic and Revenue Forecast, September 2021

Oregon Economic and Revenue Forecast, September 2021

OpenSky Policy Institute - Funding Our Priorities 8.28.14

OpenSky Policy Institute - Funding Our Priorities 8.28.14

Viewers also liked

Avoiding Budget Gimmicks Chartbook 2015

Washington has some budget tricks to avoid making tough decisions. These gimmicks will add to the national debt and should be avoided.

The President's Fiscal Year 2016 Budget in Charts

The document summarizes projections from the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB) on revenues, spending, deficits, and debt under current law and the President's budget. It shows that:

- Revenues have averaged 17.4% of GDP over the past 50 years while spending has averaged 20.1%, leading to growing budget deficits and debt levels.

- Under current policies, debt is projected to continue rising to over 80% of GDP by 2025 according to CBO and OMB estimates.

- The President's budget proposes new initiatives, tax cuts, and health care and other reforms aimed at stabilizing the debt slightly below current levels through 2025

Chartbook: The President's FY 2016 Budget

The document summarizes projections from the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB) on revenues, spending, deficits, and debt under current law and the President's budget. It shows that:

- Revenues have averaged 17.4% of GDP over the past 50 years while spending has averaged 20.1%, leading to growing budget deficits and debt levels.

- Under current policies, debt is projected to continue rising to over 80% of GDP by 2025 according to CBO and OMB estimates.

- The President's budget proposes new initiatives, tax cuts, and health care and other reforms to reduce deficits by around $930 billion compared to a baseline that

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"Committee for a Responsible Federal Budget

The document discusses the history and future of "doc fixes" - legislative actions to prevent cuts to Medicare physician payments resulting from the Sustainable Growth Rate (SGR) formula. It notes that while the SGR failed to control costs, doc fixes have led to over $165 billion in deficit reduction through offsets. It describes the bipartisan "Tricommittee" reform package and proposes a "PREP Plan" to permanently replace SGR with value-based payments while fully offsetting costs through delivery system and beneficiary reforms estimated to save over $200 billion.The President's FY 2017 Budget in Charts

The CBO January baseline report projects that trillion-dollar deficits will return and the national debt will continue rising rapidly as a percentage of GDP. The president's FY2017 budget aims to stabilize the debt ratio by proposing $3.2 trillion in tax increases and $445 billion in health care savings to pay for $1.25 trillion in new spending initiatives and sequester relief. However, the budget would still leave debt levels at post-WWII record highs without putting debt on a clear downward path or sufficiently addressing entitlement reforms.

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 ElectionCommittee for a Responsible Federal Budget

Slides from June 30, 2016 Committee for a Responsible Federal Budget webinar on the June 2016 paper "Promises and Price Tags: A Fiscal Guide to the 2016 Election." Watch the video at http://www.crfb.org/events/watch-promises-and-price-tags-fiscal-guide-2016-election.Chartbook - Promises and Price Tags

This document from the Committee for a Responsible Federal Budget (CRFB) analyzes and compares the fiscal impact of tax and spending proposals from Hillary Clinton and Donald Trump. It finds that under current policies, debt is projected to rise to 127% of GDP by 2026. Clinton's proposals could increase debt to between 87-140% of GDP, while Trump's could increase debt to between 90-150% of GDP. To stabilize or reduce debt levels, the candidates' plans would require substantial tax increases, spending cuts, or higher than projected economic growth.

Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Chartbook: Affordable Care Act "Repeal & Replace" Effects & ImplicationsCommittee for a Responsible Federal Budget

This document summarizes key information about health care spending and coverage in the United States. It shows that most health spending goes to hospital care, physician services, and prescription drugs. It is financed through private insurance, Medicare, Medicaid and other payers. The US spends a higher percentage of GDP on health care than other countries. The Affordable Care Act expanded coverage through reforms like the individual mandate, Medicaid expansion and subsidies. Repealing the ACA could increase the number of uninsured by over 20 million and add $150-1.75 trillion to the federal deficit over 10 years. Partial repeal options could also have significant costs depending on the specific provisions changed or delayed.Viewers also liked (8)

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Similar to Tax Day Charts 2015

Explaining the U.S. Tax System in Charts

Individual income, payroll, and corporate income taxes cover about two-thirds of US government spending, with the remaining one-third financed by borrowing. In 2014, around 15% of government spending was expected to be financed through deficits. Tax expenditures, such as deductions, credits, and exclusions, have grown over time and now cost almost as much as total income tax revenue. Many tax expenditures function similarly to government spending programs.

Tax Day Charts 2017

Individual income and payroll taxes cover over two-thirds of the U.S. government's spending, but deficits will finance about one-seventh of spending in 2017. The top 20% of households pay almost 70% of federal taxes, with the top 1% paying one quarter. While the U.S. has high statutory corporate tax rates, many businesses pay less thanks to tax expenditures and deductions, resulting in dramatically different effective tax burdens across industries.

Economic Health Presentation

The document discusses Vermont's fiscal challenges, including high taxes, growing spending outpacing revenue growth, stagnant private sector job growth, and an aging population. It argues Vermont needs to prioritize economic growth through private sector job creation to broaden its tax base, contain spending increases, and address its large unfunded liabilities to improve its long-term fiscal health.

Chartbook_From_Riches_to_Rags_Causes_of_Fiscal_Deterioration_Since_2001.pptx

Chartbook that accompanies recent analysis "From Riches to Rags: Causes of Fiscal Deterioration Since 2001"

Averting a Fiscal Crisis

The non-partisan Committee for a Responsible Federal Budget (CRFB) has compiled a brief background on the scope of our nation's fiscal challenges and the drivers of our debt and deficits, while outlining some of the types of solutions available to address the problems. This Powerpoint is meant to offer an objective, easily-accessible view of our country's fiscal situation as an educational tool meant to help foster open and honest discussion about these issues.

The 2016 Long-Term Budget Outlook: An Infographic

This infographic provides an overview of CBO's report, The 2016 Long-Term Budget Outlook. Gain quick insight into why CBO projects a substantial imbalance in the federal budget beyond the next 10 years.

Growing Healthcare Costs and the Federal Debt

Diane Lim Rogers, Chief Economist

Sara Imhof , Midwest Regional Director

The Concord Coalition www.concordcoalition.org

Ralph martire slide show 4 14-11

The document summarizes Illinois' fiscal crisis and the tax increases passed in 2011 to address a large budget deficit. It describes how Illinois had structural deficits due to over-reliance on property taxes and underfunding of services. The tax increases generated $7.3 billion annually but deficits remained over $1 billion due to inadequate revenues and increasing costs of education, healthcare, and human services. Further reforms are needed to generate additional revenue in a fair manner.

Ralph martire slide show 4 14-11

The document summarizes Illinois' fiscal crisis and the tax increases passed in 2011 to address a large budget deficit. It describes how Illinois has historically relied too heavily on property taxes and lacked a fair tax system. The tax increases were expected to generate $7.3 billion annually but deficits remain due to inadequate revenues and increasing costs for education, healthcare, and human services. Further reforms and revenue options are needed to structurally address Illinois' budget problems.

CBC's NYC and NYS Budget Briefings

The document provides an overview of budget calendars and economic indicators for New York State and New York City. It summarizes the composition of revenues and expenditures for New York State and New York City budgets. It also highlights areas of increasing spending such as Medicaid, education, economic development incentives, and capital projects while noting concerns over the long-term fiscal impacts and questionable priorities for settlement funds.

Rising Debt: Sinking our Future?

Presenation by Sara Imhof, Midwest Regional Director, as presented at "Rising Debt: Sinking our Future" Conference at SIUC, October 18, 2010

Our National Fiscal Challenge

The document discusses the growing fiscal challenges facing the United States government at the federal, state, and local levels. It notes that mandatory spending programs like Social Security, Medicare, and Medicaid are taking up an increasing share of the federal budget. It also highlights that total government debt in the US is higher than some financially troubled European countries. The document concludes by outlining steps that could be taken to address these fiscal issues, including entitlement and tax reforms, reducing healthcare costs, and reforming state and local pension systems.

poster9B

This document proposes a new tax model with a single flat tax rate for all income levels, limited deductions, and taxable government transfers. It summarizes the current US tax system and compares the proposed model to flat and progressive systems. The proposed model aims to eliminate poverty through government assistance while maintaining a strong economy and middle class through tax deductions and subsidies to different groups.

sl

The document discusses the federal budget and return of budget deficits in the United States. It notes that the federal budget deficit grew significantly from large surpluses in 2001 to large deficits in 2007 due to tax cuts, defense spending, and entitlement programs. The long-term fiscal outlook is challenging due to rising healthcare costs, aging of the population, and tax cuts. Reform of the US healthcare system is needed to control costs and address the growing budget imbalance.

The Great Rightward Shift: How Conservatism Shifted the Money to the 1%

The document discusses how conservative economic policies since 1980 have contributed to increasing income and wealth inequality in the United States. It notes that the top 1% now receive over 20% of income, versus 10% pre-1980, and own 42% of wealth compared to 24% in the mid-1970s. Conservative policies such as tax cuts that disproportionately benefit the wealthy 1% and weakening of unions have shifted more of the economic gains to the top earners over the past several decades. The rise of conservative media has also encouraged working-class voters to support policies that are not in their own economic interests.

CRFB webinar - Where Does the Next Phase of COVID Relief Stand - July 31, 2020

Lawmakers on Capitol Hill have been negotiating over a new package of economic and public health support to combat COVID-19. Congress has already enacted $3.7 trillion of spending, tax cuts and deferrals, loans, and other fiscal aid, but some of this support is now expiring, particularly expanded unemployment benefits.

On July 31st, Committee for a Responsible Federal Budget senior vice president Marc Goldwein presented a webinar titled "Where Does the Next Phase of COVID Relief Stand?" This slide deck was made to accompany that webinar.

Federal budget slide show civic club version

This document discusses myths and realities about the US federal budget and deficits. It contends that tax policies rather than spending have mainly driven deficits since 1981. While spending cuts could help, the largest expenditure - wars and the military - is often treated as untouchable. It also argues that solving budget problems requires addressing growing inequality in wealth and political power between the richest 10% and everyone else. Specific myths debunked include claims that Social Security and Medicare contribute to deficits, and that tax cuts for the wealthy encourage job creation. Charts show how spending has changed under Democratic and Republican presidents.

Senator Harmon Budget Presentation

This document summarizes Senator Don Harmon's presentation to the Business and Civic Council of Oak Park on June 26, 2015. It discusses the state of Illinois' budget process and challenges, including Governor Rauner's proposed budget cuts and the resulting impacts. It also outlines Democratic proposals for alternative budget and reforms, including investing in education, human services, and a middle class agenda. Potential areas of compromise are identified. Background on pension reforms and Illinois' economic strengths are also provided.

2010 12-02incometaxchartbook-101202080453-phpapp01

The director testified about trends in federal tax revenues and rates. Key points include:

- Revenues have averaged 18% of GDP over the past 40 years, ranging from 15-21%. Individual income and payroll taxes make up most revenues.

- Marginal tax rates have declined since the 1950s-1980s but remain higher for higher incomes. Tax expenditures subsidize activities like homeownership and health insurance.

- Taxes are progressive on average but top earners now earn over half of income and pay nearly 70% of taxes, up from 1979 levels. Lower tax rates can boost work and saving but also increase deficits long-term.

What Are Taxes And Best Benefits of File Taxes Each Year? 2023 | CIO Women Ma...

While we primarily consider them once a year during tax season, we deal with them often throughout the year. In addition to the benefits of file taxes on our income, we also have to pay taxes on the things we buy and the property we own. Total annual expenditures in the United States for these things add up to billions of dollars and include everything from Social Security and the military to garbage collection and park maintenance.

Similar to Tax Day Charts 2015 (20)

Chartbook_From_Riches_to_Rags_Causes_of_Fiscal_Deterioration_Since_2001.pptx

Chartbook_From_Riches_to_Rags_Causes_of_Fiscal_Deterioration_Since_2001.pptx

The Great Rightward Shift: How Conservatism Shifted the Money to the 1%

The Great Rightward Shift: How Conservatism Shifted the Money to the 1%

CRFB webinar - Where Does the Next Phase of COVID Relief Stand - July 31, 2020

CRFB webinar - Where Does the Next Phase of COVID Relief Stand - July 31, 2020

2010 12-02incometaxchartbook-101202080453-phpapp01

2010 12-02incometaxchartbook-101202080453-phpapp01

What Are Taxes And Best Benefits of File Taxes Each Year? 2023 | CIO Women Ma...

What Are Taxes And Best Benefits of File Taxes Each Year? 2023 | CIO Women Ma...

More from Committee for a Responsible Federal Budget

What's in the Latest COVID Relief Act?

The Committee for a Responsible Federal Budget gave an overview of the latest COVID relief deal and how much it will boost incomes and economic growth, and discussed the proposal for $2,000 checks.

The Cost of the Trump and Biden Campaign Plans

The Committee for a Responsible Federal Budget published the only existing comprehensive study to detail and compare the fiscal cost of President Donald Trump and Vice President Joe Biden's campaign agendas. We estimate that both candidates would add trillions to the debt – but in very different ways.

What's the Long-Term Budget Outlook

The Congressional Budget Office (CBO) released two new outlooks in september that highlight our nation's unsustainable budget trajectory over the next decade and beyond. From the federal debt reaching almost double the size of the economy by 2050, to deficits higher than in any point in modern history, CBO's report shows that our nation's fiscal outlook is much worse than estimated last year.

Who is Buying Our New COVID-19 Debt?

Slide deck from a May 11, 2020 webinar on who is buying the federal debt resulting from the COVID-19 economic relief efforts. Watch the video of the webinar at http://www.crfb.org/events/6-trillion-dollar-question-who-will-buy-our-debts.

Promoting Economic Growth through Social Security Reform

The document discusses how population aging is contributing to slower economic growth and rising government debt in the United States. It presents a framework for Social Security reform that could increase economic growth by promoting delayed retirement, rewarding work at all ages, increasing savings, and improving the sustainability of Social Security. Key aspects of the framework include raising the retirement age while protecting vulnerable workers, basing benefits on all years of earnings rather than average lifetime earnings, and automatically enrolling workers in supplemental retirement accounts. The reform aims to boost labor supply, savings, and long-term economic growth while restoring solvency to Social Security.

Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetCommittee for a Responsible Federal Budget

This document discusses federal budget priorities and spending on children. It finds that while children represent the future and economic growth, they receive a relatively small portion of federal spending. Spending on children has declined as a share of the budget since 2010 and is projected to continue declining. It is more temporary, discretionary and lacks built-in growth compared to spending on older populations. The long-term outlook for children is especially troubling as interest on the debt is projected to surpass spending on children. Some potential solutions proposed include accounting for children more in budget projections, prioritizing children through new committees or positions, and improving policies around children's health care and dedicated revenue sources.April budget outlook

The document summarizes key findings from the Congressional Budget Office's April 2018 baseline report. It finds that trillion dollar deficits will return by 2020 under current policies, driven by recent tax cuts and spending increases. The growing costs of major health and retirement programs, along with rising interest costs on the debt, will cause debt levels to exceed the 50-year historical average as a share of the economy. Trillion dollar annual deficit reduction would be needed to balance the budget by 2028 or stabilize debt levels.

Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Playing By the (Budget) Rules: Understanding and Preventing Budget GimmicksCommittee for a Responsible Federal Budget

The document discusses various budget gimmicks that allow Congress to circumvent budget rules and create the appearance of fiscal discipline while not actually reducing deficits. It identifies 20 specific gimmicks and categorizes them into assumption gimmicks, manipulating the budget window, discretionary spending gimmicks, and other gimmicks. Examples are provided for many of the gimmicks. The overall document aims to educate about how budget rules are worked around and define technical terms.America's Budget Outlook

The document summarizes a report from the Congressional Budget Office (CBO) that finds trillion dollar deficits will return by 2020 under current law. It notes that recent tax cuts and spending increases have increased the projected deficits substantially. The growing costs of Social Security, healthcare programs, and interest on the debt will be the main drivers of spending increases and higher deficits over the long run according to the CBO projections.

America's Deteriorating Budget Outlook

The document discusses projections from the Congressional Budget Office (CBO) regarding rising US budget deficits and debt levels. It notes that deficits were projected to exceed $1 trillion per year by 2022 under prior law and have increased further due to recent tax and spending legislation. If current policies are extended indefinitely, deficits could reach $2.4 trillion by 2028 and debt could exceed 113% of GDP, posing fiscal and economic risks. Higher interest rates could also significantly increase interest costs and debt levels.

Everything You Should Know About Government Shutdowns

A primer with answers to all your questions about a federal government shutdown. Such as, What services are affected in a shutdown and how?, How would federal employees be affected?, Does a government shutdown save money?, and more.

Appropriations 101

Answers to your questions about the appropriations process of the federal government, which determines annual government spending.

Marc Goldwein: The Return of Trillion Dollar Deficits

The document discusses the state of the US budget and debt prior to and under the Trump administration. The key points are:

- When Trump took office, debt was at a post-WWII high of over 100% of GDP and projected to rise sharply due to tax cuts, spending increases, and entitlement growth.

- Major trust funds were projected to become insolvent in the early-to-mid 2020s, requiring cuts up to 30% to benefits.

- Tax cuts, spending increases, and making temporary policies permanent could lead to trillion dollar annual deficits by 2027 and debt exceeding 108% of GDP.

- Entitlement growth and rising interest costs will exacerbate long-term debt problems if reforms are

Dynamic Scoring and Tax Reform

This document discusses dynamic scoring and tax reform. It makes three key points:

1) Tax cuts do not pay for themselves through economic growth and increased revenue. Reasonable estimates show that tax cuts generate far less than $1 in revenue for every $1 cut.

2) Smart tax reform has the potential to generate $300-400 billion in additional revenue through dynamic effects, but debt-financed tax cuts have smaller growth effects because debt discourages investment and slows long-term growth.

3) Models that estimate the largest growth effects from tax cuts generally ignore the economic costs of increased debt, instead assuming future tax increases or spending cuts will stabilize debt levels. When debt impacts are considered, revenue-neutral

President Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

President Trump's Fy 2018 "Skinny Budget" and the American Health Care ActCommittee for a Responsible Federal Budget

Presentation with charts on the fiscal year 2018 budget proposal from President Donald Trump and the American Health Care Act to replace ObamacarePromises and Price Tags: A Fiscal Guide to the 2016 Election

Promises and Price Tags: A Fiscal Guide to the 2016 ElectionCommittee for a Responsible Federal Budget

A comprehensive fiscal analysis of the policies put forward by presidential candidates Donald Trump and Hillary Clinton. It shows how each would affect the federal budget and national debt. See more at http://crfb.org/.Strengthening the Budget Resolution

Ideas for improving the congressional budget resolution from The Better Budget Process Initiative of the Committee for a Responsible Federal Budget.

Committee for a Responsible Federal Budget 2015 Annual Report

Committee for a Responsible Federal Budget 2015 Annual ReportCommittee for a Responsible Federal Budget

The Committee for a Responsible Federal Budget (CRFB) 2015 annual report summarizes the organization's work over the past year to promote fiscal responsibility. Some key highlights include: welcoming new leadership; providing bipartisan budget solutions to Congress; increasing media mentions as a trusted source of budget analysis; producing extensive research reports; and engaging in fact-checking during the 2016 presidential campaign to ensure candidates addressed fiscal challenges. The CRFB leveraged respected research and outreach to lawmakers to impact budget policy debates and help move the country toward a more fiscally sustainable path.Interest Rates and the Debt

Interest payments on the national debt will be the fastest growing part of the federal budget. Learn more about the relationship between interest rates and debt.

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 CampaignCommittee for a Responsible Federal Budget

The next President will need to confront a number of budgetary challenges and will likely sign into law many federal tax and spending changes. Yet too often, election campaigns are about telling voters what they want to hear rather than what they need to know. To separate fiction from reality, the new Fiscal FactChecker series will monitor the 2016 Presidential campaign on an ongoing basis. To start with, we have identified 16 myths that may come up during the campaign.

More from Committee for a Responsible Federal Budget (20)

Promoting Economic Growth through Social Security Reform

Promoting Economic Growth through Social Security Reform

Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal Budget

Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Everything You Should Know About Government Shutdowns

Everything You Should Know About Government Shutdowns

Marc Goldwein: The Return of Trillion Dollar Deficits

Marc Goldwein: The Return of Trillion Dollar Deficits

President Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

President Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

Promises and Price Tags: A Fiscal Guide to the 2016 Election

Promises and Price Tags: A Fiscal Guide to the 2016 Election

Committee for a Responsible Federal Budget 2015 Annual Report

Committee for a Responsible Federal Budget 2015 Annual Report

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Recently uploaded

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...AntoniaOwensDetwiler

"Does Foreign Direct Investment Negatively Affect Preservation of Culture in the Global South? Case Studies in Thailand and Cambodia."

Do elements of globalization, such as Foreign Direct Investment (FDI), negatively affect the ability of countries in the Global South to preserve their culture? This research aims to answer this question by employing a cross-sectional comparative case study analysis utilizing methods of difference. Thailand and Cambodia are compared as they are in the same region and have a similar culture. The metric of difference between Thailand and Cambodia is their ability to preserve their culture. This ability is operationalized by their respective attitudes towards FDI; Thailand imposes stringent regulations and limitations on FDI while Cambodia does not hesitate to accept most FDI and imposes fewer limitations. The evidence from this study suggests that FDI from globally influential countries with high gross domestic products (GDPs) (e.g. China, U.S.) challenges the ability of countries with lower GDPs (e.g. Cambodia) to protect their culture. Furthermore, the ability, or lack thereof, of the receiving countries to protect their culture is amplified by the existence and implementation of restrictive FDI policies imposed by their governments.

My study abroad in Bali, Indonesia, inspired this research topic as I noticed how globalization is changing the culture of its people. I learned their language and way of life which helped me understand the beauty and importance of cultural preservation. I believe we could all benefit from learning new perspectives as they could help us ideate solutions to contemporary issues and empathize with others.RMIT University degree offer diploma Transcript

澳洲RMIT毕业证书制作RMIT假文凭定制Q微168899991做RMIT留信网教留服认证海牙认证改RMIT成绩单GPA做RMIT假学位证假文凭高仿毕业证申请墨尔本皇家理工大学RMIT University degree offer diploma Transcript

Discover the Future of Dogecoin with Our Comprehensive Guidance

Learn in-depth about Dogecoin's trajectory and stay informed with 36crypto's essential and up-to-date information about the crypto space.

Our presentation delves into Dogecoin's potential future, exploring whether it's destined to skyrocket to the moon or face a downward spiral. In addition, it highlights invaluable insights. Don't miss out on this opportunity to enhance your crypto understanding!

https://36crypto.com/the-future-of-dogecoin-how-high-can-this-cryptocurrency-reach/

Unlock-the-Power-of-UAN-Your-Key-to-Secure-Retirement.pptx

The Universal Account Number (UAN) by EPFO centralizes multiple PF accounts, simplifying management for Indian employees. It streamlines PF transfers, withdrawals, and KYC updates, providing transparency and reducing employer dependency. Despite challenges like digital literacy and internet access, UAN is vital for financial empowerment and efficient provident fund management in today's digital age.

1比1复刻(ksu毕业证书)美国堪萨斯州立大学毕业证本科文凭证书原版一模一样

原版定制【微信:bwp0011】《(ksu毕业证书)美国堪萨斯州立大学毕业证本科文凭证书》【微信:bwp0011】成绩单 、雅思、外壳、留信学历认证永久存档查询,采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信bwp0011】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信bwp0011】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

【关于价格问题(保证一手价格)】

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

Ending stagnation: How to boost prosperity across Scotland

A toxic combination of 15 years of low growth, and four decades of high inequality, has left Britain poorer and falling behind its peers. Productivity growth is weak and public investment is low, while wages today are no higher than they were before the financial crisis. Britain needs a new economic strategy to lift itself out of stagnation.

Scotland is in many ways a microcosm of this challenge. It has become a hub for creative industries, is home to several world-class universities and a thriving community of businesses – strengths that need to be harness and leveraged. But it also has high levels of deprivation, with homelessness reaching a record high and nearly half a million people living in very deep poverty last year. Scotland won’t be truly thriving unless it finds ways to ensure that all its inhabitants benefit from growth and investment. This is the central challenge facing policy makers both in Holyrood and Westminster.

What should a new national economic strategy for Scotland include? What would the pursuit of stronger economic growth mean for local, national and UK-wide policy makers? How will economic change affect the jobs we do, the places we live and the businesses we work for? And what are the prospects for cities like Glasgow, and nations like Scotland, in rising to these challenges?

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.

1:1制作加拿大麦吉尔大学毕业证硕士学历证书原版一模一样

原版一模一样【微信:741003700 】【加拿大麦吉尔大学毕业证硕士学历证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

在线办理(TAMU毕业证书)美国德州农工大学毕业证PDF成绩单一模一样

学校原件一模一样【微信:741003700 】《(TAMU毕业证书)美国德州农工大学毕业证PDF成绩单》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting, 8th Canadian Edition by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Ebook Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Pdf Solution Manual For Financial Accounting 8th Canadian Edition Pdf Download Stuvia Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Financial Accounting 8th Canadian Edition Ebook Download Stuvia Financial Accounting 8th Canadian Edition Pdf Financial Accounting 8th Canadian Edition Pdf Download Stuvia

一比一原版(RMIT毕业证)皇家墨尔本理工大学毕业证如何办理

RMIT硕士学位证成绩单【微信95270640】《皇家墨尔本理工大学毕业证书》《QQ微信95270640》学位证书电子版:在线制作皇家墨尔本理工大学毕业证成绩单GPA修改(制作RMIT毕业证成绩单RMIT文凭证书样本)、皇家墨尔本理工大学毕业证书与成绩单样本图片、《RMIT学历证书学位证书》、皇家墨尔本理工大学毕业证案例毕业证书制作軟體、在线制作加拿大硕士学历证书真实可查.

【本科硕士】皇家墨尔本理工大学皇家墨尔本理工大学本科学位证成绩单(GPA修改);学历认证(教育部认证);大学Offer录取通知书留信认证使馆认证;雅思语言证书等高仿类证书。

办理流程:

1客户提供办理皇家墨尔本理工大学皇家墨尔本理工大学本科学位证成绩单信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

真实网上可查的证明材料

1教育部学历学位认证留服官网真实存档可查永久存档。

2留学回国人员证明(使馆认证)使馆网站真实存档可查。

我们对海外大学及学院的毕业证成绩单所使用的材料尺寸大小防伪结构(包括:皇家墨尔本理工大学皇家墨尔本理工大学本科学位证成绩单隐形水印阴影底纹钢印LOGO烫金烫银LOGO烫金烫银复合重叠。文字图案浮雕激光镭射紫外荧光温感复印防伪)都有原版本文凭对照。质量得到了广大海外客户群体的认可同时和海外学校留学中介做到与时俱进及时掌握各大院校的(毕业证成绩单资格证结业证录取通知书在读证明等相关材料)的版本更新信息能够在第一时间掌握最新的海外学历文凭的样版尺寸大小纸张材质防伪技术等等并在第一时间收集到原版实物以求达到客户的需求。

本公司还可以按照客户原版印刷制作且能够达到客户理想的要求。有需要办理证件的客户请联系我们在线客服中心微信:95270640 或咨询在线父亲的家很狭小除了一张单人床和一张小方桌几乎没有多余的空间山娃一下子就联想起学校的男小便处山娃很想笑却怎么也笑不出来山娃很迷惑父亲的家除了一扇小铁门连窗户也没有墓穴一般阴森森有些骇人父亲的城也便成了山娃的城父亲的家也便成了山娃的家父亲让山娃呆在屋里做作业看电视最多只能在门口透透气不能跟陌生人搭腔更不能乱跑一怕迷路二怕拐子拐人山娃很惊惧去年村里的田鸡就因为跟父亲进城一不小心被人拐跑了至今不见踪影害不

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Governor Olli Rehn

Bank of Finland

Press conference on the outlook for the Finnish economy

Helsinki, 11 June 2024

快速制作美国迈阿密大学牛津分校毕业证文凭证书英文原版一模一样

原版一模一样【微信:741003700 】【美国迈阿密大学牛津分校毕业证文凭证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Using Online job postings and survey data to understand labour market trends

Using Online job postings and survey data to understand labour market trendsLabour Market Information Council | Conseil de l’information sur le marché du travail

[4:55 p.m.] Bryan Oates

OJPs are becoming a critical resource for policy-makers and researchers who study the labour market. LMIC continues to work with Vicinity Jobs’ data on OJPs, which can be explored in our Canadian Job Trends Dashboard. Valuable insights have been gained through our analysis of OJP data, including LMIC research lead

Suzanne Spiteri’s recent report on improving the quality and accessibility of job postings to reduce employment barriers for neurodivergent people.

Decoding job postings: Improving accessibility for neurodivergent job seekers

Improving the quality and accessibility of job postings is one way to reduce employment barriers for neurodivergent people.Unlock Your Potential with NCVT MIS.pptx

The NCVT MIS Certificate, issued by the National Council for Vocational Training (NCVT), is a crucial credential for skill development in India. Recognized nationwide, it verifies vocational training across diverse trades, enhancing employment prospects, standardizing training quality, and promoting self-employment. This certification is integral to India's growing labor force, fostering skill development and economic growth.

New Visa Rules for Tourists and Students in Thailand | Amit Kakkar Easy Visa

Discover essential details about Thailand's recent visa policy changes, tailored for tourists and students. Amit Kakkar Easy Visa provides a comprehensive overview of new requirements, application processes, and tips to ensure a smooth transition for all travelers.

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

How will new technology fields affect economic trade?

Enhancing Asset Quality: Strategies for Financial Institutions

Ensuring robust asset quality is not just a mere aspect but a critical cornerstone for the stability and success of financial institutions worldwide. It serves as the bedrock upon which profitability is built and investor confidence is sustained. Therefore, in this presentation, we delve into a comprehensive exploration of strategies that can aid financial institutions in achieving and maintaining superior asset quality.

Recently uploaded (20)

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Discover the Future of Dogecoin with Our Comprehensive Guidance

Discover the Future of Dogecoin with Our Comprehensive Guidance

Unlock-the-Power-of-UAN-Your-Key-to-Secure-Retirement.pptx

Unlock-the-Power-of-UAN-Your-Key-to-Secure-Retirement.pptx

Ending stagnation: How to boost prosperity across Scotland

Ending stagnation: How to boost prosperity across Scotland

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Using Online job postings and survey data to understand labour market trends

Using Online job postings and survey data to understand labour market trends

New Visa Rules for Tourists and Students in Thailand | Amit Kakkar Easy Visa

New Visa Rules for Tourists and Students in Thailand | Amit Kakkar Easy Visa

Applying the Global Internal Audit Standards_AIS.pdf

Applying the Global Internal Audit Standards_AIS.pdf

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

Enhancing Asset Quality: Strategies for Financial Institutions

Enhancing Asset Quality: Strategies for Financial Institutions

Tax Day Charts 2015

- 1. Individual income and payroll taxes cover over two- thirds of government spending. In 2015, one-eighth of the government’s spending will be financed by deficits. Where Does The Federal Government’s Money Come From? Source: Congressional Budget Office, March 2015 budget projections. Deficit $486 Individual Income $1,506 Payroll $1,056 Corporate Income $328 Other $302 Billions

- 2. Income Tax Rates 0% 5% 10% 15% 20% 25% 30% 35% 40% 0 $50k $100k $150k $200k $250k $300k $350k $400k $450k $500k Gross Income Marginal Rate Average Rate (Tax rates in 2014 for a married couple filing jointly)

- 3. Who Pays Federal Taxes? Source: Congressional Budget Office, “The Distribution of Household Income and Federal Taxes, 2011.” Bottom 20% 0.6% Second 20% 4% Middle 20% 9% Fourth 20% 18% 81st to 99th Percentiles 45% Top 1% 24% The top 20% of households pay almost 70% of the nation’s taxes. The top 1% is responsible for paying nearly a quarter. (Percentage of all federal taxes paid, by household income)

- 4. 10% 12% 14% 16% 18% 20% 22% 24% 26% 1990 1995 2000 2005 2010 2015 2020 2025 Revenues Don’t Cover Spending Source: Congressional Budget Office, March 2015 budget projections. Percent of the economy (GDP) Actual Projected 20.2%SPENDING AVERAGE 17.2%REVENUES AVERAGE Deficit

- 5. $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018 Tax Breaks Have Grown Over Time Actual Projected Source: U.S. Department of the Treasury, compiled by the National Priorities Project. Inflation-adjusted dollars Tax Reform Act of 1986 There is now twice as much money in “tax expenditures” – deductions, credits, and other tax breaks – as there was after Congress last overhauled the tax code in 1986.

- 6. Source: Congressional Budget Office, Joint Committee on Taxation Tax Expenditures: Another Kind of Spending Tax Expenditures aren’t part of the budget that Congress passes every year, but are similar to government spending programs. Think about it: $1,000 given out in Pell grants and $1,000 given out through education tax credits will both give $1,000 to students. If they were counted as a normal part of the budget, tax expenditures would be over a quarter of spending. Tax Expenditures 26% Social Security 18% Health Care 19% Defense 13% Non-Defense Discretionary 12% Interest 5% Other, 7%

- 7. High Earners Benefit Most From Tax Expenditures Most tax expenditures are regressive and provide a bigger benefit to the wealthy. The top 20% receives 50% of the benefit from the largest tax expenditures. Percent of “major” tax expenditures received 0% 10% 20% 30% 40% 50% 60% Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Highest Quintile Top 1% Source: Congressional Budget Office, “The Distribution of Major Tax Expenditures in the Individual Income Tax System.” Note: Graph shows ten “major” income tax expenditures as identified by Congressional Budget Office, which make up two-thirds of total tax expenditures by dollar amount.

- 8. Tax Expenditures Rival Spending Programs in Size *Spending represented by HUD Budget. Source: Office of Management and Budget, President’s Budget FY 2016; Joint Committee on Taxation **Spending represented by Pell Grants. Source: Joint Committee on Taxation *** Refundable credits include EITC and Child Tax Credit. Spending includes SSI,TANF, and Foster Care Assistance. Source: HHS, SSA $0 $20 $40 $60 $80 $100 $120 $140 Housing* Education** Income Support*** Tax Expenditures Program Spending Billions, FY2014

- 9. U.S. Has World’s Highest Corporate Tax Rate, but Only Average Collection The official U.S. corporate tax rate is the highest in the developed world, but the average rate paid after deductions and credits is more typical. Source: U.S. Department of the Treasury, “The President’s Framework for Business Tax Reform.” Data from Fiscal Year 2011. 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% United States UK Italy Canada Germany France MarginalCorporateTaxRate Statutory Rate Effective Rate

- 10. The Tax Reform Act of 2014 would have increased the size of the economy by between 0.1 percent and 1.6 percent by 2023. Tax Reform Promotes Economic Growth 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% MEG Model, Low Change In Employment MEG Model, High Change In Employment OLG Model Low Estimate High Estimate Source: Joint Committee on Taxation

- 11. Where Tax Dollars Went In 2014 Share of Each $100 Paid in Taxes Social Security $24.11 Health $23.72 Medicare $14.42 Medicaid $8.60 Other Health $0.69 Defense and Military Benefits $21.49 Interest $6.54 Civilian Federal Retirement $2.86 Transportation $2.62 Refundable Credits $2.45 Food Stamps $2.18 Education $1.84 Supplemental Security Income $1.54 Justice $1.44 Housing Assistance $1.36 Unemployment Insurance $1.26 Natural Resource Protection $1.03 Foreign Aid $1.00 Agriculture $0.70 Other $3.87 Total $100