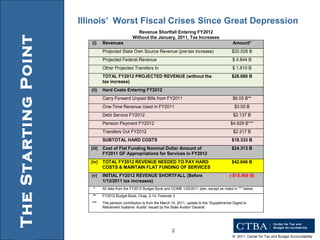

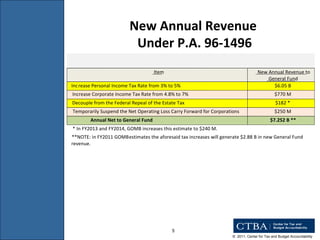

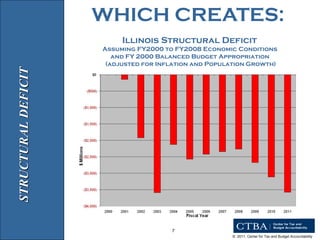

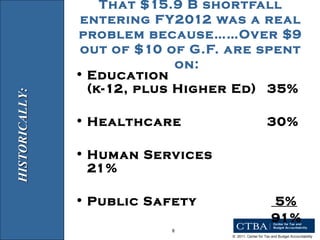

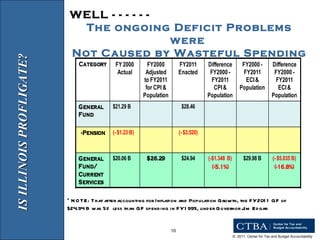

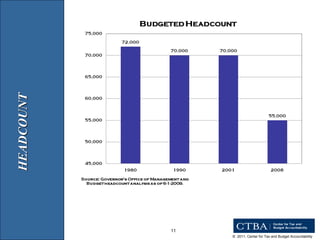

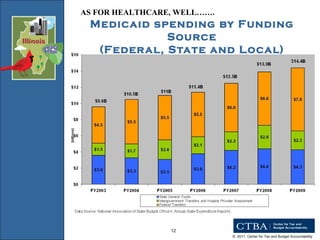

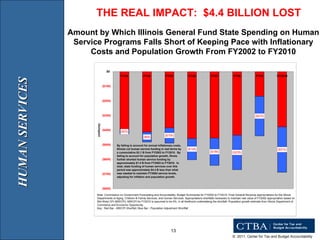

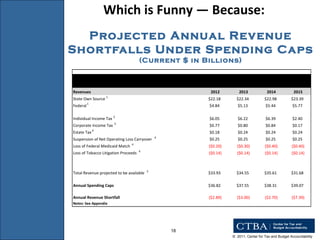

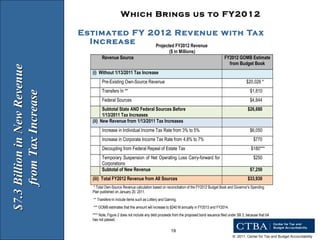

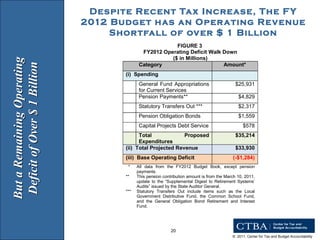

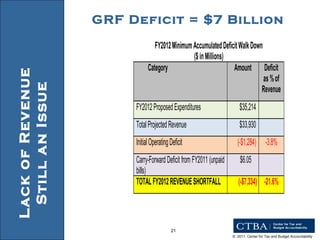

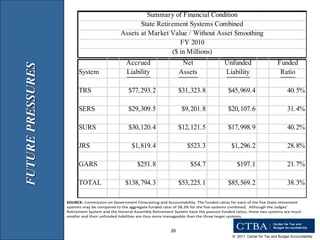

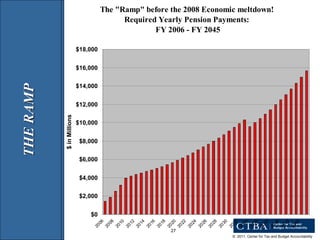

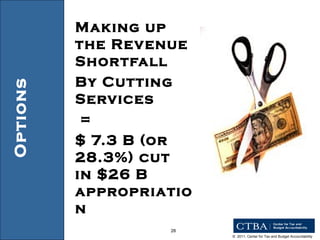

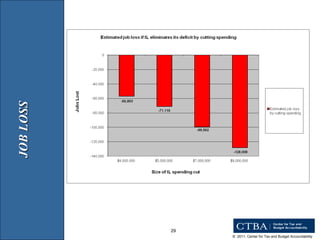

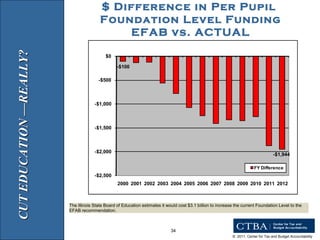

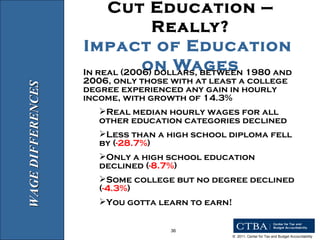

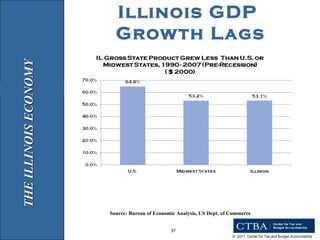

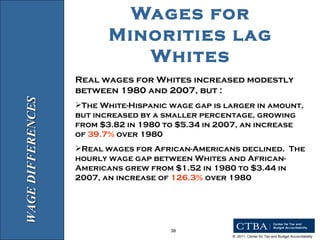

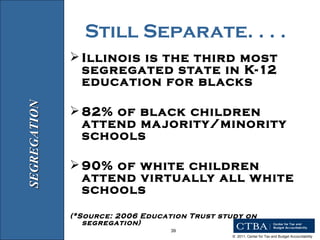

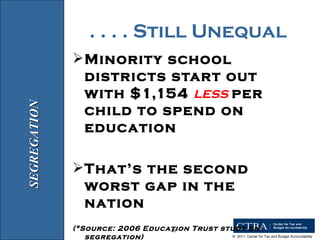

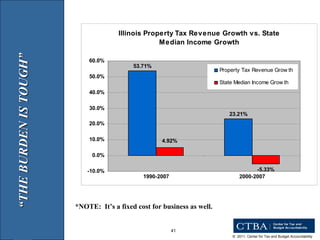

The document summarizes Illinois' fiscal crisis and the tax increases passed in 2011 to address a large budget deficit. It describes how Illinois has historically relied too heavily on property taxes and lacked a fair tax system. The tax increases were expected to generate $7.3 billion annually but deficits remain due to inadequate revenues and increasing costs for education, healthcare, and human services. Further reforms and revenue options are needed to structurally address Illinois' budget problems.

![CENTER FOR TAX AND BUDGET ACCOUNTABILITY 70 E. Lake Street Suite 1700 Chicago, Illinois 60601 direct: 312.332.1049 Email: [email_address] Tax Increases, Spending Caps and the FY2010 General Fund Budget in Illinois For: Campus Facility Association University of Illinois (Urbana-Champaign) UIUC YMCA 1001 S. Wright Street, Champaign, IL Presented by: Ralph Martire, Executive Director Thursday, April 14, 2011; 4:00 pm](https://image.slidesharecdn.com/ralphmartireslideshow4-14-11-110414184139-phpapp01/75/Ralph-martire-slide-show-4-14-11-1-2048.jpg)

![For More Information: Center for Tax and Budget Accountability www.ctbaonline.org Ralph M. Martire Executive Director (312) 332-1049 [email_address] Ron Baiman, Ph.D. Director of Budget and Policy Analysis (312) 332-1480 [email_address] Yerik Kaslow Research Associate (312) 332-2151 [email_address] Further Information](https://image.slidesharecdn.com/ralphmartireslideshow4-14-11-110414184139-phpapp01/85/Ralph-martire-slide-show-4-14-11-43-320.jpg)