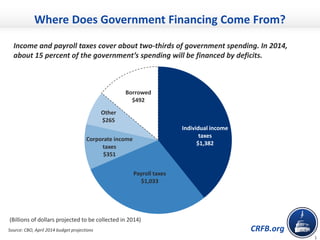

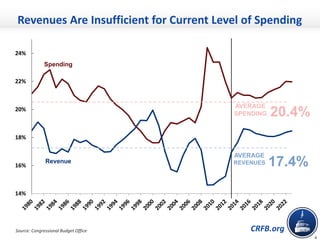

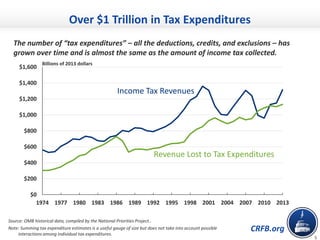

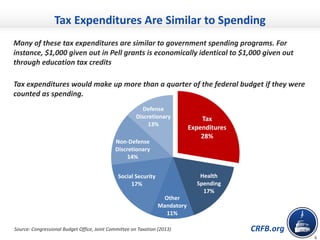

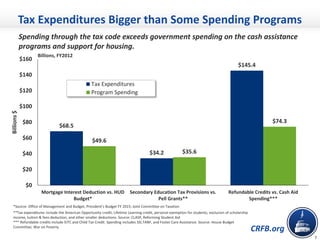

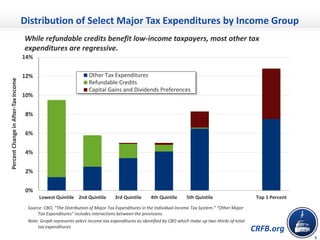

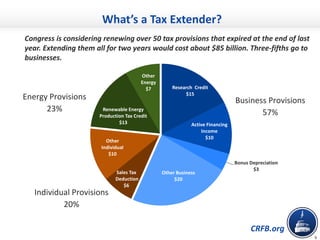

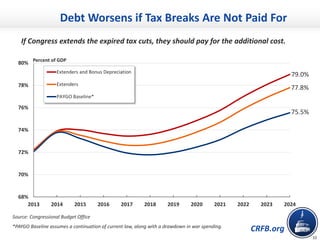

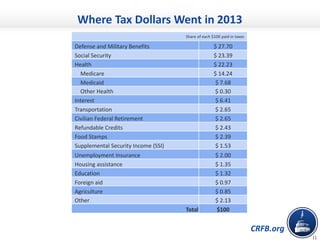

Individual income, payroll, and corporate income taxes cover about two-thirds of US government spending, with the remaining one-third financed by borrowing. In 2014, around 15% of government spending was expected to be financed through deficits. Tax expenditures, such as deductions, credits, and exclusions, have grown over time and now cost almost as much as total income tax revenue. Many tax expenditures function similarly to government spending programs.