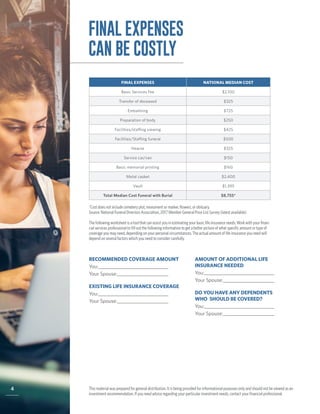

The document discusses final expense life insurance policies that can help cover funeral and other end-of-life costs. It notes that final expenses like funerals can cost thousands of dollars, but many Americans incorrectly believe that government programs will fully cover these costs. The document then provides details on three final expense life insurance policies - Immediate Solution, 10 Pay Solution, and Easy Solution - that offer coverage from $1,000 to $50,000 with no medical exams required. Riders are available to accelerate the payout for qualifying health issues. Worksheets are included to help estimate costs and determine the appropriate coverage amount.